Self Employed Pension Deduction, Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial

Self employed pension deduction Indeed lately has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Self Employed Pension Deduction.

- Table 2 From Informality And Public Policies To Overcome It The Case Of Brazil Semantic Scholar

- Solved Juan Who Is Single Is A Self Employed Carpenter Chegg Com

- Ppt Chapter 3 Business Expenses Retirement Plans Powerpoint Presentation Id 2310418

- Mega Backdoor Roth Conversions For Self Employed Business Owners 2020 Update Newfocus Financial Group

- Oecd Ilibrary Home

- Self Employed Workers How To Plug A 69 000 Savings Gap

Find, Read, And Discover Self Employed Pension Deduction, Such Us:

- An Introduction To Taxation Ppt Download

- Chapter 6 Business Expenses Howard Godfrey Ph D Ppt Video Online Download

- The Qbi Deduction Reduction On Small Business Retirement Plans

- Self Employed Sep Ira Tax Deduction Sep Contribution Limit And Maximum Benefit Depends On Taxable Income

- Deduction Under Income Tax 80ccc And 80ccd

If you re looking for Government Newspaper Of India you've come to the right place. We have 101 images about government newspaper of india including images, photos, photographs, backgrounds, and more. In these page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Business use of your home including use by day care providers.

Government newspaper of india. But in terms of pensions this is a disadvantage. Self employed tax deductions strategy for individual with large cash flow. Retirement savings for self employed individuals.

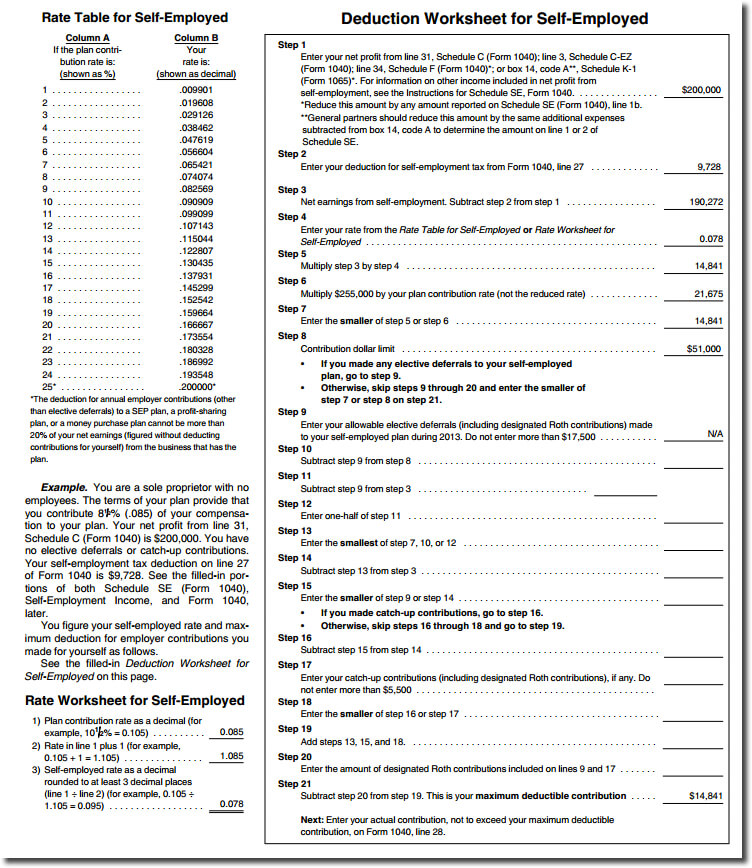

Another business only retirement plan is the simplified employee pension ira or sep ira. Since the law no longer distinguishes between corporate and other plan sponsors the term is seldom used. Your total amount of self employment tax 1145140 is reported on line 4 of schedule 2.

If you are saving for a retirement plan you may have a nice advantage in being able to deduct some of those savings as a self employed person. One big attraction of being self employed is you dont have a boss. For a self employed individual the following retirement plans could prove beneficial.

There are around 48 million self employed people in the uk accounting for 15 of the uk workforce. Under this plan you can contribute up to either 25 percent of your income or 56000 whichever is less. You then report any other taxesthere are eight categorieson the same form total.

People below 50 can make contributions of up to 18000 and those above the age of 50 can make additional 6000 contribution adding to a total of 24000. A document published by the internal revenue service irs that provides information on how taxpayers who use. The deductions go on the same schedule 1 as health insurance premiums.

Plan contributions for a self employed individual are deducted on form 1040 on the line for self employed sep simple and qualified plans and not on the schedule c. If you made the deduction on schedule c or made and deducted more than your allowed plan contribution for yourself you must amend your form 1040 tax return and schedule c. A self employed pension or sep plan which allows business owners a relatively simple method to contribute towards their employees as well as their own retirement plans.

Retirement plans for self employed people were formerly referred to as keogh plans after the law that first allowed unincorporated businesses to sponsor retirement plans. You make contributions to an individual retirement account or an annuity that is set up for each person participating in the plan. Yet just 31 of the self employed are saving into a pension.

Educating Supporting Representing Income Tax Chartered Tax Consultant Applied Tax Module 3 Ken O Brien 25 Th 26 Th January Ppt Download Government Newspaper Of India

More From Government Newspaper Of India

- Ancient Egyptian Government Official

- Self Employed Business Loans

- Government Quarters Interior

- Government Quota In Private Medical Colleges In Tamilnadu Fees Structure

- Highest Paying Government Jobs In India 2019

Incoming Search Terms:

- Mcguire Liston Financial Services Posts Facebook Highest Paying Government Jobs In India 2019,

- Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial Highest Paying Government Jobs In India 2019,

- Self Employed Sep Ira Tax Deduction Sep Contribution Limit And Maximum Benefit Depends On Taxable Income Highest Paying Government Jobs In India 2019,

- Publication 590 A 2019 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service Highest Paying Government Jobs In India 2019,

- Chapter 14 Retirement And Estate Planning Mcgraw Hill Irwin Ppt Video Online Download Highest Paying Government Jobs In India 2019,

- Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial Highest Paying Government Jobs In India 2019,