Self Employed Quarterly Tax Payment Due Dates, Understanding Estimated Tax Payments Montgomery Community Media

Self employed quarterly tax payment due dates Indeed lately has been sought by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about Self Employed Quarterly Tax Payment Due Dates.

- Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

- Estimated Taxes Report Working Point Knowledge Base

- Understanding Estimated Tax Payments Lvbw

- Taxes For Bloggers How To Do Taxes On Blog Income 2020

- Important Tax Dates

- How Estimated Taxes Work Safe Harbor Rule And Due Dates 2020

Find, Read, And Discover Self Employed Quarterly Tax Payment Due Dates, Such Us:

- Taxes For The Self Employed And Independent Contractors

- Taxseasonhub Instagram Posts Photos And Videos Picuki Com

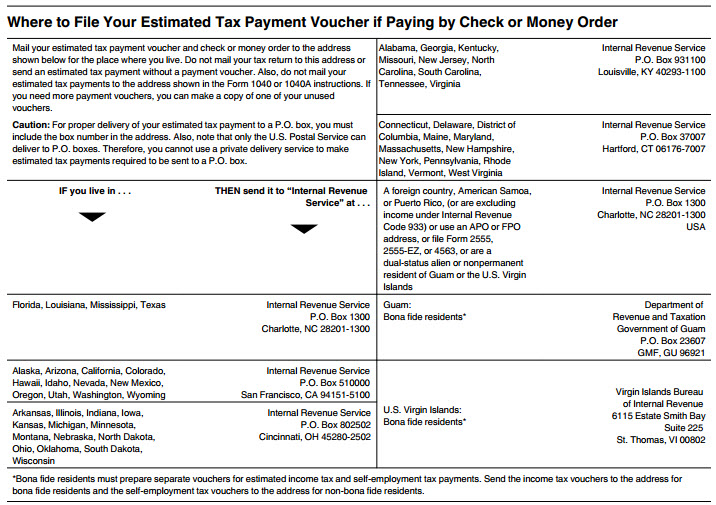

- Publication 505 2020 Tax Withholding And Estimated Tax Internal Revenue Service

- The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

- 12 Tax Deadlines For July 15 It S Not Just The Due Date For Your Tax Return Kiplinger

If you re looking for Public Procurement Government Procurement Process you've come to the perfect place. We ve got 103 graphics about public procurement government procurement process adding images, photos, pictures, wallpapers, and more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Some self employed people decide to pay the penalty at the end of the tax year rather than take money out of their businesses during the year to pay estimated taxes.

Public procurement government procurement process. Estimated tax payments english ir 2020 205 september 9 2020. There are a few exceptions though. The irs has established four due dates for paying estimated taxes throughout the year.

First quarter the first quarter of a calendar year is made up of january february and march. The first quarter estimated tax payment for 2020 was originally due april 15 2020. Irs notice 2020 18 this news should come as a relief to the millions of self employed who dont have taxes withheld from their pay and often owe money to the irs.

What are the quarters. If you timely deposited all taxes when due you have 10 additional calendar days to file the return. If you make your living as a self employed worker youll likely have to make estimated tax payments you must pay estimated taxes if you expect to owe at least 1000 in federal tax for the year.

In general you must deposit federal income tax withheld and both the employer and employee social security and medicare taxes. Second quarter the second quarter of a calendar. If you do this though make sure you pay all the taxes you owe for the year by april 15 of the following year.

View the tax calendar online en espanol. You can see all events or filter them by monthly depositor semiweekly depositor excise or general event types. File form 941 employers quarterly federal tax return.

View due dates and actions for each month. If youre self employed work as an independent contractor or run a business you may have to make estimated tax paymentsnormally theyre due in april june september and january and paying. Here is the irs quarterly estimated tax timeline.

Visit this page on your smartphone or tablet so you can view the online calendar on your mobile device. Typically the due date is the 15th for each of the months in which payments must be made. If the 15th falls on a weekend or a federal holiday however the due date is moved to the following business day.

Note find 2020 quarterly estimated tax due dates here self employed individuals typically must pay quarterly estimated taxes on a schedule established by the irs.

Do You Owe Estimated Tax Payments To The Irs Or Ohio Department Of Taxation Gudorf Tax Group Llc Public Procurement Government Procurement Process

More From Public Procurement Government Procurement Process

- Self Employed Furlough Scheme Uk

- Non Government Organization Meaning

- Upcoming Government Exams 2020 In Tamil Nadu

- Self Employed Help Ni

- France Muhammad Cartoon Government Building

Incoming Search Terms:

- Uj Dw4kh3uo7cm France Muhammad Cartoon Government Building,

- Easiest Way To Pay Self Employment Estimated Taxes Accounting For Jewelers France Muhammad Cartoon Government Building,

- When Do I Make Self Assessment Payments And File My Tax Return Low Incomes Tax Reform Group France Muhammad Cartoon Government Building,

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group France Muhammad Cartoon Government Building,

- 12 Tax Deadlines For July 15 It S Not Just The Due Date For Your Tax Return Kiplinger France Muhammad Cartoon Government Building,

- Quarterly Estimated Payments Due Dates Get It Back Tax Credits For People Who Work France Muhammad Cartoon Government Building,

20)