Self Employed National Insurance Increase, Aphc Welcomes U Turn On Self Employed National Insurance Increase Heating Plumbing Monthly Magazine Hpm

Self employed national insurance increase Indeed lately has been hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Self Employed National Insurance Increase.

- Increase In National Insurance Contributions For Self Employed Is Bad News For Family Farms Fuw Says Farm Business

- May Agrees To Delay Legislation Over Tax Rise For Self Employed After Tory Revolt Politics The Guardian

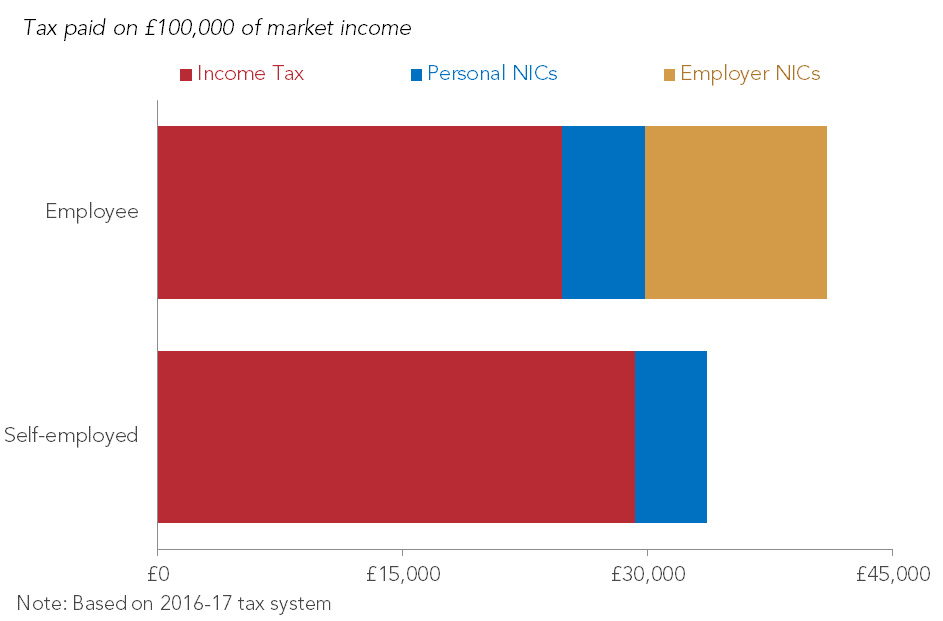

- A Small And Sensible National Insurance Rise For The Self Employed Is Not The Real Strivers Tax Resolution Foundation

- Self Employed Hit By Higher Bills For National Insurance Budget 2017 The Times

- New Bombshell For Self Employed Pay 400 More Nics Or Lose State Pension National Insurance The Guardian

- Federal Insurance Contributions Act Tax Wikipedia

Find, Read, And Discover Self Employed National Insurance Increase, Such Us:

- Theresa May Defends Increase In National Insurance For The Self Employed As Fair

- National Insurance Increase For Self Employed U Turn Philip Hammond Axes 2 Nic Increase Irish Tech News

- National Insurance Rise Baby Steps In Right Direction Says Ifs Financial Times

- Institute For Fiscal Studies Backs National Insurance Increase Bbc News

- Philip Hammond Defends Scrapping National Insurance Rise For The Self Employed Politics The Guardian

If you are looking for Has Furlough Been Extended For Self Employed you've arrived at the ideal location. We ve got 104 images about has furlough been extended for self employed adding pictures, photos, pictures, backgrounds, and more. In these web page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Tax News Factsheet National Insurance And The Self Employed Has Furlough Been Extended For Self Employed

Class 4 if your profits are 9501 or more a year.

Has furlough been extended for self employed. But now i am being penalised by a tory party who have to this date billed themselves as the party for business and holding to their manifesto mandate of not increasing taxes. Class 2 if your profits are 6475 or more a year. As anticipated the chancellor announced today changes to the taxation of the self employed by increasing the rate of class 4 national insurance contributions nic.

Class 2 and class 4 nics are charged at different rates. You usually pay 2 types of national insurance if youre self employed. From its current level of 9 there will be an increase of 1 from 6 april 2018 up to 10 and a further 1 increase from 6 april 2019 up to 11 onwards.

The main rate of national insurance contributions for the self employed is set to increase chancellor philip hammond has announced. Not only has the government broken its 2015 election pledge to not increase national insurance contributions for 5 years but the measure represents a tax on aspiration and wealth creation and is completely unfair. I like many others work long hours and have always paid our taxes and national insurance contributions.

Self employed national insurance rates. Class 4 national insurance contributions are only charged if your profits are above 9500 a yearthe rate is nine per cent of profits between 9501. On the face of it it seems fair to bring self employed taxes in line with those.

The class 2 national insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more. Under the current system the self employed may have to pay both class 4 and class 2 nics. I am self employed.

In a letter to conservative mps hammond confirmed the 2bn 2 per cent increase to class 4 national insurance for the self employed will not go ahead just one week after he announced the planned increase in his spring budget. As part of the 2020 budget chancellor rishi sunak has announced national insurance thresholds for 2020 21 tax year will be increased. The couple face paying thousands more each year from 2018 due to the increase in national insurance.

Both employed workers and self employed workers that pay class 4 contributions will be able to earn up to 9500 in 2020 21 before national insurance contributions nics kick in.

New Bombshell For Self Employed Pay 400 More Nics Or Lose State Pension National Insurance The Guardian Has Furlough Been Extended For Self Employed

More From Has Furlough Been Extended For Self Employed

- Govt Employee Government Worker Cartoon

- Government Holidays

- Government Issued Id Card

- Government Quarantine Facilities List Singapore

- Government Unemployment News

Incoming Search Terms:

- Theresa May Defends Increase In National Insurance For The Self Employed As Fair Government Unemployment News,

- Family Hit By National Insurance Increase For Self Employed Face Paying Hundreds More Each Year Government Unemployment News,

- National Insurance Increase For Self Employed U Turn Philip Hammond Axes 2 Nic Increase Irish Tech News Government Unemployment News,

- Tax News Factsheet National Insurance And The Self Employed Government Unemployment News,

- Self Employed Archives Page 2 Of 3 Epayme Government Unemployment News,

- National Insurance Contribution Threshold To Rise Paish Tooth Government Unemployment News,