Self Employed Vs Limited Company Uk, Sole Trader Vs Partnership Vs Limited Company

Self employed vs limited company uk Indeed lately is being sought by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about Self Employed Vs Limited Company Uk.

- Coronavirus Report Ipse

- Where Do You Have Your Company Located

- 7 Advantages A Sole Trader Self Employed Business Has Over A Limited Company Bytestart

- Personal Trainer Sole Trader Or Limited Company Origym

- Self Employed Vs Employee Vs Ltd Shoot Me Down Accountingweb

- Self Employed Vs Limited Company Which Is Right For My Business

Find, Read, And Discover Self Employed Vs Limited Company Uk, Such Us:

- Self Employed Vs Limited Company Status What You Need To Know

- Uk Es Consulting Ltd Linkedin

- Self Employed Vs Limited Company Which Way Is Best For My Business

- Uk Freelance Workers Reported Self Employed Status Download Scientific Diagram

- Should I Be Self Employed Or A Limited Company Ihorizon

If you are looking for Uk Government Lockdown Map you've come to the perfect place. We have 100 graphics about uk government lockdown map including pictures, photos, pictures, wallpapers, and much more. In such page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The business needs to be registered with companies house directors must be appointed and an annual tax return along with a set of accounts must be filed.

Uk government lockdown map. You can change to a limited company later if your business grows or your needs change. For many smaller businesses or self employed tradespeople being a sole trader offers a few financial advantages but it also brings an increased level of risk. As a sole trader you run your own business as a self employed person and are solely responsible for the success of it.

Should you set up as a sole trader or limited company. Use our free online limited company tax calculator to compare your take home pay as a limited company versus as a sole trader. For new businesses with lower turnovers and profits its possible to thrive as self employed.

Its the simplest business structure out there which is probably why its the most popular and you can set up as one via the govuk website youll need to do this for tax purposes. A sole trader is essentially a self employed person who is the sole owner of their business. One of them is the legal form your business is going to take.

Failure to submit returns on time usually results in significant fines. If youre an individual starting a small business doing odd jobs and trying to build a stable income by trading on your own it might be easy to start out as self employed. To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed.

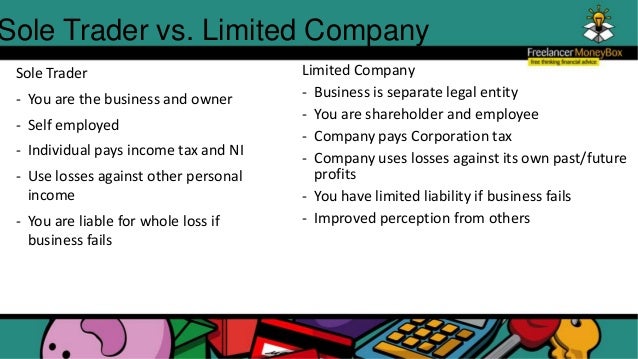

Limited company vs self employed which do you choose. Both sole traders and directors of limited companies are required to submit a personal self assessment to hmrc but those operating a limited company must also submit extra paperwork to regulatory authorities corporation tax annual accounts vat returns if vat registered. Sole trader vs self employed.

Which is better self employed vs limited company a conclusion. But when those numbers start to increase its a good idea for the health of the business to register as a limited company. What is a limited company.

Should i be self employed or a limited company. Becoming a limited company can protect owners from these risks by giving them limited liability but it can also mean a lot more admin and fiduciary duties for the directors. Choosing whether to set up as self employed or a limited company is dependent on your situation.

A sole trader is basically the same as someone who is self employed.

More From Uk Government Lockdown Map

- Payday Government Malaysia 2020

- The Furlough Bonus Scheme

- Register Self Employed Deadline

- Government Zoom Meeting

- Government Help To Buy Scheme

Incoming Search Terms:

- Lecture 2 Uk Company Law Law3102 Mdx Studocu Government Help To Buy Scheme,

- Limited Company Vs Self Employed Pentins Business Advisers Government Help To Buy Scheme,

- Self Employment Vs Limited Company Which To Choose Mc Business Accounts Government Help To Buy Scheme,

- How Umbrella Companies Work Nixon Williams Government Help To Buy Scheme,

- Set Up A Limited Company Or Be Self Employed Bytestart Government Help To Buy Scheme,

- Self Employed Or Company Morris Co Cheshire Government Help To Buy Scheme,