Self Employed Sss Contribution 2020, Sss Requirements For Self Employed Fill Online Printable Fillable Blank Pdffiller

Self employed sss contribution 2020 Indeed recently is being hunted by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Sss Contribution 2020.

- Sss Extends Anew Its Contribution Payment Deadline To June 15 Businessmirror

- Sss Advisory Sss Extends Payment Perez Sardoncillo Certified Public Accountants Facebook

- In Line With The Declaration Of State Of Moneygment By Togetech Inc Facebook

- Using Your Sss Contributions To Apply For A Salary Loan Blend Ph Online Peer To Peer Funding Platform In The Philippines

- Sss Contribution Table Payment Schedule 2020 Bir Tax Information Business Solutions And Professional System

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries

Find, Read, And Discover Self Employed Sss Contribution 2020, Such Us:

- Updating Sss Status To Voluntary Via Online Mielygraphy

- Sss Contribution Table Benefits And Mode Of Payment

- 1

- Using Your Sss Contributions To Apply For A Salary Loan Blend Ph Online Peer To Peer Funding Platform In The Philippines

- Register New Employees With Sss Philhealth And Pag Ibig Fund

If you re searching for Government Employee Id Government Of Gujarat Identity Card you've come to the perfect location. We ve got 104 graphics about government employee id government of gujarat identity card including pictures, photos, photographs, backgrounds, and much more. In these page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Updated Sss Contribution Table For 2019 Howtoquick Net Government Employee Id Government Of Gujarat Identity Card

Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw Government Employee Id Government Of Gujarat Identity Card

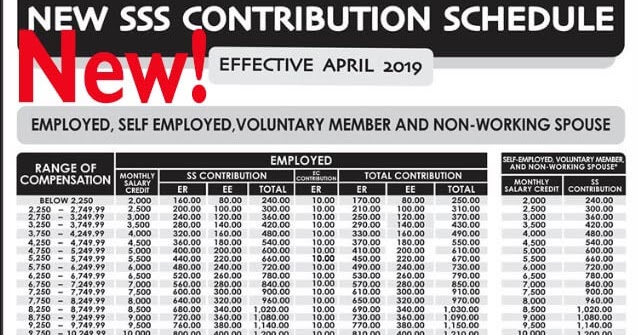

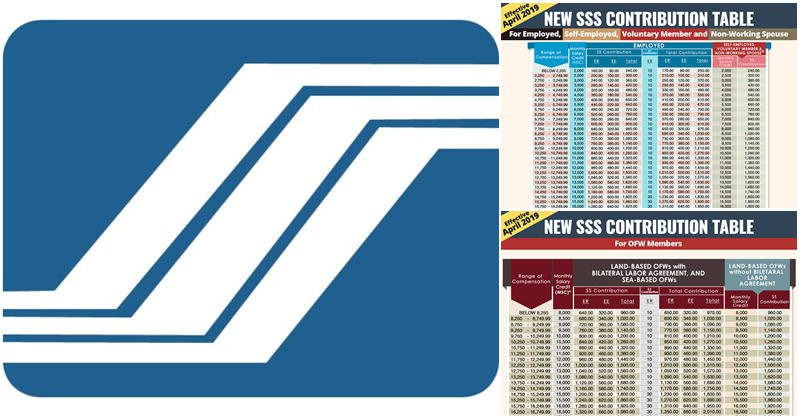

If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members.

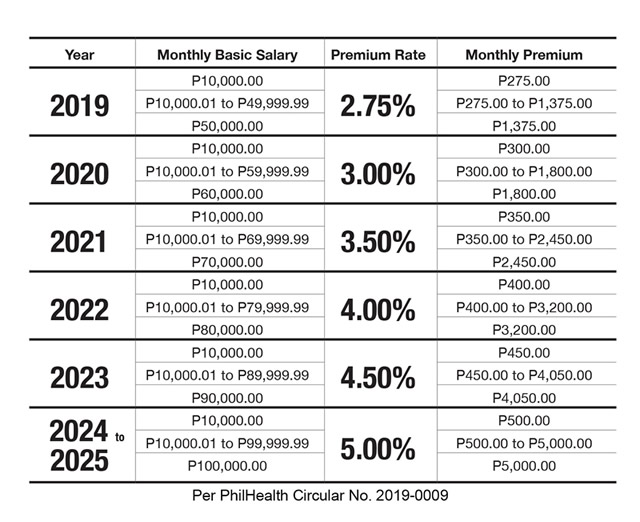

Government employee id government of gujarat identity card. There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw. Sss contribution table 2020. You can pay until the 30th of november 2020.

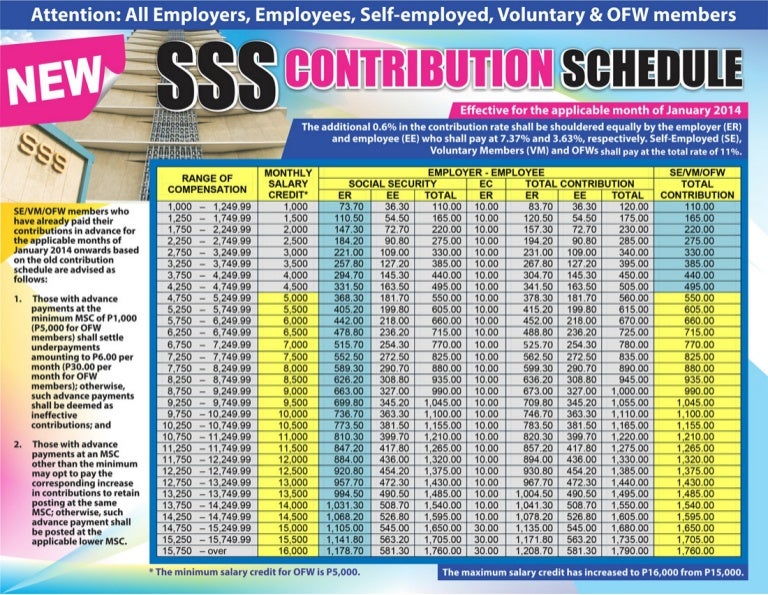

The employees compensation commission ecc issued on march 6 2019 board resolution no. Sss contributions of employed self employed voluntary member and non working spouse. The employer pays 8 while the employee pays 4.

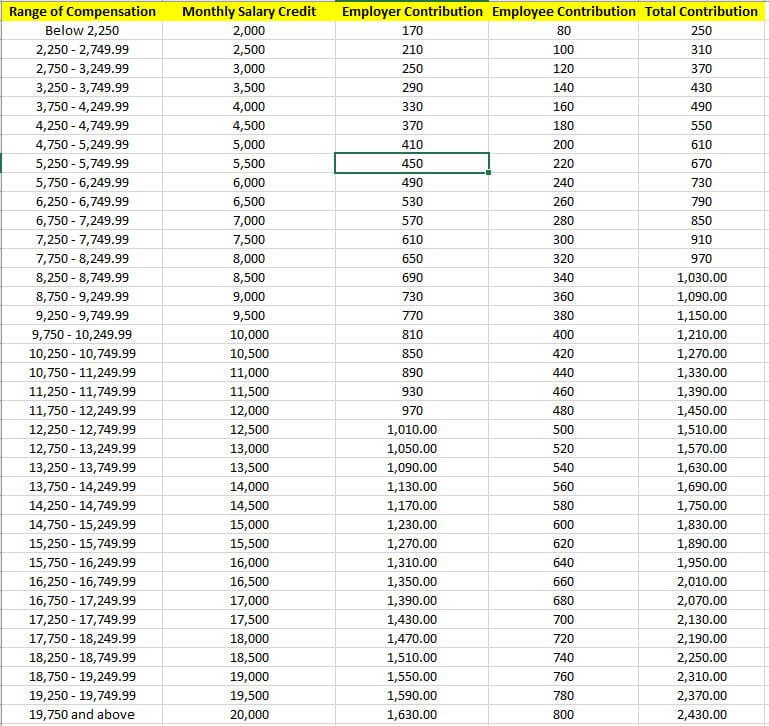

The monthly ec contribution of an se member is either of the two. The updated sss contribution table starting april 2020 for employees and employers voluntary self employed ofw and kasambahay or household workers to have at least a rough idea on how much contributions are. Summary of sss benefits.

In this way theyll be able to understand if theyre under over or just right in paying. The monthly ec contribution of an se is either of the two. The sss contribution table for 2020 is located below specifically created for those who are self employed voluntary or are overseas filipino workers.

2020 sss contribution table for self employed voluntary or overseas filipino workers. The contribution rate for overseas filipino workers ofws earning less than p8250 monthly is p960 and p2400 for those with more than p19750 monthly. The sss contribution table above and the succeeding ones can be used only from april 2019 to the end of 2020 as the contribution rate will increase again in 2021 onwards.

Starting applicable month of september 2020 payment reference number prn issued to sss self employed members will include ec contributions. Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses. Non working spouses contribution is half 50 of the their working spouses most recent monthly salary credit with a.

Good news to all its regular household employers self employed voluntary and non working spouse members the social security system sss further extends the deadline of payment or remittance of all contributions. 19 03 05 the policy on expanding the coverage of the employees compensation program ecp to the self employed se compulsory members of the social security system. Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000.

Sss Extends Contribution Payments Deadline To June 15 Ptv News Government Employee Id Government Of Gujarat Identity Card

More From Government Employee Id Government Of Gujarat Identity Card

- Government Of Canada Logo Font

- Government Types For Kids

- Self Employed Health Insurance Options Florida

- Furlough Scheme News Uk

- Government Of India Issued Rules For Administration In Which State

Incoming Search Terms:

- Using Your Sss Contributions To Apply For A Salary Loan Blend Ph Online Peer To Peer Funding Platform In The Philippines Government Of India Issued Rules For Administration In Which State,

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries Government Of India Issued Rules For Administration In Which State,

- Moneygment Sss Is Further Extending The Deadline Of Facebook Government Of India Issued Rules For Administration In Which State,

- Sss Extends Contribution Payment Deadline To June 30 Government Of India Issued Rules For Administration In Which State,

- The Sss Contribution Rate Will Increase In April 2019 Cloudcfo Government Of India Issued Rules For Administration In Which State,

- Sss Contribution Table Payment Schedule 2020 Bir Tax Information Business Solutions And Professional System Government Of India Issued Rules For Administration In Which State,