Self Employed Health Insurance Deduction, What Is Self Employed Health Insurance Deduction Self Employed Health Insurance

Self employed health insurance deduction Indeed recently has been sought by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about Self Employed Health Insurance Deduction.

- Self Employed Health Insurance Deduction

- Getting A Tax Deduction For Health Insurance As A Small Business Owner Small Biz Tax Guy

- Self Employed Health Insurance Deduction

- Self Employment Tax Deductions Reducing Your Tax Liability

- Section 106 Health Insurance Tax Deduction For Employer Groups

- Self Employed Health Insurance Deduction Simplified Internal Revenue Code Simplified

Find, Read, And Discover Self Employed Health Insurance Deduction, Such Us:

- Hsa And Retirment Plans

- Self Employed Health Insurance Daveramsey Com

- How To Take Advantage Of Self Employed Health Insurance Deduction Healthmarkets

- Self Employed Health Insurance Everything You Need To Know

- Self Employed Health Insurance Deduction Healthinsurance Org

If you re looking for Self Employed Business Owner Resume you've reached the ideal place. We ve got 100 images about self employed business owner resume adding images, pictures, photos, wallpapers, and more. In such webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

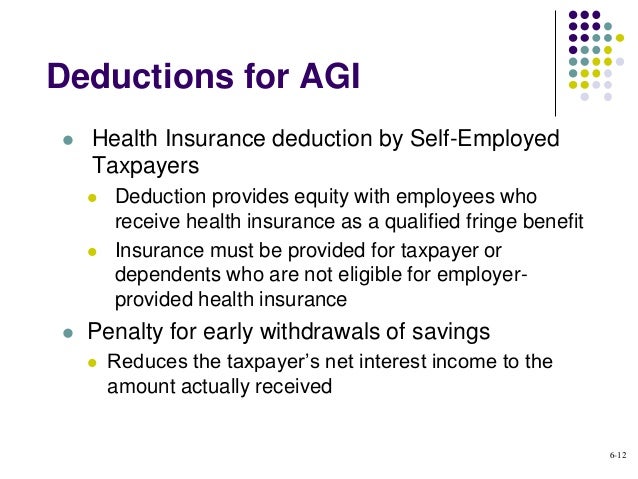

It can be equal to 100 percent of what you pay in premiums and its an adjustment to income so it lowers your agi helping you to qualify for still other advantageous tax breaks.

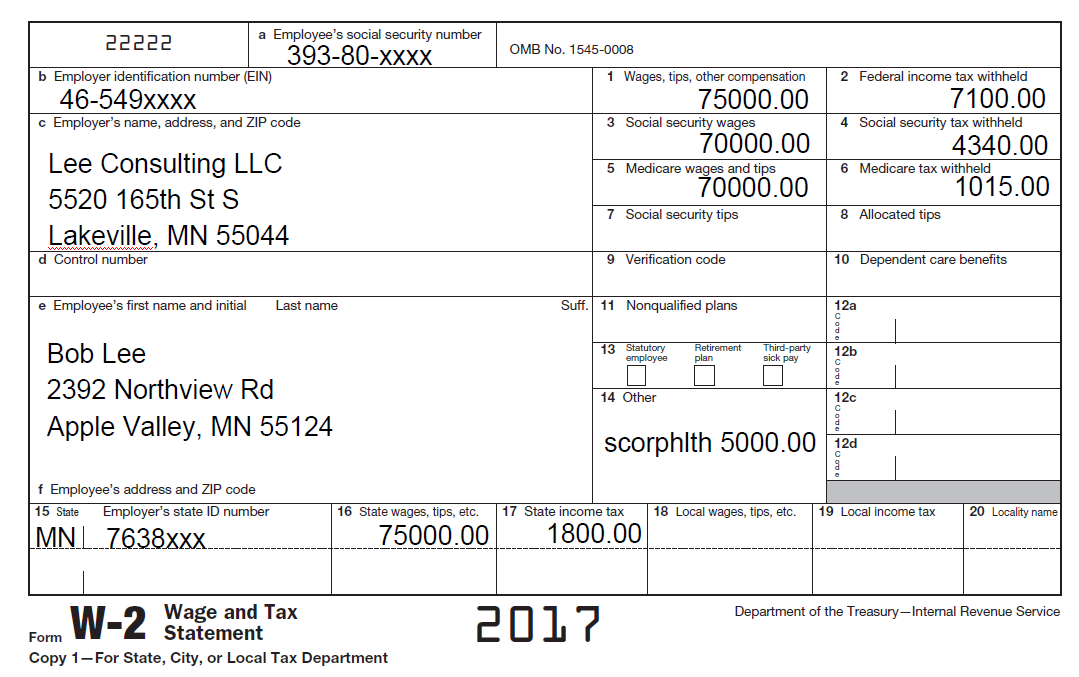

Self employed business owner resume. The deduction applies to your premiums and those of your spouse and dependents. Self employed health insurance deduction. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not.

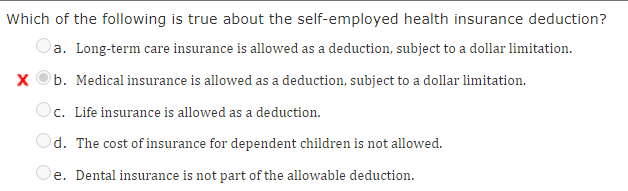

If you qualify the deduction for self employed health insurance premiums is a valuable tax break. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

Youll find the deduction on your personal income tax form and you can file for it if you were self employed and showed a profit for the year. Self employed people who cant get subsidized health insurance through a spouse can deduct premiums. Self employed health insurance deduction worksheet legal guidance rev.

The deduction which youll find on line 16 of schedule 1 attached to your form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. A child includes your son daughter stepchild adopted child or. The self employed health insurance tax deduction is one of the better tax breaks available if you qualify for it.

2014 41 this revenue procedure provides guidance that a taxpayer may use to compute the deduction under 162 of the internal revenue code for health insurance costs for self employed individuals and the premium tax credit allowed under 36b. This includes dental and long term care coverage. And that will help to keep you healthyand happyin 2020 and beyond.

Some other tips for claiming the deduction enter your self employment health insurance deduction on line 29 of form 1040. If you qualify for the deduction claiming it will reduce your adjusted gross income or agi. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. The self employed health insurance deduction is an adjustment to income also known as an above the line deduction because you dont need to itemize to benefit from it. Self employed health insurance deduction.

More From Self Employed Business Owner Resume

- Government Yojnaye

- Government Guidelines For Covid 19 Treatment

- Government Covid

- Market Failure And Government Intervention Examples

- Government Scholarship Programs In The Philippines

Incoming Search Terms:

- The Best Self Employed Health Insurance Options Government Scholarship Programs In The Philippines,

- Health Insurance Self Employed Health Insurance Government Scholarship Programs In The Philippines,

- Self Employed Health Insurance Deduction Government Scholarship Programs In The Philippines,

- How Does The Program Calculate Form 8962 With The Intuit Accountants Community Government Scholarship Programs In The Philippines,

- 11 Deductions For Independent Insurance Agents Hurdlr Government Scholarship Programs In The Philippines,

- Self Employed Health Insurance Deduction Government Scholarship Programs In The Philippines,