What Is Furlough Pay For August, Sunak Tells Firms To Pay Into Virus Furlough Scheme From August Business Industry News Analysis Magazines Asian Trader

What is furlough pay for august Indeed recently has been hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will discuss about What Is Furlough Pay For August.

- Rishi Sunak Announces Employers Must Pay Some Furlough Costs For Staff From August Heart

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Small Business Workforce Trends During Covid 19 August 2020 Gusto

- The Government Is Not Paying Nine Million People S Wages Resolution Foundation

- Job Retention Scheme Furlough Faqs Covid 19 Accounting 4 Contractors

- What Are The August Changes To The Furlough Scheme

Find, Read, And Discover What Is Furlough Pay For August, Such Us:

- Furlough Changes From August 1 Explained With Employers Starting To Pay Wages

- Cjrs Seiss Announcement Fabulous Group

- Companies Will Not Pay 20 Of Furlough Costs Until October Personnel Today

- Blog Flexible Furlough Holiday Claims

- New Furlough Rules From Saturday Including How Your Pay Will Change On August 1 Mirror Online

If you re looking for Government Contract Types Chart you've come to the right place. We ve got 104 graphics about government contract types chart including images, photos, pictures, backgrounds, and more. In these web page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

In september employers had to pay 10 of workers pay while the government pays 70.

Government contract types chart. From 1 august 2020 the level of the coronavirus job retention scheme grant will be reduced each month. Changes from august 1 the government will continue to pay 80 per cent of staff wages up to the 2500 a month cap. You must contribute the outstanding 20 yourself to bring the wage for the furloughed worker up to the mandated 80.

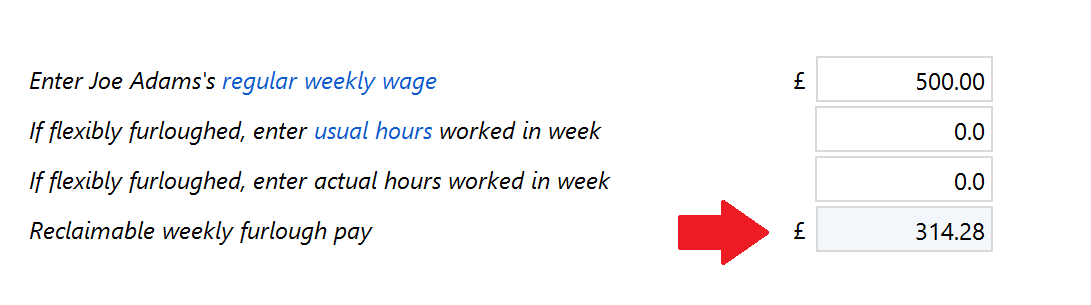

For august the government will pay 80 of wages up to a cap of 2500 for the hours an employee is on furlough and employers will pay er nics and pension contributions for the hours the employee. Can i furlough my zero hours worker if they have another job. This represents about 5 per cent of employment costs for.

You can claim for 60 of wages up to a maximum claim of 1875 per employee. However businesses will need to start picking up the furlough bill on august 1. If your workers pay varies because they are on a zero hours contract then the 80 limit will be based on the same months earning from a previous year or their average monthly pay during the 2019 20 tax year whichever is highest.

Employers will be required to resume payments of the 3 minimum auto enrolment pension contribution to furloughed workers from 1 august. It will start slowly withdrawing support and asking employers to pay more. Businesses will start picking up the furlough bill in august when they have to pay national insurance ni and pension contributions.

In march the government agreed to cover the cost for defined contribution dc members. The main change to the rules which came in for august is the amount covered by the government will be reduced to 70 up to a wages cap of 218750 for the hours the employee is on furlough. As with the august 2020 payroll you also pay er nics and pension contributions.

Currently the government is paying 80 per.

Https Www Iris Co Uk Wp Content Uploads 2020 07 Earnie Covid 19 E2 80 93 Furlough Job Retention Scheme Changes And Important Dates Pdf Government Contract Types Chart

More From Government Contract Types Chart

- Policy Making Process Uk Government

- Self Employed Third Grant Payment

- Government Accounting Manual Volume 3

- Self Employed Pension

- Cornerstone Government Affairs

Incoming Search Terms:

- Coronavirus Job Retention Scheme Closure To New Entrants From July Holywell Town Council Cornerstone Government Affairs,

- New Furlough Rules From Saturday Including How Your Pay Will Change On August 1 Mirror Online Cornerstone Government Affairs,

- Https Www Iris Co Uk Wp Content Uploads 2020 07 Earnie Covid 19 E2 80 93 Furlough Job Retention Scheme Changes And Important Dates Pdf Cornerstone Government Affairs,

- Calculating Redundancy Pay And Notice Pay For Furloughed Employees Face2facehr Cornerstone Government Affairs,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrchgqbqs4gdvysw85ev2 0tthrmahuzjaz6mhsdfq Usqp Cau Cornerstone Government Affairs,

- Cjrs Brightpay Calculating Processing Furlough Pay In Brightpay Brightpay Documentation Cornerstone Government Affairs,