Self Employed Bounce Back Loan Hsbc, How To Apply For A Small Business Coronavirus Bounce Back Loan

Self employed bounce back loan hsbc Indeed lately is being hunted by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Self Employed Bounce Back Loan Hsbc.

- How To Apply For A Small Business Coronavirus Bounce Back Loan

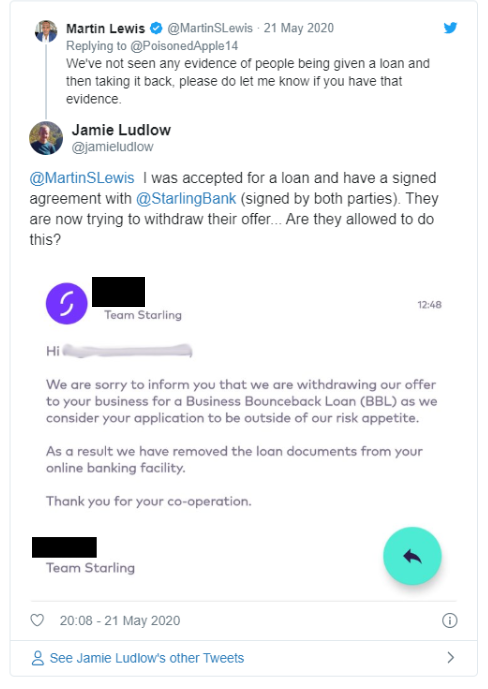

- Mse To Refer Starling Bounce Back Loan Complaints To Regulator

- Bounce Back Loans Help For Small Businesses And Income Support For Those Missing Out Elsewhere Eg Limited Company Directors And Self Employed

- Government Launch Bounce Back Loans To Fix Cbils Problems Prestige Business Management

- Pdf The World S Local Bank Hsbc S Expansion In The Us Canada And Mexico

- Bounce Back Loan Scheme Gdb Gatwick Diamond Business

Find, Read, And Discover Self Employed Bounce Back Loan Hsbc, Such Us:

- Hsbc Bounce Back Loans

- Lloyds Rapped For Forcing Bounce Back Loans Borrowers To Open Accounts

- Business Bounce Back Loans For Property Investors Grl Landlord Association

- Hsbc Handling Of Bounce Back Loans Branded Shambles By Businesses

- Why You Can T Just Withdraw A Bounce Back Loan From The Company

If you are looking for Self Employed Retirement Plans Canada you've come to the perfect place. We ve got 100 graphics about self employed retirement plans canada including pictures, photos, pictures, backgrounds, and more. In such webpage, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

And your business started on or before the 5th april 2019 and you can provide a self assessment tax return for this as part of your application or.

Self employed retirement plans canada. The bank has approved 194000 bounce back loans so far worth 59bn and said it is approving a new loan every 20 seconds. If you are applying for a bounce back loan and you have a personal current account used for your sole trader business with hsbc and your business was established on or before 5 april 2019 you will be asked to supply your account number and sort codewe will require you to provide and attach a scanned copy of your 201819 self assessment tax return with this application form. Bounce back loans dont affect your eligibility for other government personal support.

Hsbc halting bounce back loan applications due to huge demand will anger small business customers hoping to sneak under the wire and take out the one year interest free loan before november 30. Bounce back loans help for small businesses and income support for those missing out elsewhere eg limited company directors and self employed 3 november 2020 small businesses can now apply for a new 100 state backed loan worth up to 50000 with no interest charged or repayments needed in the first 12 months. Weve confirmed this with a number of individual lenders.

The only link i have been able to find is for the tax year overview. A scanned copy of. I am looking to apply for a bounce back loan with hsbc.

If youre applying for a bounce back loan and you have a personal current account that you have used for your business purposes and your business was established on or before 5 april youll need to provide a scanned copy of your 201819 self assessment tax return. Weve approved over 118000 bounce back loans so far and have been working hard to get these much needed loans to our customers as quickly as possible peter trotman director of business broker vision business advisers and an hsbc business customer for four years blames hsbc opening up bounce back loans to non hsbc customers for. The bounce back loan is offered by hsbc as part of the uk governments bounce back loan scheme the scheme.

Meanwhile hsbc is offering the loans to all new and existing customers and popular mobile. Not a problem in itself i have been in business for 17years now but not sure where i find this on the hmrc self assesment site. As part of the application it is asking me for my 2018 2019 tax return.

More From Self Employed Retirement Plans Canada

- Government Exams After Graduation 2021

- Self Employed Income Support Grant August

- Government Lenovo Laptop Display Price

- Uk Furlough Scheme Uk

- Furlough Voluntary Leave

Incoming Search Terms:

- Tide Halts Bounce Back Loan Lending Leaving 10 000s Stuck On Its Waiting List Furlough Voluntary Leave,

- Chancellor Launches New Scheme To Speed Up Lending For Smes Reaction Business Insider Furlough Voluntary Leave,

- Hsbc Uk Introduces Bounce Back Loans Scheme For Small Businesses Furlough Voluntary Leave,

- Hsbc Profits Plunge By More Than 82 As Loans Sour This Is Money Furlough Voluntary Leave,

- My Firm May Fold Because I Can T Get A Bounce Back Loan Bbc News Furlough Voluntary Leave,

- Wrong Bank Account Number On My Echosign Mr Bounce Back Bounce Back Loan Complaints Furlough Voluntary Leave,