Self Employed Or Limited Company, Limited Company Vs Sole Trader 2019 20 Jf Financial

Self employed or limited company Indeed lately has been hunted by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this post I will discuss about Self Employed Or Limited Company.

- Self Employed Or Limited Company

- Self Employed Coronavirus Support What Can The Government Do For Limited Company Directors Ipse

- When Are Llc Members Subject To Self Employment Tax Pasquesi Sheppard Llc

- Mortgage Lenders Income Requirements For The Self Employed Niche

- Self Employed Small Business Blog Seed Accounting Solutions

- Sole Trader Vs Limited Company Sole Trader Accounting Classes Limited Company

Find, Read, And Discover Self Employed Or Limited Company, Such Us:

- Government S Coronavirus Support For Self Employed Excludes Small Limited Companies Nextfin

- Which Is Best Limited Company Or Self Employed

- Ijm Financial Accounting Services Ltd Need Accounting Taxation Services Companies Self Employed Individuals We Got You As Well Doubles Vendors Caterers Event Coordinators Small Contractors Doctors Lawyers Operating Any Type

- Becoming A Ltd Driver 2019 Pages 1 7 Text Version Fliphtml5

- Common Misconceptions About The Government S Financial Support For Freelancers The Number Ninja

If you are searching for 1040 Tax Self Employed Tax Return Example you've come to the ideal place. We have 100 images about 1040 tax self employed tax return example including pictures, pictures, photos, wallpapers, and more. In such page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Vat Self Employed And Ltd Company Directors Coronavirus Updates 1040 Tax Self Employed Tax Return Example

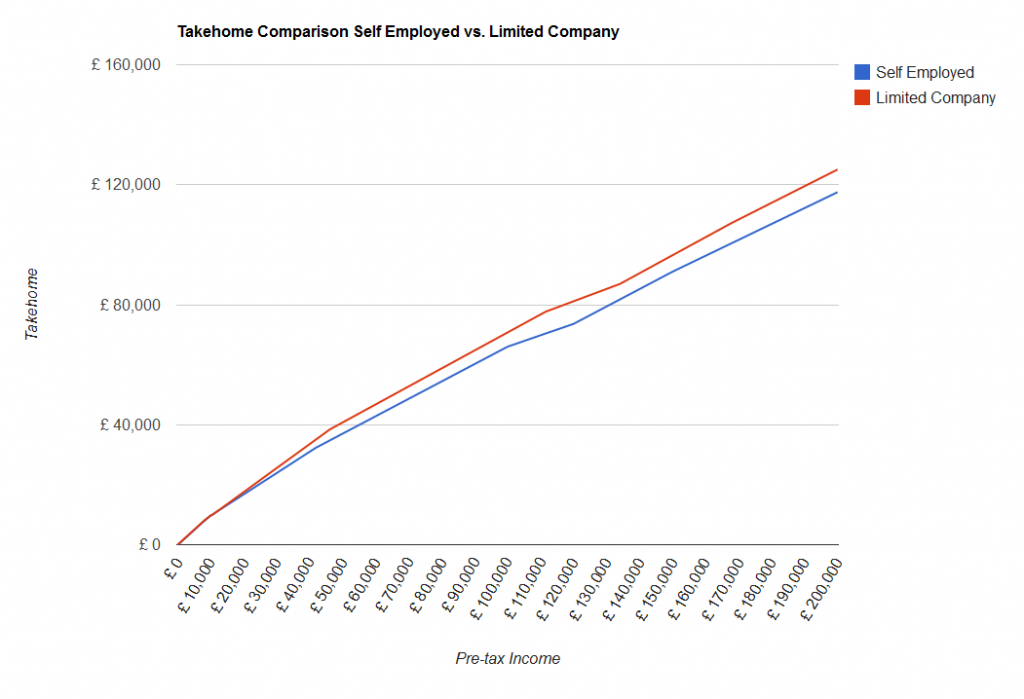

To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed.

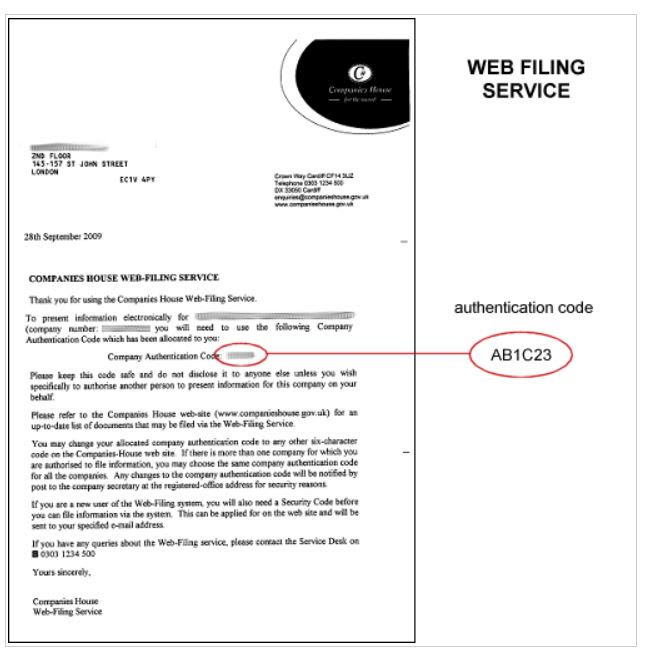

1040 tax self employed tax return example. The tax and hmrc relationship will continue if you trade through a limited company but you will also have to work with companies house. The business needs to be registered with companies house directors must be appointed and an annual tax return along with a set of accounts must be filed. A contractor can be self employed employed or a worker see below depending on whether they work for an agency or not.

Being self employed means that you will only need to deal with hmrc and the relationship is likely to be very taxed based. You can change to a limited company later if your business grows or your needs change. The personal financial risk is a key factor to consider when weighing up whether to register as a self employed or set up a private limited company.

Self employed vs limited company. Choosing to set up as a limited company is not as straightforward as registering as self employed and it does come with ongoing additional administration responsibilities. Our handy guide to the pros and cons of being self employed as a sole trader or setting up a limited company if you are starting out in business your first question is likely to be what is the best way for me to do it and do i really have to set up a new limited company.

Its possible to be employed and self employed at the same. Limited company vs self employed which do you choose. And for contractors working in the construction industry check out the construction industry scheme cis for details on your hmrc status.

As a self employed individual both your business and personal tax affairs are seen as one meaning that you as an individual are indistinguishable from your business as far as hmrc are concerned. Self employed and limited company tax. You can take out specialist liability or indemnity assurance schemes but you are still individually liable.

Should i be self employed or a limited company. Limited companies pay corporation tax on all annual profits and company directors are taxed personally on the income they draw down from the company via. Which way is best for my business.

Unlike a limited company which affords its directors with the limited liability protection measures a self employed business owner does not have those same levels of legal protection. In some ways this makes things simple as you only have one tax return to complete annually but it does mean.

More From 1040 Tax Self Employed Tax Return Example

- Self Employed Furlough Till October

- Government Exams After Graduation In India

- Rules Of New Furlough Scheme

- Expenses Self Employed Small Business Bookkeeping Template

- Government Covid Meme

Incoming Search Terms:

- Employed And Self Employed Government Covid Meme,

- What Is The Difference Between Self Employed And Sole Trader Government Covid Meme,

- The Difference Between Being Self Employed And A Limited Company Youtube Government Covid Meme,

- Mortgage Lenders Income Requirements For The Self Employed Niche Government Covid Meme,

- Bounce Back Loans Help For Small Businesses And Income Support For Those Missing Out Elsewhere Eg Limited Company Directors And Self Employed Government Covid Meme,

- Help For Self Employed But Limited Company Contractors Lose Out Contractor Tap Government Covid Meme,