Uk Furlough Scheme Faq, Furlough Scheme And Job Support Scheme Faqs Clapham Collinge

Uk furlough scheme faq Indeed lately has been sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the article I will discuss about Uk Furlough Scheme Faq.

- Http Www Chadwicklawrence Co Uk Wp Content Uploads 2020 04 Covid 19 Furloughed Workers Faqs 04 04 20 Pdf

- Job Retention Scheme Extension Furlough Faq Music Industries Association

- Can The Government Furlough Scheme Help Your Business Ride The Covid 19 Storm Business Leader News

- Coronavirus Job Retention Scheme Update

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Uk Furlough Scheme Early Years Sector Welcomes Extension Cyp Now

Find, Read, And Discover Uk Furlough Scheme Faq, Such Us:

- United Kingdom Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Uk Furlough Scheme Explained How The Government Avoided Mass Unemployment Youtube

- Is The Furlough Scheme Going To Be Extended By Chancellor Rishi Sunak Lbc

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Coronavirus Furlough And The Job Support Scheme Jss Faqs Cipd

If you re looking for Self Employed Bounce Back Loan you've come to the perfect place. We have 104 graphics about self employed bounce back loan including images, photos, photographs, backgrounds, and much more. In these web page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Originally launched in march 2020 the furlough scheme was expected to end on 31 october 2020 to be replaced by a new scheme the job support scheme from 1 november.

Self employed bounce back loan. Originally launched in march 2020 the furlough scheme was expected to end on 31 october 2020 to be replaced by a new scheme the job support scheme from 1 november. Staff not previously furloughed can be put on the extended scheme provided they were on their employers paye payroll by 2359pm on friday 30 october 2020 and provided the employer submitted real time information about them to hmrc by that date. This is not covered in the governments furlough scheme at all but we have included a faq as we are being asked this by clients.

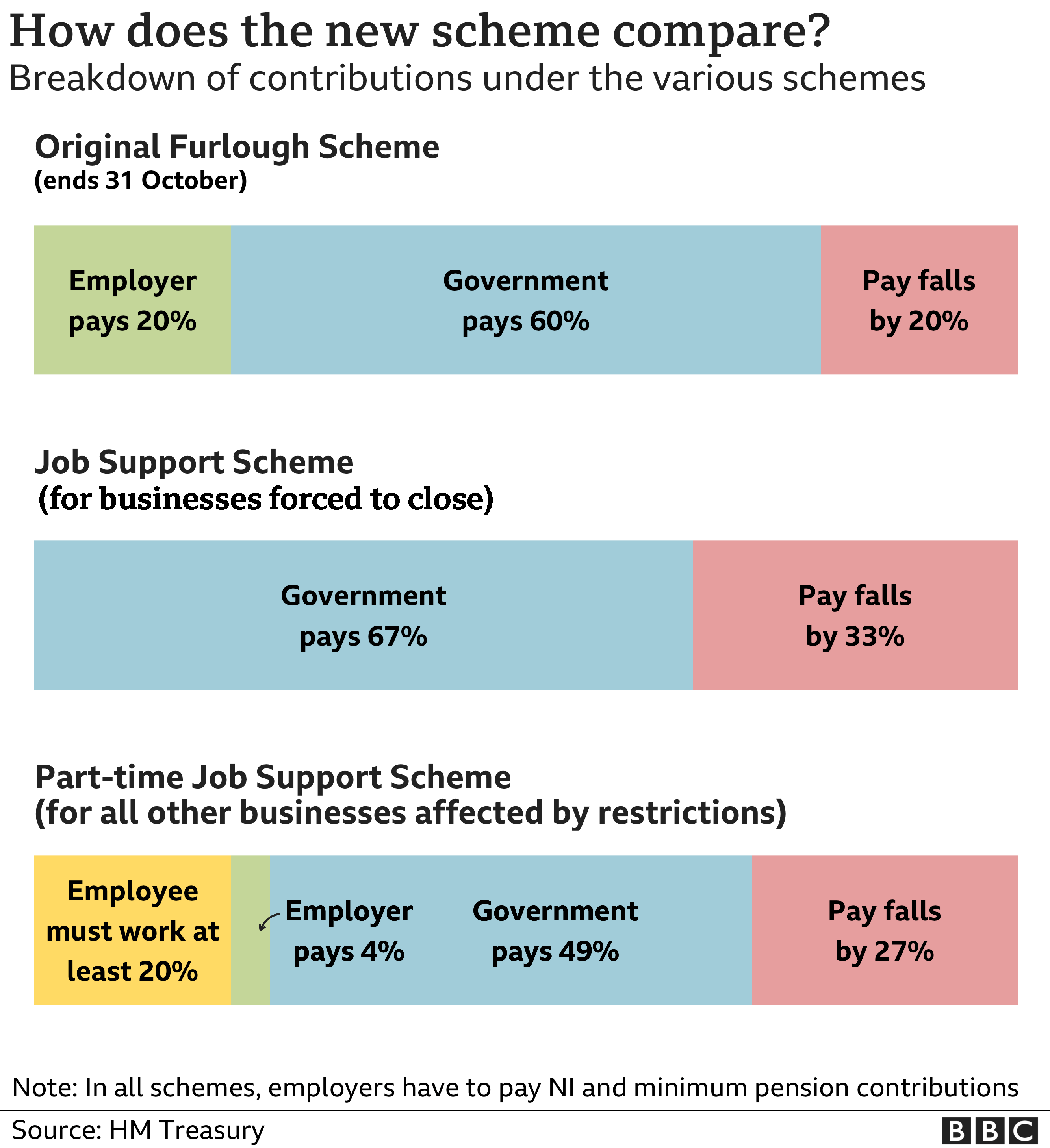

The job support scheme offers enhanced support to businesses forced to close under the governments new tier system whilst still supporting businesses whose trade has been affected. The government contribution is less than that under the furlough scheme. The job support scheme will replace the furlough scheme from 1 st november 2020.

Emi options are the most tax advantaged and therefore the most popular of all uk employee share incentives but the favourable tax treatment ceases if a disqualifying event occurs in relation to an emi. Job retention scheme jrs extension faqs why was the scheme extended. Employees must be paid through a paye scheme to be eligible.

The term has been adopted by the government when setting out arrangements under the coronavirus job retention scheme cjrs to support employers and employees in response to the unprecedented situation presented by the covid 19 pandemic. The rules this time around are slightly different to the original and flexible furlough scheme. However was extended as a result of the governments decision to.

The jrs was first put in place to provide employers whose operations had been affected by coronavirus with wage assistance from 1 march 2020. These faqs deal with the mechanics of furloughing workers under the job retention scheme jrs in place during november 2020. Below are some key faqs concerning what we currently know about the extension.

The term furlough means a temporary leave of absence for employees during which they are not required to work. Employees can not undertake work for or on behalf of their employer while they are furloughed. The government understands that these are unprecedented times and the furlough scheme has been brought in to help all employers who have seen their operations affected by the covid 19 crisis.

It is designed to allow employers to retain their employees through the crisis and to help protect the uk economy. However as a result of recently announced national lockdown restrictions in england the furlough scheme has been extended across the uk and the job support scheme postponed.

More From Self Employed Bounce Back Loan

- Government Nursery Garden Near Me

- Government And Public Administration Career Cluster Jobs

- 10 Year Government Bond Yield India Live

- Government Agency Unemployment

- Government Icon Outline

Incoming Search Terms:

- Furlough Leave Uk Faqs Updates Hunter Global Business Solutions Government Icon Outline,

- The Coronavirus Job Retention Scheme Faqs For Uk Employers Lawyers Solicitors London Government Icon Outline,

- Job Retention Scheme Furlough Faq Accountants Hull Government Icon Outline,

- Coronavirus Your Furlough Questions Answered Government Icon Outline,

- The Uk S Coronavirus Furlough Scheme Explained Wired Uk Government Icon Outline,

- Eligible For Uk Furlough Scheme Faq On Furloughing Employees Government Icon Outline,