Self Employed What Can I Claim Tax Back On, Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

Self employed what can i claim tax back on Indeed recently is being hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Self Employed What Can I Claim Tax Back On.

- Tax For Self Employed And Freelance Workers In Belgium Expatica

- Britske Self Assessment Danove Priznani Slevy Na Dani Pro Osvc Taxback Com

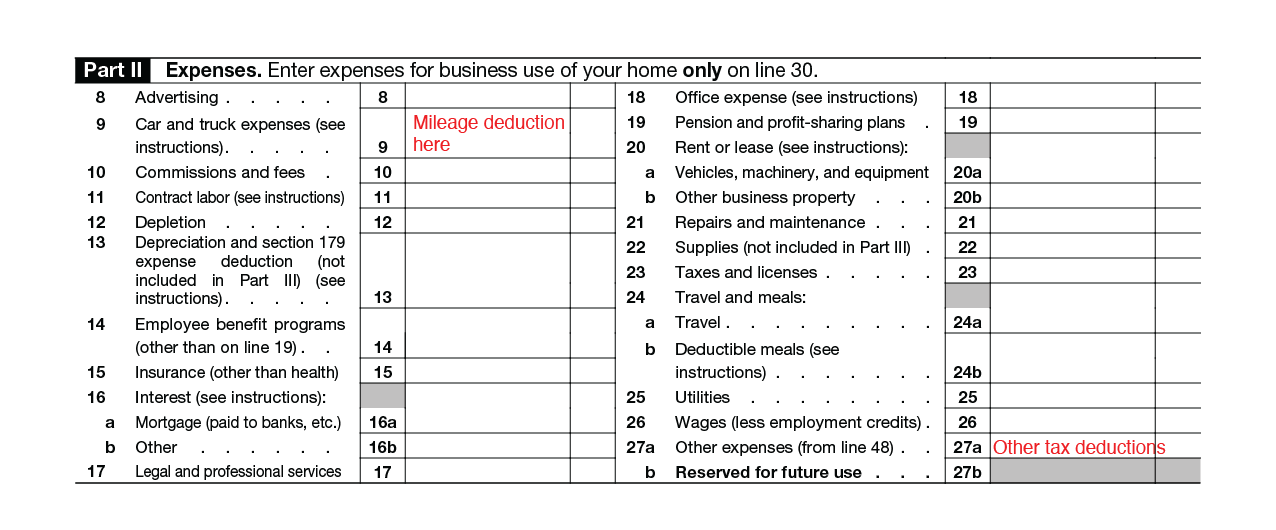

- Claiming Car Mileage Allowance Car Mileage Claim Gst

- How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

- How To Fill In A Self Assessment Tax Return Money Advice Service

- Rapid Refunds Rapidrefunds Twitter

Find, Read, And Discover Self Employed What Can I Claim Tax Back On, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqpqt Vyooh83b70zudldx5dvml5a2yjw5rq9gsknqudjwy4lf6 Usqp Cau

- 1

- Rebate My Tax Ltd Tax Preparation Service Westerham 30 Reviews 42 Photos Facebook

- Can I Get A Ppi Tax Refund If I M Self Employed Learn How Gowing Law

- What Self Employed Expenses Can I Claim On My Tax Return Viking Wanderer

If you are searching for New Furlough Scheme Explained you've arrived at the perfect place. We have 104 images about new furlough scheme explained including pictures, photos, photographs, wallpapers, and much more. In these webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

But tax is never as easy as all that.

New furlough scheme explained. Your business earns 25000 in a tax year but your allowable expenses add up to 5000. Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. In brief you can claim the cost of your own food and drink when youre travelling on business.

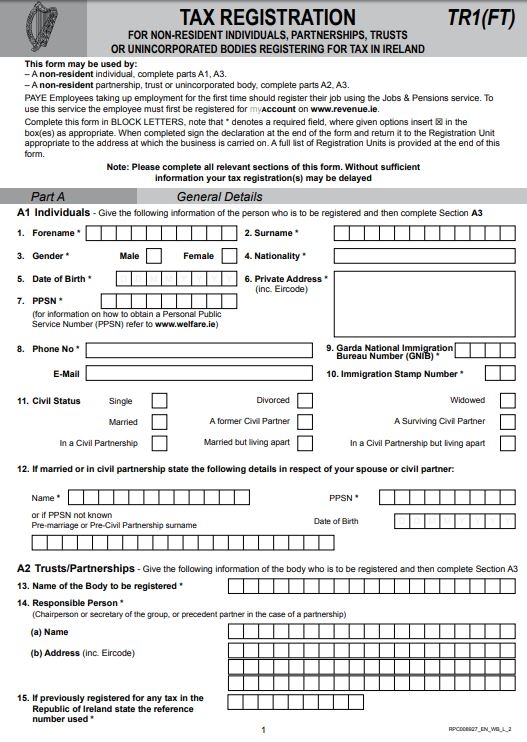

Understanding which of your self employed expenses are allowable and calculating your profit accurately is important for making sure you pay the right amount of tax. If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10. An expense is allowable as a deduction only if it is incurred wholly and exclusively for business purposes.

For instance if youre a cis worker and dont wear a standard uniform you can claim for your high vis jackets and boots but you cant claim for generic work clothes like jeans. If youre self employed your business will have various running costs. Over the years ive come to realise that not many self employed people are aware of this but you can actually claim a proportion of your council tax as an allowable expense if you work from home.

You can claim back tax on any work tools that youve purchased or hired plus any protective clothing or uniform laundering if youre paye. The rules are different if youre an employee including of your own limited company or if youre self employed. Claire georghiades fca of accountsresource explains how to work out what motor expenses you can claim if youre self employed when are motor expenses classed as an allowable expense.

You may be able to calculate your car van or motorcycle expenses using a flat rate known as simplified expenses for mileage instead of the actual costs of buying and running your vehicle. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. How to claim keep records of all your business expenses as proof of your costs.

Business use of your home including use by day care providers. Lets look at each of them in turn. Claiming council tax as an.

More From New Furlough Scheme Explained

- Government Number Plate India

- Furlough Scheme Rules November 2020

- Government Of India Is Encouraging Cultivation Of Pulses

- Self Employed Unemployment California Reddit

- Executive Branch Us Government Organizational Chart

Incoming Search Terms:

- Screenskills Freelance Toolkit 01 11 18 Executive Branch Us Government Organizational Chart,

- Turbotax Self Employed Online 2019 File Self Employment Taxes Executive Branch Us Government Organizational Chart,

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse Executive Branch Us Government Organizational Chart,

- Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting Tax Preparation Business Tax Tax Checklist Executive Branch Us Government Organizational Chart,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqpqt Vyooh83b70zudldx5dvml5a2yjw5rq9gsknqudjwy4lf6 Usqp Cau Executive Branch Us Government Organizational Chart,

- Working From Home Make Sure You Claim These Expenses Freeagent Executive Branch Us Government Organizational Chart,