Self Employed Bounce Back Loan, Treasury Pushes To Double Bounce Back Loan Repayment Period To 10 Years

Self employed bounce back loan Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the article I will discuss about Self Employed Bounce Back Loan.

- Bounce Back Loan Scheme Bbls Santander Corporate Commercial Banking

- Over A Million Bounce Back Loans Approved For Small Businesses Gov Uk

- Bounce Back Loan Scheme Your Questions Answered Kreston Reeves

- Hu Update Love Local App Microbusiness Fund Bounceback Loans Self Employed Tax Credits Hu Academy

- Fraud Markers Threaten Small Firms Hopes For A Bounce Back Loan The Crusader Finance Express Co Uk

- Bounce Back Loans All You Need To Know Much More With Less

Find, Read, And Discover Self Employed Bounce Back Loan, Such Us:

- Apply For A Business Bounce Back Loan Bbbl Optimum

- Microbusiness 50 000 Bounce Back Loans How They Work

- Bounce Back Loan Scheme Business Interruption Loan Scheme And Self Employment Income Support Scheme Updates Blackburn Bid

- Coronavirus Bounce Back Loan Scheme Will Prove Largely Ineffective And Costly To Our Economy

- Banks Not Just Taxpayers Stand To Lose From Bounce Back Loan Defaults Financial Times

If you are searching for Self Employed Scheme Extension you've arrived at the ideal location. We have 104 images about self employed scheme extension adding images, pictures, photos, wallpapers, and much more. In these web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Here are all the facts you need to know about bounce back loans and how they.

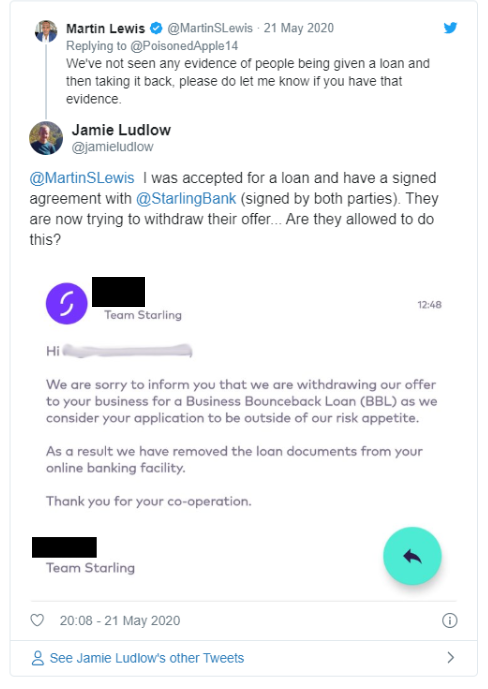

Self employed scheme extension. Martin said the bounce back loans. Weve confirmed this with a number of individual lenders. If you have taken out a bounce back loan you now have more options for repaying it under the pay as you grow scheme.

What is the bounce back loan scheme bbls. Bounce back loans can be used to repay existing finance. Small businesses and self employed workers can now apply for a state backed loan worth up to 50000 with no interest or repayment for the first 12 months.

Although not an ideal solution the new bounce back loan scheme bbls launched by the government offers a valuable source of cash for taxpayers who are not eligible to claim other coronavirus support such as a grant through the furlough scheme or self employed scheme. 8 bounce back loan need to knows. Small businesses can access loans of between 2000 and 50000 through the bounce back loan scheme.

One option that the government introduced in april 2020 as a potential avenue for those who could not access the main job retention scheme jrs or self employment income support scheme seiss was the bounce back loan scheme bbls. Under the scheme the government guarantees 100 percent of the loan. Part of support for businesses and self employed people during coronavirus guidance.

Bounce back loans dont affect your eligibility for other government personal support. The bounce back loan scheme was launched in may 2020 amid fears that the previous coronavirus funding would not be provided quickly enough for self employed workers and small businesses to get back to work as restrictions eased. These are interest free for 12 months and no repayments will be due during this time.

After some businesses struggled to access credit through the coronavirus business interruption loan scheme cbils the chancellor announced a new bounce back loan scheme bbls. You can still apply for a bounce back loan and get the self employment income support grants and you may still be eligible for universal credit.

More From Self Employed Scheme Extension

- Self Employed Business Owner

- Quickbooks Self Employed Login Uk

- Government Regulation In Lieu Of Law Perppu No 12020

- Government Of Canada Structure Chart

- Government Issues Guidelines On Loan Relief To Implement Scheme By November 5

Incoming Search Terms:

- What Happens If Businesses Cannot Repay Bounce Back Loans Lucas Johnson Insolvency Practitioners Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,

- New Bounce Back Loans To Launch Today Gov Uk Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,

- Covid 19 Update On The Small Business Bounce Back Loan Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,

- Rishi Sunak On Twitter More Businesses Can Now Benefit From Our Bounce Back Loan Scheme The Deadline For Applications Has Been Extended To The End Of January While Firms Can Top Up Existing Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,

- Co Op Bank Bounce Back Loans An Update Baranov Associates Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,

- Banks Not Just Taxpayers Stand To Lose From Bounce Back Loan Defaults Financial Times Government Issues Guidelines On Loan Relief To Implement Scheme By November 5,