Self Employed Tax Calculator 201920, Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

Self employed tax calculator 201920 Indeed recently is being sought by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about Self Employed Tax Calculator 201920.

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- Taxtips Ca 2020 And 2019 Canadian Income Tax And Rrsp Savings Calculator

- How To Calculate Income Tax Fy 2018 19 Examples Slab Rates Tax Rebate Ay 2019 20 Fincalc Tv Youtube

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

- Free Tax Return Calculators

Find, Read, And Discover Self Employed Tax Calculator 201920, Such Us:

- 2020 Self Employment Tax Calculator

- How To Calculate Income Tax In Excel

- Download Excel Based Income Tax Calculator For Fy 2019 20 Ay 2020 21

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download

If you re searching for Self Employed Retirement Plans Dave Ramsey you've reached the perfect location. We ve got 104 images about self employed retirement plans dave ramsey including pictures, pictures, photos, backgrounds, and much more. In these web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

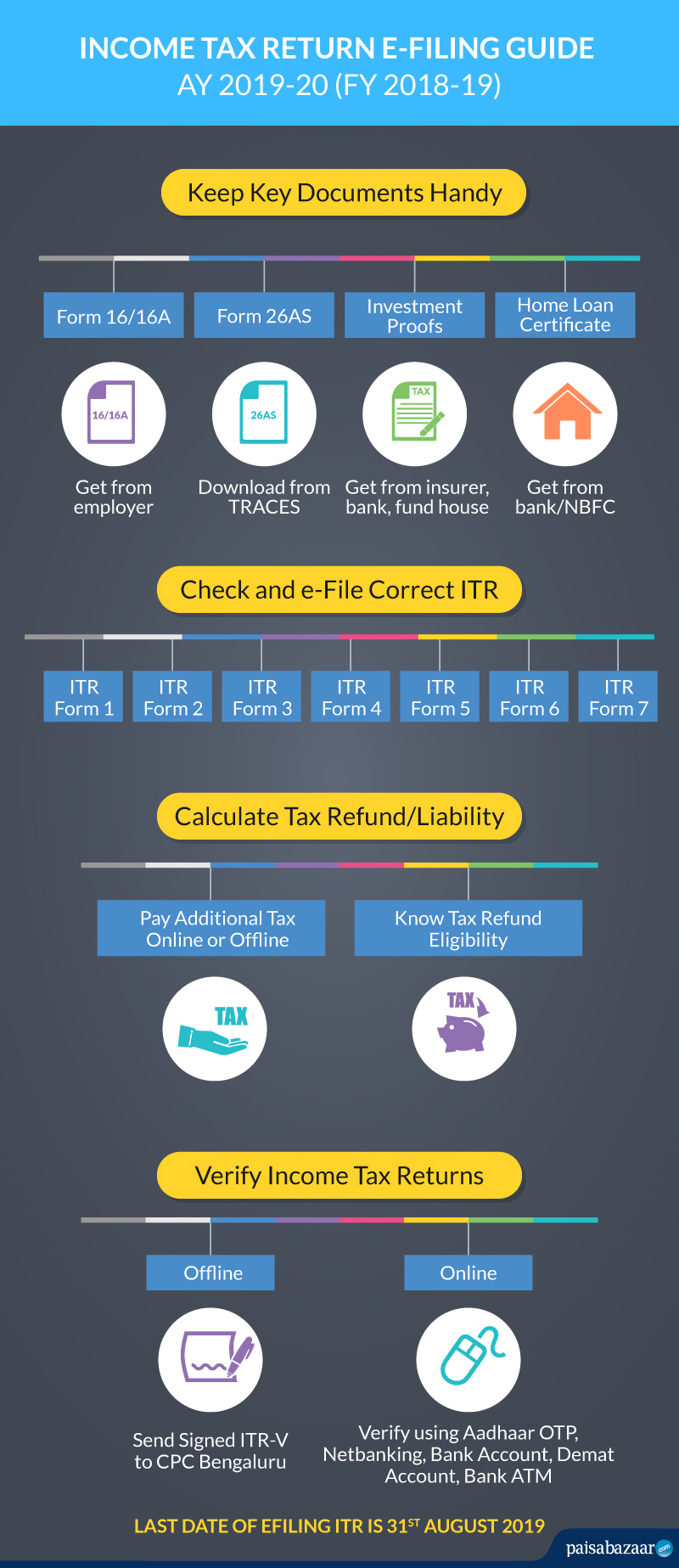

The changes from 2018 for budget 2019 are.

Self employed retirement plans dave ramsey. Age attained during 2021. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability. Employers rely on an employees personal data submitted to their human resource department to compute monthly.

The calculator uses tax information from the tax year 2020 2021 to show you take home pay. More information about the calculations performed is available on the details page. Self employment tax consists of social security and medicare taxes for individuals who work for themselves.

Annual salary please note that the results you see on your screen are estimates only. Employees who receive a w 2 only pay half of the total social security 62 and medicare 145 taxes while their employer is responsible for paying the other half. Your income employment or self employment income.

Use our handy calculator to find out how much tax will you will pay tax year. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions.

Self employed tax calculator 2020 2021 self employment profits are subject to the same income taxes as those taken from employed people. The deadline is january 31st of the following year. You pay 7200 40 on your self employment income between 10000 and 28000.

You will need to submit a self assessment tax return and pay these taxes and contributions yourself. However occasioned to any person by reliance on this calculator. For a more robust calculation please use quickbooks self employed.

Self employed tax and national insurance calculator. Mtd is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. As of 2014 malaysians no longer need to submit tax returns and can use monthly tax deduction as their final tax payment.

Use deloittes irish tax calculator to estimate your net income based on the provisions in the latest budget. This calculator is designed for illustrative purposes onlythe results should in no way be viewed as definitive for personal tax purposes for your individual tax payment. 2 per cent rate of usc now kicks in at 19874 an increase of 500.

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. If you receive a form 1099 you may owe self. 2018 self employed tax calculator.

Have you made a qualifying pension contribution.

Tax Planning Calculator Want To Know How Much You Need To Invest To Save Tax Use This Calculator To Find Out The Economic Times Self Employed Retirement Plans Dave Ramsey

More From Self Employed Retirement Plans Dave Ramsey

- Government Guidelines For Physical Activity And Exercise Uk

- Government Employees Insurance Company Phone Number

- Will Self Employed Furlough Scheme Be Extended

- Government Monopoly Examples In Real Life

- Government Of India Act

Incoming Search Terms:

- How To Create An Income Tax Calculator In Excel Youtube Government Of India Act,

- Income Tax Calculator For Fy 2019 20 Ay 2020 21 Excel Download Government Of India Act,

- Coming Soon Excel Spreadsheet Personal Income Tax Calculator Pi Accounting Government Of India Act,

- Self Employment Income Support Scheme Seiss Calculator Gerrards Cross Nunn Hayward Government Of India Act,

- How To Calculate Income Tax In Excel Government Of India Act,

- Budget 2020 National Insurance Tax Boost Which News Government Of India Act,