Sss Self Employed Payment Form, Ss Form Rs 5 Fill Online Printable Fillable Blank Pdffiller

Sss self employed payment form Indeed lately has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about Sss Self Employed Payment Form.

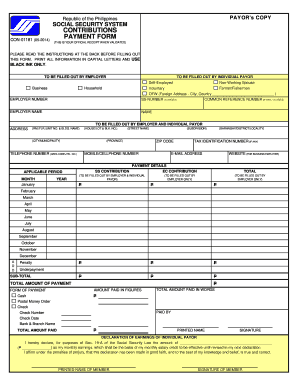

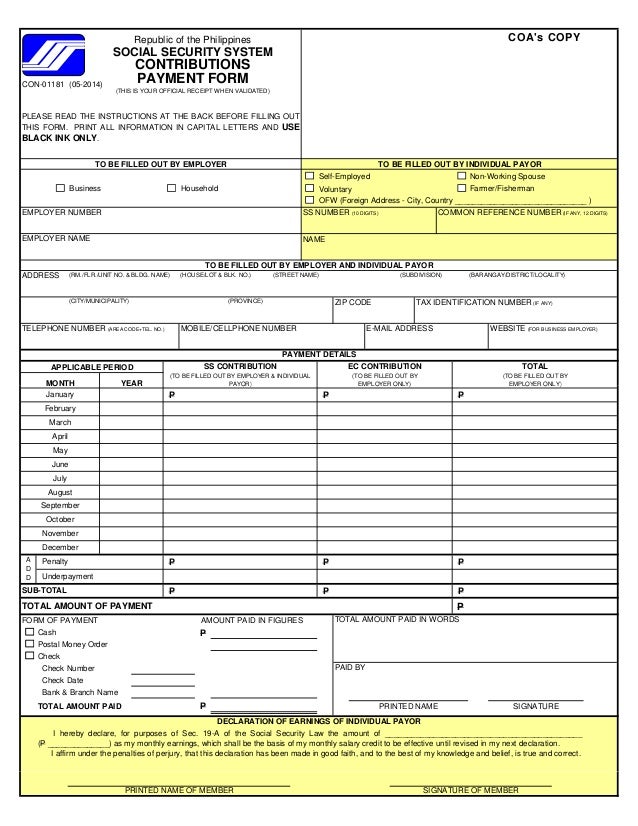

- Con 01181 Contributions Payment Form Pdf D47ew9r2mmn2

- Sss Requirements For Self Employed Fill Online Printable Fillable Blank Pdffiller

- 11 Easy Steps To Pay Your Sss Contributions Online And Generate Prns Too Taxumo File Pay Your Taxes In Minutes

- Sss Pinay Investor

- Sss Online Registration And Steps To Check Sss Your Contribution Online

- Hr Talk Top 10 Questions Re Sss Sickness Benefit Answered Tina In Manila

Find, Read, And Discover Sss Self Employed Payment Form, Such Us:

- Sss Payment Form Fill Online Printable Fillable Blank Pdffiller

- How To Pay Sss Contributions Using Prn Generated Form

- Sss Salary Loan For Self Employed Or Voluntary Members A Quick Guide Scribbling Neurons

- How To Be An Sss Voluntary Member

- How To View And Check Your Sss Contributions Online Balinkbayan Blog

If you re searching for Government Building you've reached the right location. We ve got 104 graphics about government building including images, pictures, photos, wallpapers, and much more. In these web page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Sss contribution online payment guide for ofw self employed and voluntary updated on october 26 2020 by matt here is the complete guide on how to pay your sss contribution and loans online via bancnet gcash and unionbank.

Government building. The total contributions paid by the employer in this payment form includes the social security contributions shared by both the. Sickness benefit application form for self employedvoluntary member member separated from employment medical certificate. This sss contribution payment guide applies only to employers and individually paying members self employed voluntary non working spouse and land based ofws in countries without bilateral labor agreement.

Fund amendment form. Fund payment form. Sss benefits for.

Last updated on 09042020 by filipiknow. To be filled out by individual payor self employed. Employer on or before the 5th calendar day following the applicable month.

Keep himselfherself always informed of changes and enhancements in ec policies and benefit structure. Social security system con 01181 05 2014 contributions payment form this is your official receipt when validated please read the instructions at the back before filling out this form. For ofws the minimum monthly salary credit is p5000.

To be filled out by employer. The prn was generated may 13 2020 when the member was still on employed status. Register with the mysss portal.

Apply for unified multi purpose id umid card. Non working spouses contribution is 50 of the their working spouses last posted monthly salary credit which should not be lower than p2000. Pay your monthly amortization on the following schedule.

For self employed voluntary non working spouse farmerfisherman. Over payment prior periods under payment n e t d u e p p please pay on or before 1. The sss contribution table below is for self employed individuals voluntary members and overseas filipino workers.

Self employedvoluntary member on or before the last working day of the applicable month. If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members. Print all information in capital letters and use black ink only.

Pay this prn before deadline once paid and after 1 to 3 business days you will see your status changed from employed to voluntary paying. Pay your contributions following the payment deadline to avoid application of payments prospectively. Fund withdrawal form.

More From Government Building

- What Does Furlough Mean

- What Is Furlough In The Uk

- Self Employed Printable Free Blank Profit And Loss Statement Pdf

- Government Logo Design Competition

- Self Employed Loans Bad Credit

Incoming Search Terms:

- Can I Pay Philhealth Online Fill Out And Sign Printable Pdf Template Signnow Self Employed Loans Bad Credit,

- Updated Sss Contribution Table 2019 Employee Employer Share Self Employed Loans Bad Credit,

- How To Get Sss Prn Or Payment Reference Number Para Sa Pinoy Self Employed Loans Bad Credit,

- Https Www Sss Gov Ph Sss Downloadcontent 3ffilename 3dirr Ra11199 Ss Act Of 2018 Pdf Self Employed Loans Bad Credit,

- Sss E 4 Form 1d47dq6vx242 Self Employed Loans Bad Credit,

- Sss Contributions Table And Payment Deadline 2020 Sss Inquiries Self Employed Loans Bad Credit,