Government Budget Balance Formula, Solved Q1 What Is Gdp Write Down The National Income Fo Chegg Com

Government budget balance formula Indeed lately has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Government Budget Balance Formula.

- Balanced Surplus And Deficit Budget What Is Budget

- Fund Balance It May Not Be What You Think It Is

- Solved Consider The Aggregate Demand Ad Aggregate Suppl Chegg Com

- Current Account Balance Of Payments Wikipedia

- Eghoimqhu3kpm

- Current Account Savings Investment Economics Help

Find, Read, And Discover Government Budget Balance Formula, Such Us:

- Public Spending And Taxation The Institute For Government

- Eghoimqhu3kpm

- Pdf Government Budget Balance And Economic Growth

- Living Economics Trade Deficits Transcript

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctz6pqegmisyjiojjlvhukxm57vginvxsp Sdw2pwhffr2b Uqq Usqp Cau

If you are searching for Government Debt To Gdp Ratio you've arrived at the ideal location. We have 104 images about government debt to gdp ratio adding pictures, photos, pictures, wallpapers, and more. In these webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

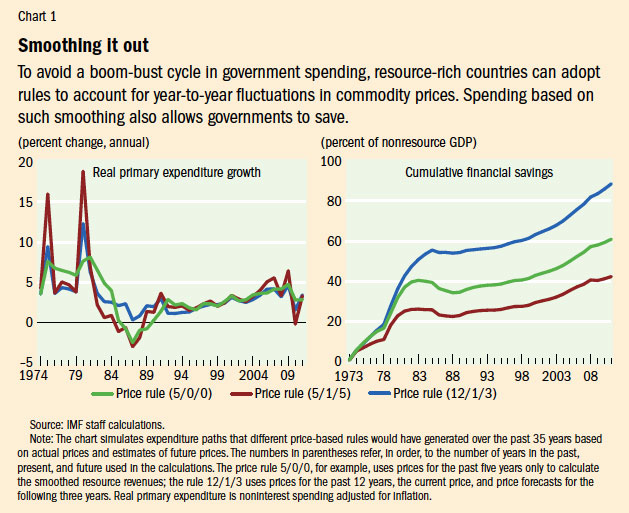

While it may be beneficial for governments to sock away surpluses for so called rainy day funds in case of a downturn in tax revenue the government is generally not expected to operate as a for profit business.

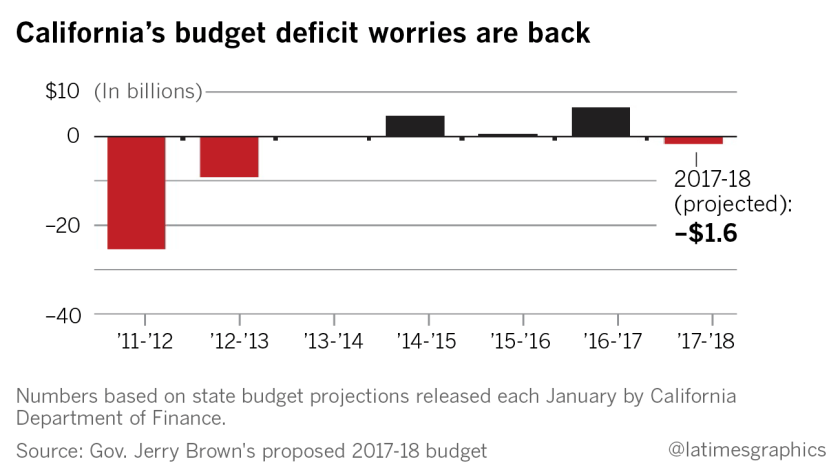

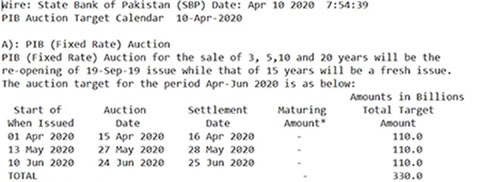

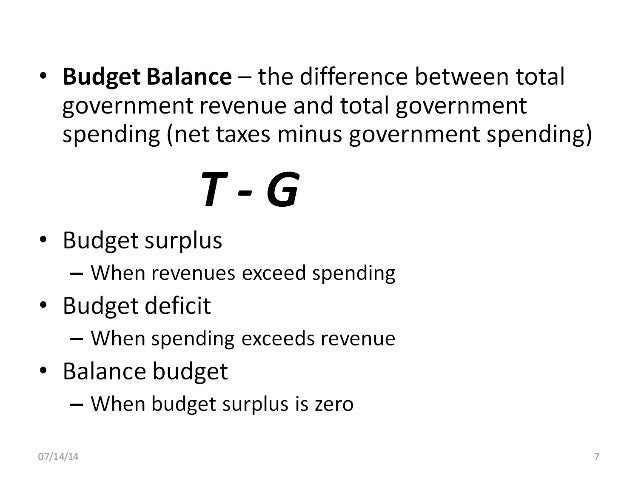

Government debt to gdp ratio. As an equation overall fiscal deficit primary deficit government interest payments. A balanced budget particularly that of a government is a budget in which revenues are equal to expenditures. This may be illustrated here.

The calculation should be performed periodically during the development of the budget. A budget deficit exists when the governments total expenditure consisting of purchases of goods and. Budget deficit total expenditures by the government.

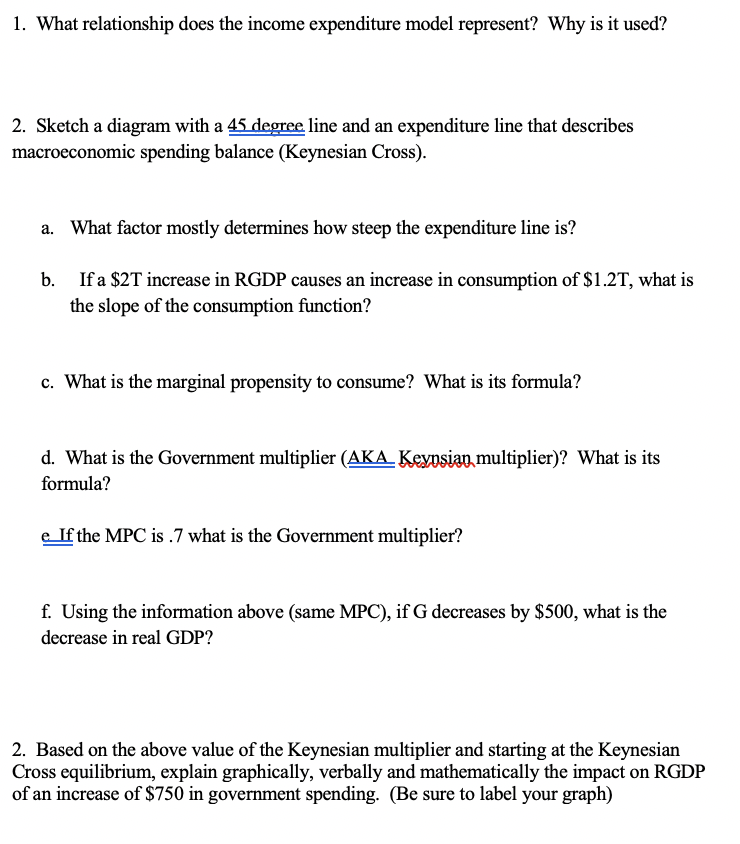

The expansionary effect of a balanced budget is called the balanced budget multiplier henceforth bbm or unit multiplier. Let us assume an mpc of 075. If we consider the skm without foreign trade ie if we take a closed economy the bbm can be less than one if we change the usual assumption about the tax function.

Where annual expenses of a budget exceeds the annual income of the budget then it is known as budget deficit indicating financial unhealthiness of a country which can be reduced by taking the attempts of different measures like reduction of revenue outflow and increasing revenue inflow. Balanced budget means nuetral fiscal policy. Let us make an in depth study of the proportional tax function and the balanced budget multiplier.

While a budget deficit expands an economy and a budget surplus contracts it a balanced budget on the other hand leaves the economy alone. Normally in the skm with government we take taxes as fixed. Referencing to this article government budget balance the budget balance equation is mathy c i g x mmath c is consumption spending i is private investment spending g is government spending on goods and services x is exports and.

Show how to calculate the budget balance of government. Periodically during the budget development process estimates should be prepared to reflect the projected ending fund balance. A government runs a balanced budget when it does not want to mess with the economy.

Here an increase in government spending matched by an increase in taxes results in a net increase in income by the same amount. A balance budget is when. The implication is that interest payments are singled out as a special category of the budget.

This is the essence of bbm. Alternatively primary deficit non interest spending taxes. A government budget is a financial statement presenting the governments proposed revenues and spending for a financial yearthe government budget balance also alternatively referred to as general government balance public budget balance or public fiscal balance is the overall difference between government revenues and spendinga positive balance is called a government budget surplus and.

The primary budget balance is the government fiscal balance excluding interest payments.

More From Government Debt To Gdp Ratio

- Government Universities In Lahore For Bscs

- Self Employed Pandemic Unemployment Assistance Arizona

- Furlough Scotland September 2020

- Furlough Scheme Uk Timeline

- Self Employed Working From Home

Incoming Search Terms:

- Appended Note 3 1 Self Employed Working From Home,

- Budget Solutions 2020 A 5 Year Plan To Balance Illinois Budget Pay Off Debt And Cut Taxes Illinois Policy Self Employed Working From Home,

- Learning Objectives Fiscal Policy Lo1 See Why The Federal Government S Budget Depends On The Rate Of Taxation The Size Of The Gdp And Its Own Spending Ppt Download Self Employed Working From Home,

- Current Account Formula Examples How To Calculate Current Account Self Employed Working From Home,

- Government Budget And The Economy Cbse Notes For Class 12 Macro Economics Learn Cbse Self Employed Working From Home,

- What Drives The Responsiveness Of The Budget Balance To The Business Cycle In Eu Countries Intereconomics Self Employed Working From Home,