What Is Furlough Amount Based On, How Laid Off And Furloughed Employees Can Keep Their Health Coverage Third Way

What is furlough amount based on Indeed lately is being hunted by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will talk about about What Is Furlough Amount Based On.

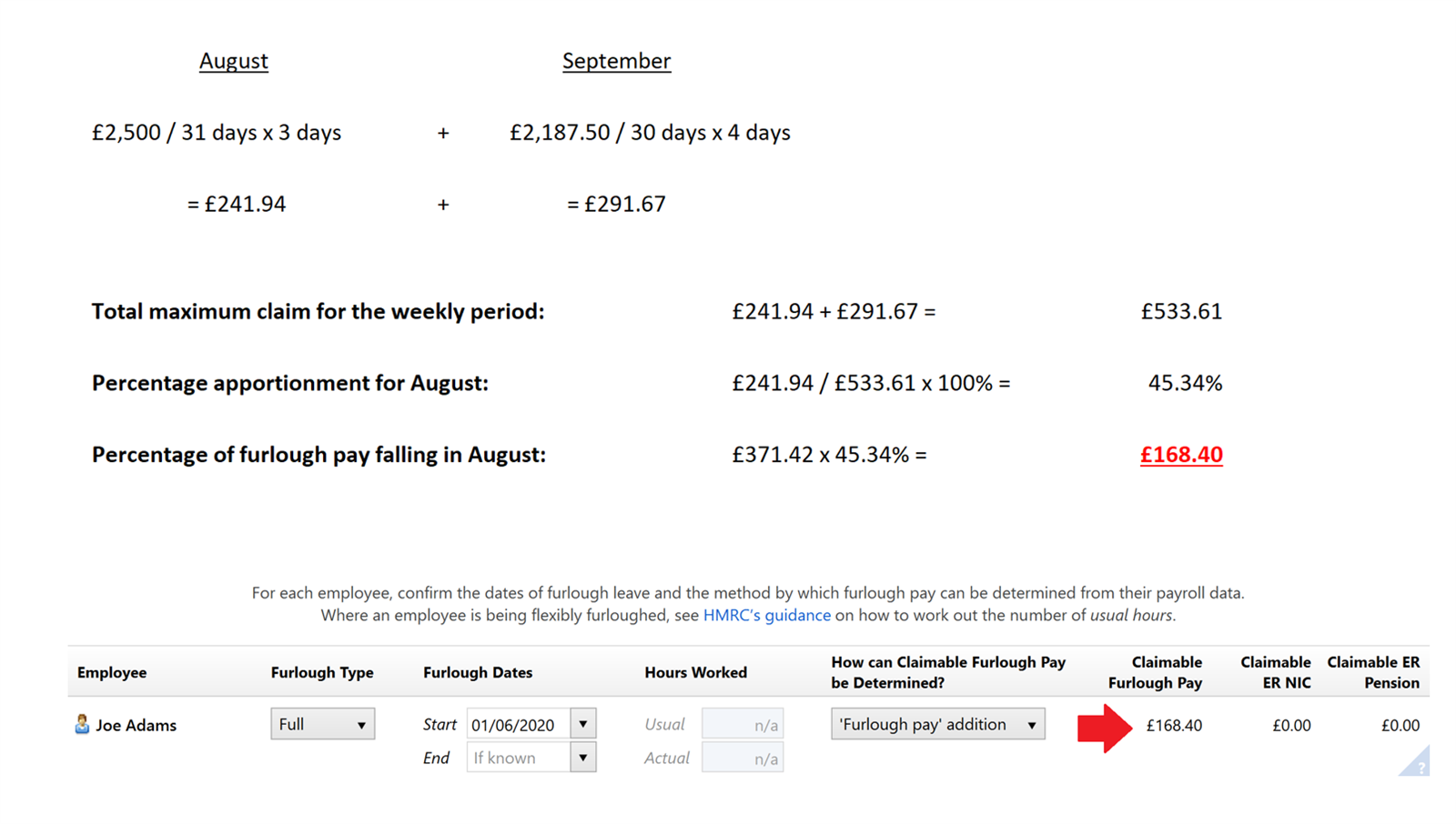

- Cjrs Flexible Furlough Scheme Making A Claim Through Hmrc Brightpay Documentation

- How To Furlough Workers Paycircle

- Cjrs Brightpay Pay Periods Crossing September October Brightpay Documentation

- Uk Coronavirus Furlough Wind Down Dates And Costs For Uk Retailers To Note Lexology

- Https Www Keytime Co Uk Wp Content Uploads 2020 05 Keytime Covid 19 Furloughed Employee And Job Retention Scheme Payroll Processing Changes V8 Pdf

- Update Here Are The Side Projects Fintechs Are Launching To Ease Strain Of Coronavirus Altfi

Find, Read, And Discover What Is Furlough Amount Based On, Such Us:

- Uk Coronavirus Furlough Claim Calculator

- More Than One In Four Uk Workers Now Furloughed Bbc News

- Almost 1 900 Reports Of Furlough Fraud To Hmrc Personnel Today

- Coronavirus The Amount Of Money Made By Furlough Fraudsters Makes For Depressing Reading Business News Sky News

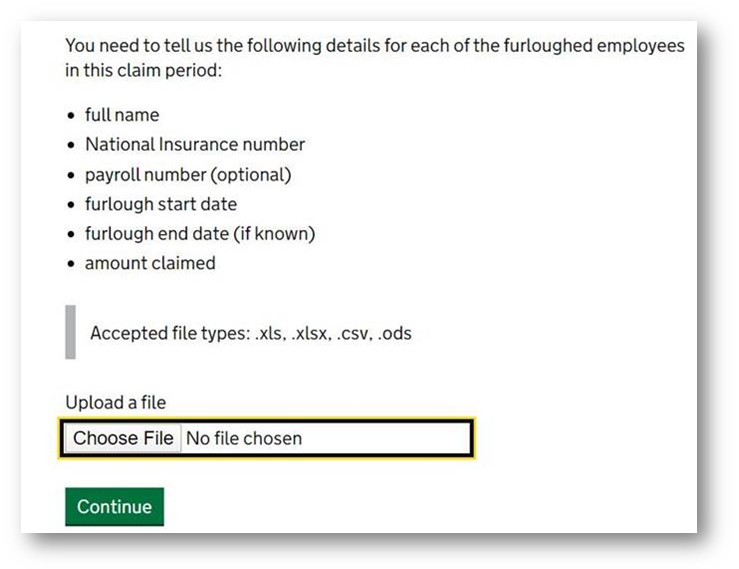

- Making A Claim Through Hmrc S Coronavirus Job Retention Scheme Cjrs Portal Fourth Hotschedules Customer Community

If you re looking for Local Government Functions Pdf you've arrived at the right place. We ve got 100 graphics about local government functions pdf including pictures, photos, pictures, wallpapers, and more. In these webpage, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Https Www Iris Co Uk Wp Content Uploads 2020 07 Earnie Covid 19 E2 80 93 Furlough Job Retention Scheme Changes And Important Dates Pdf Local Government Functions Pdf

As the employee is on fixed pay and the claim period is again the full pay period the maximum wage amount and 80 of usual wage will be the same amounts so the furlough pay is again based on.

Local government functions pdf. The amount of 2500 per month appears to be gross a reference to the employees wage during furlough being subject to usual income tax and other deductions but employers can claim employer nics and auto enrolment pension contributions ie. The government may decide to announce that furlough will extend into the summer. So to work out 80 of your wage your employer will start with what you got paid in the last pay period before 19 march divide by the total number of days in that pay period multiply by the number of.

Furlough will end in december when england comes out of lockdown the government says. For workers paid a fixed full or part time salary furlough pay is based on what was earned during the last paid period before 19 march 2020. In the second phase of the scheme from july onwards employees are permitted to work for the employer on some days and the employer pays for hours worked.

Originally furlough was set up to cover march april and may payroll but this has now been extended to june. The amount an employee earned in the same month last year or the average amount an employed earned from the last year. After furlough employees will usually return to their job afterwards unless redundancies follow.

This calculator is designed to provide a quick overview of furlough amounts based on the 80 rule with a maximum monthly amount of 250000 per employee. How do i calculate furlough payments to employees. Start with the amount of minimum furlough pay.

The calculator works by defining an annualised salary and producing an indicative daily rate based on 260 working days per year as a benchmark. As such employers will need to ensure that the furlough payment provides sufficient monies to cover these training hours. Where the furlough payment is less than the appropriate minimum wage entitlement for the training hours the employer will need to pay the additional wages to ensure at least the appropriate minimum wage is paid for 100 of.

Depending on which month youre claiming for multiply by. The minimum furlough period on the first phase of the scheme was three consecutive weeks. Regions will then be classed into tiers as before based on their coronavirus risk level and the job.

More From Local Government Functions Pdf

- Self Employed Working From Home Jobs Uk

- Hp 245 G5 Government Laptop Wifi Drivers

- Government Covid Relief Fund

- Self Employed Government Assistance Covid 19

- Self Employed Payslip Template Uk

Incoming Search Terms:

- Uk Borrowing Soars In August As Covid Costs Mount Bbc News Self Employed Payslip Template Uk,

- Coronavirus What Does Furlough Mean And How Will It Affect Workers Worldwide World Economic Forum Self Employed Payslip Template Uk,

- Support In Payroll For Furloughed Workers Freeagent Self Employed Payslip Template Uk,

- Chancellor Announces Flexible Furlough Scheme Detail Bii Self Employed Payslip Template Uk,

- How To Calculate Redundancy Pay For Furloughed Staff The Gazette Self Employed Payslip Template Uk,

- Uk Furlough Scheme Faqs News Views Self Employed Payslip Template Uk,