Self Employed Vat Calculator, Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Self employed vat calculator Indeed lately is being sought by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Self Employed Vat Calculator.

- Whillans Tax Calculators For Android Apk Download

- Self Employed Tax As A Freelancer In The Uk Expatica

- Taxcalc News February Taxcalc

- Workplace Calculator Www Sodra Lt

- Payment On Account 2020 What It Is How To Calculate Your Tax Bill Deadline To Pay And How To Reduce It Lovemoney Com

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

Find, Read, And Discover Self Employed Vat Calculator, Such Us:

- Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

- Money Digital Tax Roll Out Should Be Halted To Save Self Employed From Unknown Costs Vat

- Vat For Freelancers Basics You Need To Know Kontist

- Study Tips Discount Types Foundation Bookkeeping Aat Comment

- Pro Rata Salary Calculator Salary Calculator 2020 21 Transferwise

If you are searching for Government Qr Code App Nz you've come to the right place. We ve got 104 graphics about government qr code app nz adding images, photos, photographs, backgrounds, and much more. In such page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Calculation Of Price Of Construction Work Without Vat Performed By Download Scientific Diagram Government Qr Code App Nz

Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year.

Government qr code app nz. Self employed tax calculator 2020 2021. Instead of keeping records of all receipts and then separating business and personal use you can simply claim 45p per mile or 25p for mileage over 10000 on business mileage. How to use our calculator.

See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability. You pay 7200 40 on your self employment income between 10000 and 28000.

Sponsored article on the vat calculator. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Leave blank any years during which you were not self employed.

Self employment profits are subject to the same income taxes as those taken from employed people. The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions. More information about the calculations performed is available on the details page.

You pay 2000 20 on your self employment income between 0 and 10000. Employed and self employed. It can be difficult to work out the amount of tax national insurance and student loan that you will owe to hmrc if you are both employed and self employed at the same time.

The deadline is january 31st of the following year. If you made a loss in any of the years then please enter a minus before the amount. Before using this tool please see our disclaimers.

You will need to submit a self assessment tax return and pay these taxes and contributions yourself. If self employed mileage vat costs can be reclaimed as a simple tax relief for motoring expenses. If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion.

Universal social charge prsi and vat. Anita forrest is a chartered accountant spreadsheet geek money nerd and creator of wwwgoselfemployedco the uk small business finance blog for the self employed community. You will need to obtain information from your filed tax returns for 201819 201718 and 201617 to estimate your grant.

This means that self employed people pay a total of 11 usc on any income over 100000. An extra charge of 3 applies to any self employed income over 100000 regardless of age. Here she shares simple straight forward guides to make self employment topics like taxes bookkeeping and banking easy to understand.

More From Government Qr Code App Nz

- Types Of Government Worksheets Printable

- Self Employed Furlough Cheats

- Government Quota Seats In Private Medical Colleges In Karnataka

- Government Contractor Jobs Maryland

- Self Employed Health Insurance Deduction Schedule C

Incoming Search Terms:

- Self Employed Business Expenses All You Need To Know Quickbooks Uk Blog Self Employed Health Insurance Deduction Schedule C,

- Flat Rate Vat Scheme For Contractors Scheme Details Self Employed Health Insurance Deduction Schedule C,

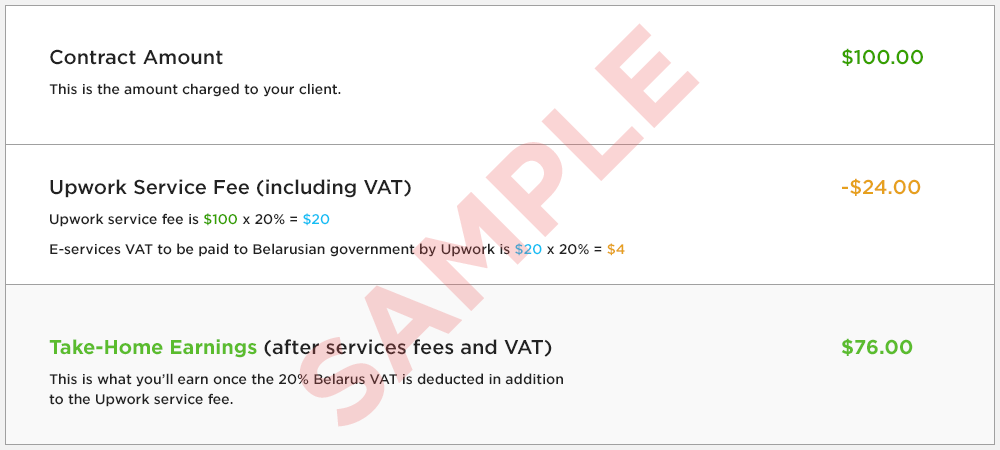

- Value Added Tax Vat Upwork Help Self Employed Health Insurance Deduction Schedule C,

- Milan Italy September 272018 Tax Income Business Finance Stock Image 1189579885 Self Employed Health Insurance Deduction Schedule C,

- Vat The Pros And Cons Of Voluntary Registration Self Employed Health Insurance Deduction Schedule C,

- A Uk Freelancer S Overview Of Vat Freelance Uk Self Employed Health Insurance Deduction Schedule C,