Self Employed Personal Loan App, Personal Loan 3 Steps To Apply For Loan Online Citibank Malaysia

Self employed personal loan app Indeed lately has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of the post I will talk about about Self Employed Personal Loan App.

- Personal Loan For Self Employed Instent Personal Loan Personal Loan For Students Personal

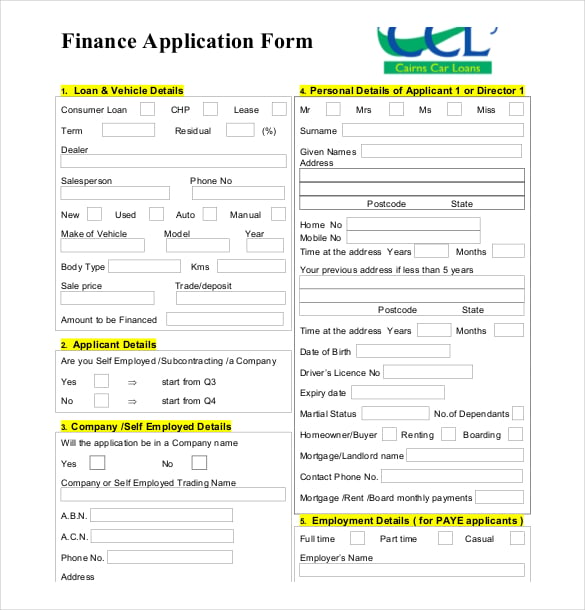

- Personal Loan Application Form Template Jotform

- Top 3 Loan Websites For Self Employed Personal Loan App 2019 Youtube

- Flexible Personal Loans Pepper Money Au

- Personal Loans

- How To Apply For A Personal Loan If You Are Self Employed Tben The Bharat Express News

Find, Read, And Discover Self Employed Personal Loan App, Such Us:

- Top 3 Loan Websites For Self Employed Personal Loan App 2019 Youtube

- Online Loan Without Income Proof Personal Loan For Self Employed Loan New App Enroot Pay Loan Youtube

- Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

- 22 Best Instant Personal Loan Apps In India November 2020 Moneytap

- Lyrwvpkhy5omym

If you are searching for Government Expenditure Subsidy Graph you've reached the ideal place. We have 104 graphics about government expenditure subsidy graph including pictures, photos, photographs, backgrounds, and more. In these page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Personal Loan For Low Cibil Score Personal Loan In 2 Minutes 10 99 Government Expenditure Subsidy Graph

This special personal loan scheme is tailor made for fixed as well as for self employed professionals.

Government expenditure subsidy graph. Personal loan for self employed professionals. Application process of apply for a personal loan for self employed those who are self employed should say so as early into the loan application process as possible. The sba clarifies that while partnerships are eligible for ppp loans a partner in a partnership may not submit a separate ppp loan application for themselves as a self employed individual.

Though it may be hard to look for a personal loan dedicated for self employed you should know that banks offer these loans to the group under different requirements. Self employed doctors over the age of 25 years can avail this loan. Personal loan app for self employed in united arab emirates 2019 muntazeer mehdi october 22 2019 personal loan app and a personal loan is an unbound type of loan its offering is finished by different advance suppliers based on your financial assessment.

Of years in operation pan number etc. Paysense one of the best instant loan apps in india has both an app and a website where salaried professionals and self employed individuals can apply for an instant personal loan. To help identify the best personal loans for self employed we have listed the top 5 personal loans in malaysia as below.

Self employed individuals between 28 years and 65 years of age can apply for a personal loan from icici bank. A self employed individual needs to have 3 4 years of business stability and an operational current account with hdfc to avail the loan without an income proof. Instead the self employment income of general active partners may be reported as a payroll cost up to 100000 annualized on a ppp loan application.

So if you are looking for the best loan app for self employed entrepreneurs then you are at the right place. Take a look below to know which banks offer a personal loan to self employed with no income proof. The lender will find out eventually and honesty can help quickly weed out the lenders that are not willing to work with those who are self employed.

Check eligibility and select a personal loan for self employed entrepreneurs or freelancers. For a self employed personal loan online 1. The lender charges a fixed rate of interest.

For pre approved customers the loan amount will be disbursed to their account within 3 seconds. You neednt bother with any security for the cash acquired from the supplier. Apply online for a dfcc credit card by filling the online application form with the required information and submit.

You will be asked to enter certain information pertaining to your personal information including address the nature of your business income statements of the past 2 years total no. The eligibility criteria to get a personal loan or an instant loan personal loan for self employed business owner is.

More From Government Expenditure Subsidy Graph

- Self Employed Government Grant Next Payment

- Government Symbol Png

- Government Scholarship Programs In India

- World Government Adalah

- Furlough Rules For Employees

Incoming Search Terms:

- Document Requirements For Personal Loan Bpi Furlough Rules For Employees,

- Instant Personal Loan Indicash Loan App My India Knowledge Furlough Rules For Employees,

- 5 Things You Did Not Know About Personal Loan Axis Bank Furlough Rules For Employees,

- Instant Personal Loan In 2020 Personal Loans Personal Loans Online Online Loans Furlough Rules For Employees,

- Hdfc Bank Loan Assist On The App Store Furlough Rules For Employees,

- Personal Loan Instant Personal Loan App Paysense Apps On Google Play Furlough Rules For Employees,