Self Employed Quarterly Tax Estimator, Quarterly Tax Calculator Calculate Estimated Taxes

Self employed quarterly tax estimator Indeed recently is being sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the post I will talk about about Self Employed Quarterly Tax Estimator.

- Self Employment Tax Calculator 1099 Schedule C Estimated Taxes

- How Estimated Taxes Work Safe Harbor Rule And Due Dates 2020

- Quarterly Estimated Taxes For Self Employed Individuals Affordable Bookkeeping Payroll

- How To Calculate Estimated Taxes For Self Employed

- Guide To Adjusting Your Self Employed Estimated Tax Payments Taxact Blog

- You Need To Pay Your Taxes Quarterly If Marketwatch

Find, Read, And Discover Self Employed Quarterly Tax Estimator, Such Us:

- How To Do Self Employed Taxes

- Publication 505 2020 Tax Withholding And Estimated Tax Internal Revenue Service

- Uj Dw4kh3uo7cm

- Five Key Tax Tips About Tax Withholding And Estimated Tax

- The Ultimate Self Employment Guide To Filing Estimated Taxes

If you re looking for Korean Government Scholarship Program 2021 you've arrived at the right place. We have 104 images about korean government scholarship program 2021 adding images, photos, pictures, wallpapers, and much more. In such web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

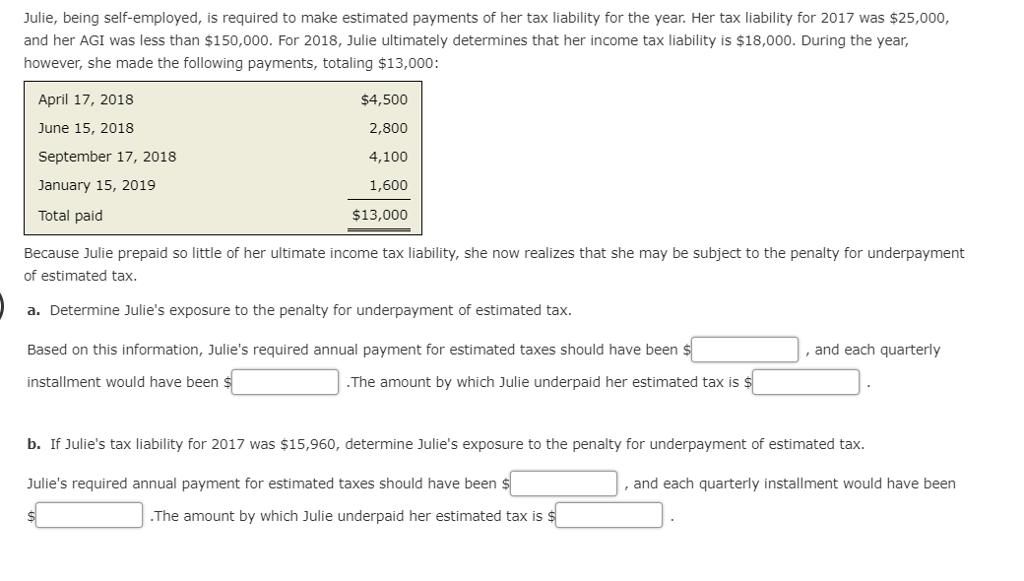

Solved Julie Being Self Employed Is Required To Make Es Chegg Com Korean Government Scholarship Program 2021

The self employment tax is calculated on 9235 of your total income.

Korean government scholarship program 2021. 980350 1271659 2252009 stephanies total estimated taxes. 124 for social security tax and 29 for medicare. For a more robust calculation please use quickbooks self employed.

The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. To calculate her estimated quarterly tax payments for each quarter stephanie simply adds together her income tax and her self employment tax for the year and divides this number by four. Use this calculator to estimate your self employment taxes.

As you may know small business owners and self employed workers often have to pay estimated taxes four times a year. Now the final step. This tool uses the latest information provided by the irs including annual changes and those due to tax reform.

Multiply your estimated total income not your agi by 9235 to calculate your taxable income for the self employment tax. Normally these taxes are withheld by your employer. The 1099 tax rate consists of two parts.

You must pay estimated taxes if you are a sole proprietor a partner in a partnership or member of a limited liability company and you expect to owe at least 1000 in federal tax for the year. 22520094 563002 stephanies quarterly tax. The self employment tax rate includes 92 for medicare and 124 for social security.

This calculator estimates your federal and state level income tax and then divides by four. Please note that the self employment tax is 124 for the federal insurance contributions act fica portion and 29 for medicare. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

Paying taxes on your self employment income. You are required to pay self employed tax if you earned 400 and above. If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax.

This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. Gather your 2019 tax documents including 1099s business receipts bank records invoice payments and related documents to fill in the drop down sections. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income.

If you indicate that you have a w2 job the calculator assumes standard withholding allowances and subtracts your expected end of year refund from the end of year tax liability. The calculations provided should not be considered financial legal or tax advice. To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number.

The self employment tax applies evenly to everyone regardless of your income bracket.

More From Korean Government Scholarship Program 2021

- 10 Year Government Bond Yield India Live

- What Is Furlough Percentage For August

- Government Icon

- Self Assessment Self Employed Accounts Template Uk

- Government Policy Making System

Incoming Search Terms:

- Irs Estimated Quarterly Tax Payments Basics By Xendoo Issuu Government Policy Making System,

- How Much Should You Budget For Taxes As A Freelancer Government Policy Making System,

- Estimated Taxes Report Working Point Knowledge Base Government Policy Making System,

- Self Employment Tax And Irs Estimated Tax Payment Government Policy Making System,

- How To Do Self Employed Taxes Government Policy Making System,

- Daniel Vassallo On Twitter Just Finished My 2019 Tax Return And My First Quarterly Tax Estimate For 2020 You Still Get To Do Some Unpleasant Work When You Re Self Employed What You Don T Government Policy Making System,