What Is Furlough Payment Based On, The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

What is furlough payment based on Indeed recently is being sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will talk about about What Is Furlough Payment Based On.

- New Law To Ensure Furloughed Employees Receive Full Redundancy Payments Gov Uk

- Https Www Gsa Gov Cdnstatic Furlough Guide To Reading My Earning 26 Leave Statement Pdf

- How To Approach Redundancy As The Furlough Scheme Winds Down Personnel Today

- Https Www Gsa Gov Cdnstatic Furlough Guide To Reading My Earning 26 Leave Statement Pdf

- Furloughed Workers Redundancy Sums Will Be Based On Usual Pay Uk News The Guardian

- Furlough Scheme Changes What Are The New Part Time Rules And How Is My Pay Affected

Find, Read, And Discover What Is Furlough Payment Based On, Such Us:

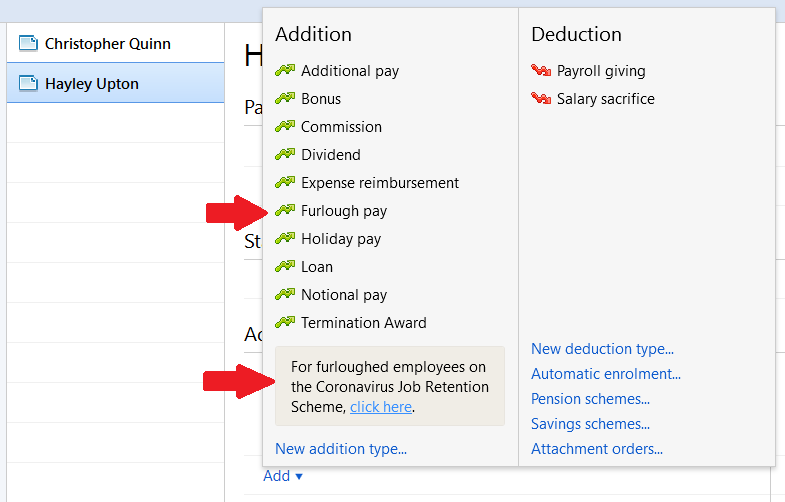

- Furloughed Workers Moneysoft

- All You Need To Know About The Flexible Furlough Scheme Paris Smith

- The Uk S Coronavirus Furlough Scheme Explained Wired Uk

- Coronavirus Up To 3 5bn Furlough Claims Fraudulent Or Paid In Error Hmrc Bbc News

- Faqs Recording Furlough Leave In Xero Payroll Xero Blog

If you are looking for Government Budget Surplus Budget Images you've come to the right location. We have 100 graphics about government budget surplus budget images adding images, pictures, photos, wallpapers, and much more. In such webpage, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Ni and any other deductions on furlough payments.

Government budget surplus budget images. The amount employers can claim will increase to 80 of wages capped at 2500. We will calculate most of your payments based on your full salary rather than. The government is covering 80 per cent of the wages of furloughed staff up to 2500 but employees can.

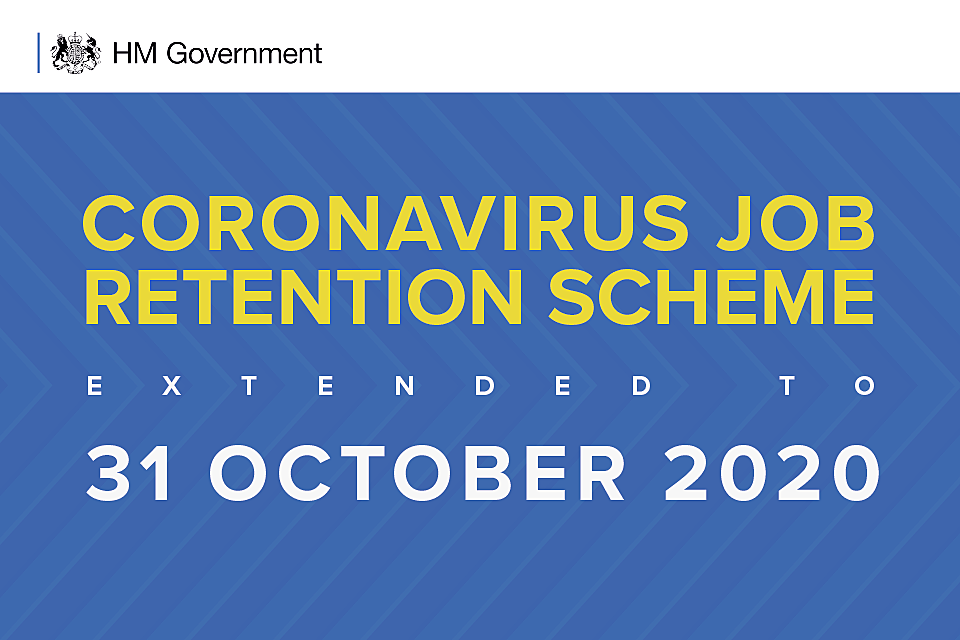

Dont be risk averse. Furlough will end in december when england comes out of lockdown the government says. Probably the most commonly asked questions for us at the moment surround the furlough payments to employees and the claiming of the grant from hmrc.

Pay during furlough is taxable in the same way as someones usual pay would be. In this case furloughed workers are those unable to work due to the coronavirus pandemic because their. Regions will then be classed into tiers as before based on their coronavirus risk level and the job.

A furlough is a temporary leave of employees due to special needs of a company or employer. The furlough system has been but in place to protect peoples income and keep it coming in. This list is not comprehensive but covers a fair bit of ground.

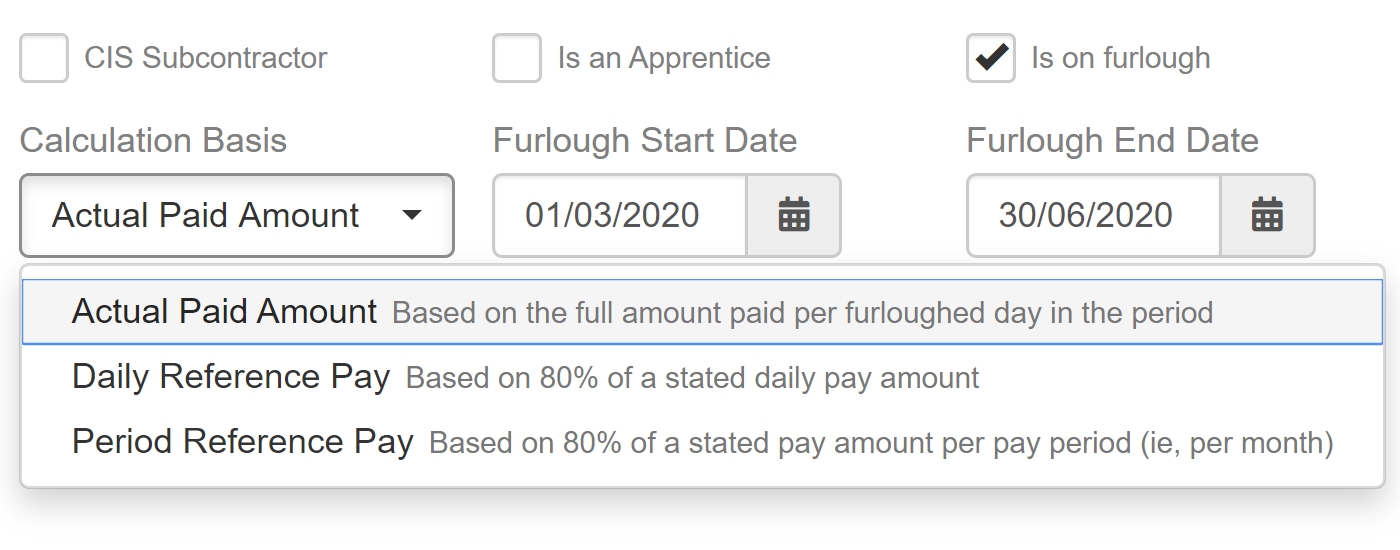

So to work out 80 of your wage your employer will start with what you got paid in the last pay period before 19 march divide by the total number of days in that pay period multiply by the number of. For employees whove worked for you for at least 12 months the gross pay figure is based on the higher of 80 of. How much furlough pay you get will depend on the agreement youve made with your employer.

This isnt like normal times when you have to jump over hurdles to get money. The furlough scheme has been extended until december 2020. If youre waiting for furlough payments youre likely to face a small further delay.

Flexible furlough must last for at least 7 days in a calendar month for an employer to make a claim. For workers paid a fixed full or part time salary furlough pay is based on what was earned during the last paid period before 19 march 2020.

More From Government Budget Surplus Budget Images

- Government Scholarship For College Students In India

- Furlough Scheme Uk Update

- Government Furlough Scheme New Rules

- Self Employed Vs Employed Calculator

- Is Furlough Scheme Changing

Incoming Search Terms:

- Furlough Scheme Changes What Are The New Part Time Rules And How Is My Pay Affected Is Furlough Scheme Changing,

- Covid 19 Coronavirus Business Impact 10 June Deadline For Placing Employees On Furlough For The First Time Lexology Is Furlough Scheme Changing,

- Coronavirus Job Retention Scheme Phase One Johnston Carmichael Is Furlough Scheme Changing,

- How Will Hmrc Deal With Furlough Fraud Davis Grant Is Furlough Scheme Changing,

- Coronavirus Job Retention Scheme Get The Details Right Accountingweb Is Furlough Scheme Changing,

- Https Home Treasury Gov System Files 266 Frequently Asked Questions For Furloughed Employees 2018 12 20 Pdf Is Furlough Scheme Changing,