Central Government Loans For Msme, Govt Operationalises Rs 20 000 Crore Stress Fund For Msmes Issues Guidelines To Avail Loan From Banks

Central government loans for msme Indeed recently is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will discuss about Central Government Loans For Msme.

- Narendra Modi Launches Msme Support Programme Updates Gst Registered Firms To Get 2 Rebate On Incremental Loan Of Up To Rs 1 Crore Business News Firstpost

- Central Government Will Waive Compound Interest On Loans Up To Two Crore Finance Khabar

- What Is One District One Product Scheme For Msmes By Smalll Business Loan Online Issuu

- Covid 19 Relief Government Announces For Msmes Rs 3 Lakh Crore Collateral Free Loans

- Msme Loan Alert Get Rs 1 Cr In Just 59 Minutes Payu Blog

- Msme Loan In 59 Minutes Online Application Process

Find, Read, And Discover Central Government Loans For Msme, Such Us:

- Jokowi Relaxes Loan Settlements To Help Small Businesses Cope With Covid 19 Effects Business The Jakarta Post

- Msme Loan Alert Get Rs 1 Cr In Just 59 Minutes Payu Blog

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqctahwdoivwprvuddu9rcxxwmstds2hpqfcsqqpfeyyyibobpl Usqp Cau

- Https Www Unescap Org Sites Default Files Publications Wp 20 03 20msmes 20in 20ldcs Pdf

- Govt Widens Criteria For Loans To Msmes Ani Bw Businessworld

If you re searching for Self Employed Scheme Login you've reached the right place. We have 103 graphics about self employed scheme login including pictures, photos, photographs, backgrounds, and more. In such web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

The major msme loan eligibility is the procedure of getting registered under the sector of the government.

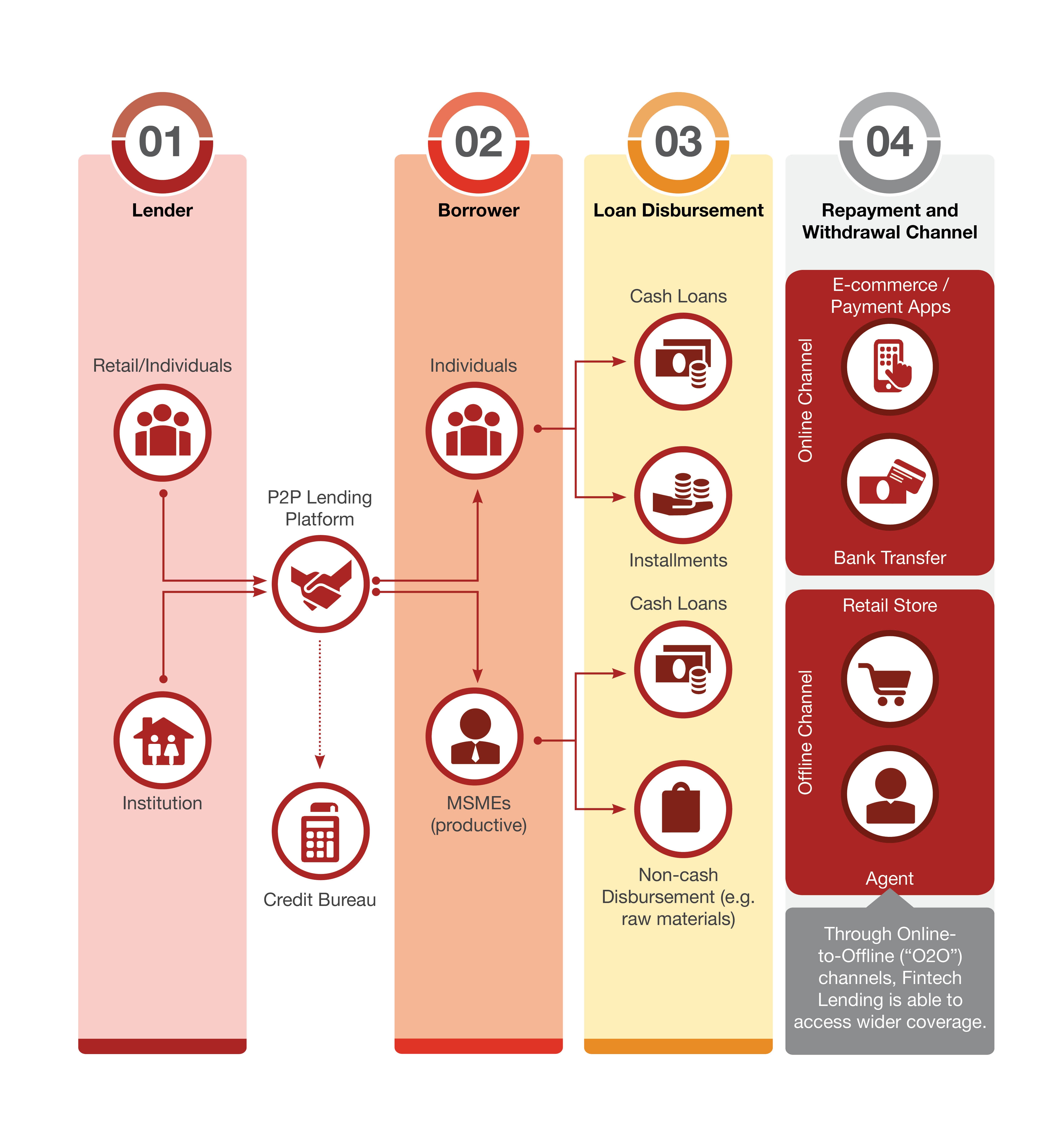

Self employed scheme login. The guarantee cover is 50 percent of the sanctioned amount for credit ranging from rs 10 lakh to rs 100 lakh per mse borrower for retail trade activity. The government provides for a number of schemes that can help business people who are associated with the msme sector. The central government is going all out to ensure that liquidity concerns of the msme sector are addressed on priority under its emergency credit line guarantee scheme eclgs.

These loans will have a 4 year tenure and will be valid up to october 31 2020. Additional read check out the new msme insolvency codes from covid 19 relief package. One of the major measures is the collateral free automatic loans worth rs 3 lakh crore guaranteed by the central government with liberal terms benefitting 45 lakh msmes.

Criteria for msme loans there are a number of msme bank loan eligibility criteria factors which are very essential in availing loans related to the micro small and medium enterprises. Around two lakh msmes will benefit from it. There are specific government registration portals.

The loans which are provided by the central government mostly focus on providing capital funding to business people who are associated with this specific sector in order to help them with the initiation capital. The extent of guarantee cover is 80 percent. This measure is aimed at the viable msmes and the terms of the loan are.

Apply for msme loans for new business loans are available for new businesses in the micro small and medium sector. Industry body ficci had recently sought rs 45 lakh crore in fiscal support for the msme sector and had written to the government to also release rs 25 lakh crore stuck in refunds and dues to tide over the crisis. To help the msmes the government announced a rs 20000 crores subordinate debt for stressed msmes.

More From Self Employed Scheme Login

- Government Gazette South Africa August 2020

- Furlough Extended Germany

- Government Furlough Scheme Holidays

- Government Spending Us Budget Pie Chart

- Government Official Letter Formal Letter Format

Incoming Search Terms:

- Making Jagat Guru Atmanirbhar Part 1 Government Official Letter Formal Letter Format,

- Central Govt Helps 20 000 Cr Funds To Encourage Msme S Hifhif Government Official Letter Formal Letter Format,

- Sources Of Finance For Entrepreneur Ship Ppt Download Government Official Letter Formal Letter Format,

- Now Doctors Cas Lawyers Also Can Get Loan Under Msme Emergency Credit Scheme As Govt Relaxes Criteria The Financial Express Government Official Letter Formal Letter Format,

- The Relationship Between Government Policy And The Growth Of Entrepreneurship In The Micro Small Amp Medium Enterprises Of India Government Official Letter Formal Letter Format,

- Psu Banks Loan Portal Off To A Flying Start Smarty Business Government Official Letter Formal Letter Format,