Self Employed Person Income Relief Scheme Application, Step By Step Guide To Applying For The Self Employed Person Income Relief Scheme Sirs Resources For Parents Students Tutors Find Private Tutors In Sg

Self employed person income relief scheme application Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the article I will talk about about Self Employed Person Income Relief Scheme Application.

- Fdawu Portal The Solidarity Budget Enhanced Support For Singaporeans

- About 88 000 To Automatically Benefit From Self Employed Person Income Relief Scheme Bucks Sg

- Sirs Useful Guides

- Support For Singaporeans Affected By Covid 19 Ministry Of Social And Family Development

- Ntuc To Process Applications Appeals For Self Employed Persons Income Relief Scheme Watsupasia Asia S Latest News Entertainment Platform

- Step By Step Guide To Applying For The Self Employed Person Income Relief Scheme Sirs Resources For Parents Students Tutors Find Private Tutors In Sg

Find, Read, And Discover Self Employed Person Income Relief Scheme Application, Such Us:

- Self Employed Singaporeans Can Apply For Relief From April 27 The Star

- Around Two In Three Sirs Applications Have Been Approved Some Self Employed Still Unable To Benefit Nestia

- Govt Studying Ways To Continue Supporting Self Employed Persons Beyond 2020 But Needs To Taper Towards Normalcy Todayonline

- News Covid 19 Ntuc Announces Self Employed Person Income Relief Scheme From April 27 People Matters

- Coronavirus Scheme Pays Out 360m To Self Employed Singapore News Top Stories The Straits Times

If you are searching for Government Employee Gift Rules you've reached the right place. We have 101 graphics about government employee gift rules including pictures, photos, photographs, backgrounds, and more. In these webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

How To Qualify And Apply For Self Employed Person Income Relief Scheme Sirs Ahboy Com Government Employee Gift Rules

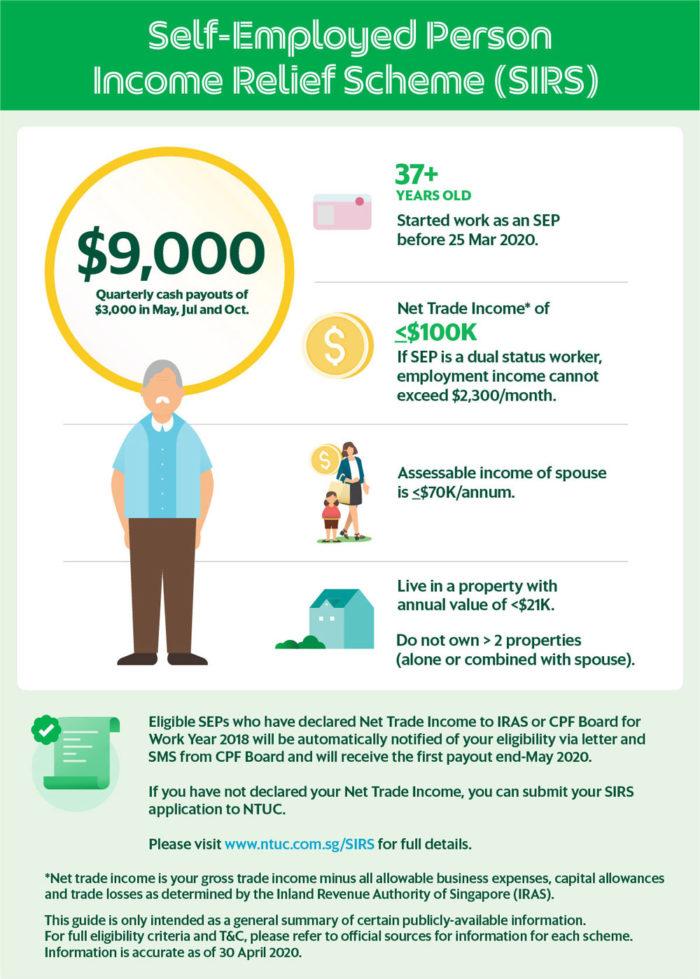

Sep income relief scheme sirs announcement on 26 march 2020 support for self employed persons in fighting the moving target that is the coronavirus pandemic the singapore governments priority is to save jobs and protect singaporeans livelihoods.

Government employee gift rules. Individuals who have put in an application for sirs should also not proceed to put in an application for the covid 19 support grant. While the self employed person income relief scheme sirs is a good initiative to provide financial support to the self employed and freelancers there was quite a bit of confusion ever since it was announced. Covid 19 has hit self employed people particularly hard.

All application will have to be submitted individually. Where to apply for self employed person income relief scheme sirs application and appeals will open on monday 27 april 2020. Self employed and freelancers can now apply for relief from 9am to 10pm daily.

Singapore self employed people can apply for the self employed person income relief scheme sirs from april 27 and check online if they are automatically eligible it was announced on sunday. The self employed person income relief scheme sirs was first announced by deputy prime minister dpm heng swee keat as part of the resilience budget on 26 march 2020. 2 under the scheme eligible seps will receive three quarterly cash payouts of 3000 each in may july and october 2020.

With a fall in business activity and restrictions on movement many have seen their incomes evaporate. Pif you are a person with your own business you work for yourself and you are in the position to realise a business profit or loss you are considered a self employed person. Self employed person income relief scheme sirs is introduced by singapores ministry of manpower mom to help self employed individuals amid the economic crisis due to the covid 19 pandemic.

In order to help self employed persons through this difficult time the government has set up the self employed person income relief scheme sirs. Eligible individuals will receive 3 quarterly cash payouts of s3000 each quarter in may july and october 2020. Self employed persons income relief scheme.

If found to be benefitting from both the covid 19 support grant and sirs concurrently individuals may be disqualified from the schemes and may be requested to repay. Your income is derived from the buying and selling of goods or from providing professional or personal servicesppa self employed person can be a sole proprietor.

More From Government Employee Gift Rules

- Government Monopoly Graph

- Government Lockdown Phases Ireland

- Us Government Notes

- Gnm Nursing Government College In Gujarat List

- What Does Furlough Mean In Spanish

Incoming Search Terms:

- If Only Singaporeans Stopped To Think Solidarity Budget 5 1 Billion Third Covid 19 Relief Package To Save Jobs And Support Businesses And Families What Does Furlough Mean In Spanish,

- The Online Citizen What Does Furlough Mean In Spanish,

- Are You Eligible For The Self Employed Person Income Relief Scheme What Does Furlough Mean In Spanish,

- Sirs Self Employed Person Income Relief Scheme Sirs What Does Furlough Mean In Spanish,

- Sep Income Relief Scheme Sirs What Does Furlough Mean In Spanish,

- Ntuc Chief Answers Faqs About 9k Grant For Self Employed People Whereby Application Starts Today Goody Feed What Does Furlough Mean In Spanish,