Self Employed Sss Contribution Table 2018, Sss Contribution Table 2019 Mastercitizen S Blog

Self employed sss contribution table 2018 Indeed lately has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about Self Employed Sss Contribution Table 2018.

- Sss Contribution Table 2017 Sss Answers

- How To Pay Your Sss Contribution As A Voluntary Member Sss Answers

- Philippines Mandatory Employee Benefits Contributions

- Kabayan Ofws In Gcc And Middle East Sss Contribution Table For 2016

- New Sss Contribution Table 2020 Sss Answers

- Sss Contribution Table Everyday Grace

Find, Read, And Discover Self Employed Sss Contribution Table 2018, Such Us:

- Republic Of The Philippines Social Security System

- Sss New Contribution Rates 2019 Business Software For Sss Contribution

- Sss Contribution Table 2017 Sss Answers

- Sss Contribution Table 2018 How Is It Different From The New One Para Sa Pinoy

- Updated Sss Contribution Table 2019 Employee Employer Share

If you are searching for Self Employed Courier Tax Allowances you've arrived at the perfect place. We have 104 graphics about self employed courier tax allowances including pictures, pictures, photos, backgrounds, and more. In these webpage, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Sss Online Registration And Steps To Check Sss Your Contribution Online Self Employed Courier Tax Allowances

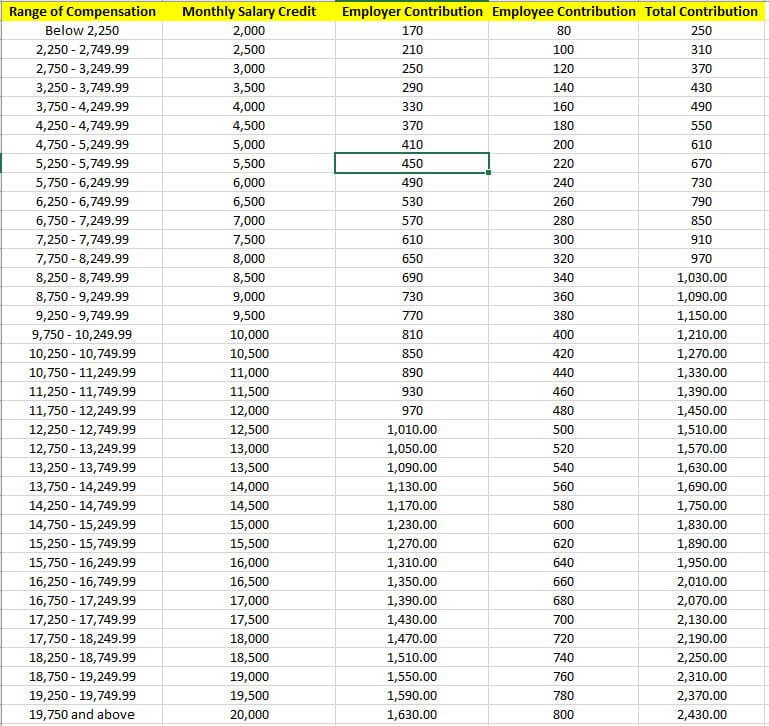

See down below the sss contribution table for 2018.

Self employed courier tax allowances. My instagram feed demo. Sss contributions table 2018 for self employed voluntary ofw members. For your sss contributions until march 2019 you may refer to the old sss contribution table 2018 below.

For voluntary self employed non working spouse and ofw members. How to reset sss password or user id 2019 forgot password september 20 2019. Self employed and voluntary members pay for the total sss contribution table such members would shoulder the employer share.

Table of sss contributions for ofws voluntary self employed and employed members. Old sss contribution table 2018. The sss contribution table guides you on the amount that you should pay as a member of the sss.

Sss contributions january 2014 to march 2019. For employed members the present rate of contribution is 11 of the monthly salary credit received by the member or not more than php16 000. For employed members the present rate of contribution is 11 of the monthly salary credit received by the member or not more than php16 000.

There are 37 monthly salary credits beginning from 2000 pesos and increasing in increments of 500 pesos up to the maximum of 20000 pesos as of the latest sss contribution table effective april 2019. Your employer should shoulder the 73670 10 ec and the remaining 36330 is your contribution which is deducted from your monthly salary. The 11 rate is being shared by the employee 363 and the employer 737.

The easiest way to view sss contribution online november 19 2019. Oman air job vacancies for cabin crew. Sss maternity benefits requirements and computation september 24 2019.

The 11 rate is being shared by the employee 363 and the employer 737. Cabin attendant or flight attendant. Sss online registration for sss members 2019 september 24 2019.

For employees this means that if your monthly salary is 10000 with a fixed monthly salary credit of 10000 based on the sss contribution table for employees displayed above your total monthly contribution should be 1110. My instagram feed demo. See down below the sss contribution table for 2018.

November 28 2018 by janice 7 comments.

More From Self Employed Courier Tax Allowances

- Self Employed Personal Loan Hdfc Bank

- New Furlough Scheme For Wales

- Dog Government Hospital Near Me

- What Is Earliest Furlough Date

- Self Employed Furlough Scheme Gov Apply

Incoming Search Terms:

- Complete Guide To Sss Online Registration Contribution Benefits Grit Ph Self Employed Furlough Scheme Gov Apply,

- Updated Sss Contribution Table For 2019 Howtoquick Net Self Employed Furlough Scheme Gov Apply,

- Updated Sss Contribution Table For 2019 Howtoquick Net Self Employed Furlough Scheme Gov Apply,

- Latest 2014 2015 Sss Contribution Table For Employers And Employees Onlinefilipinoworkers Com Self Employed Furlough Scheme Gov Apply,

- How Much Is The Required Monthly Contributions For Voluntary Members Of The Sss Self Employed Furlough Scheme Gov Apply,

- How To Continue Paying Your Sss Contributions As An Ofw Sss Inquiries Self Employed Furlough Scheme Gov Apply,