Self Employed Health Insurance Deduction 2019, Optimal Choice Of Entity For The Qbi Deduction

Self employed health insurance deduction 2019 Indeed lately has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about Self Employed Health Insurance Deduction 2019.

- Health Insurance Buyer S Guide Self Employee Health Insurance Deduction

- Hsa And Retirment Plans

- Philhealth Sets New Contribution Schedule Assures Immediate Eligibility To Benefits Philhealth

- Self Assessment Tax Return A Guide For The Self Employed

- A Very Decent Blog Decent

- Is Health Insurance Deductible If You Re Self Employed

Find, Read, And Discover Self Employed Health Insurance Deduction 2019, Such Us:

- Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts

- Why Self Employed Health Insurance Deduction Is No

- Publication 17 2019 Your Federal Income Tax Internal Revenue Service

- Deducting Health Expenses Self Employed Health Insurance Deduction More Stride Blog

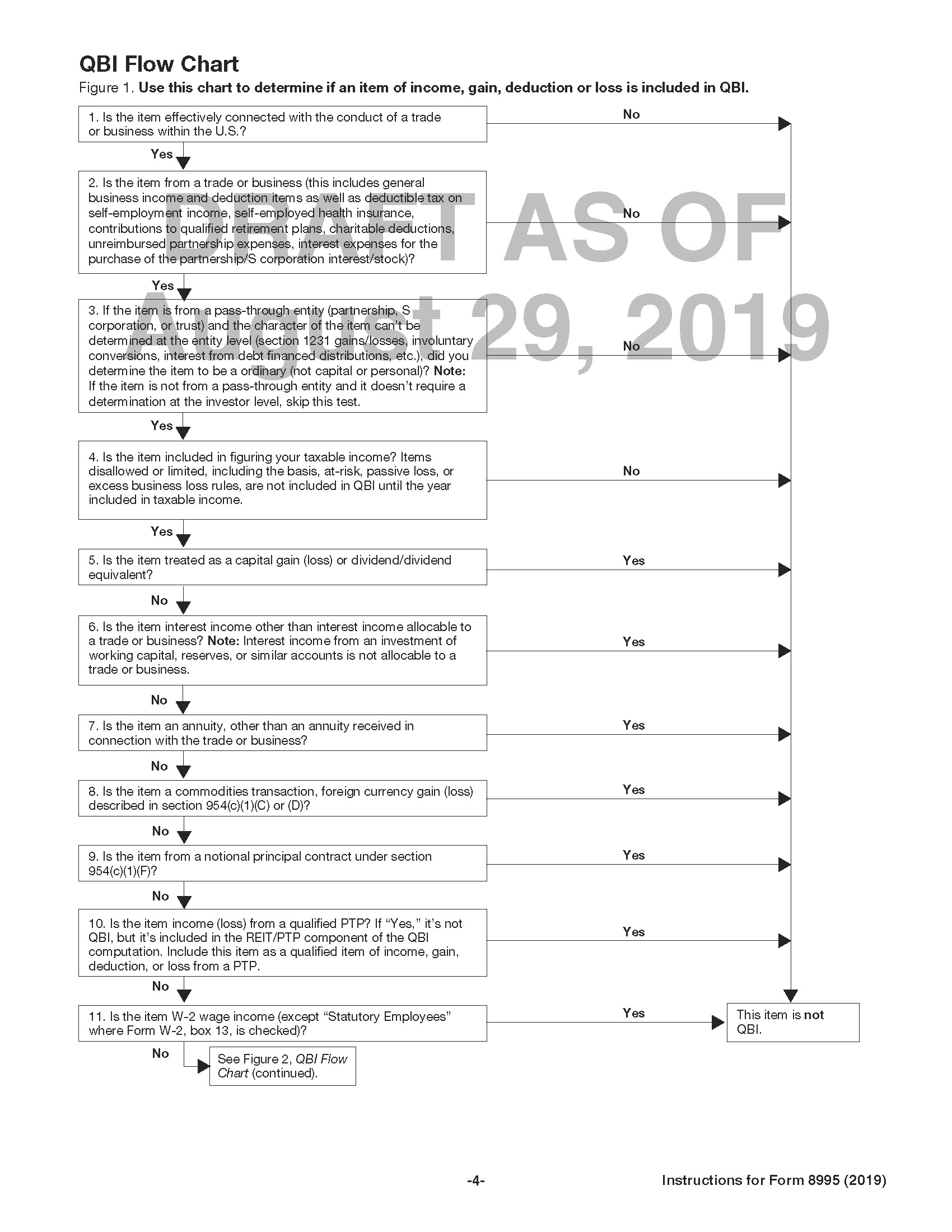

- Jeff The Buckinghammer Levine Cpa Pfs Cfp On Twitter Well Here S A Big Pile Of Suck For You Deductions For Se Tax Se Health Insurance And Retirement Plans Do Reduce Qbi This Was

If you re searching for What Is Furlough Leave In Ireland you've reached the ideal location. We have 104 images about what is furlough leave in ireland adding pictures, pictures, photos, backgrounds, and more. In these page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

What is furlough leave in ireland. Youll find the deduction on your personal income tax form and you can file for it if you were self employed and showed a profit for the year. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. The self employed health insurance deduction is an adjustment to income also known as an above the line deduction because you dont need to itemize to benefit from it.

You will be able to deduct many of the expenses such as any transportation related costs taxi fares lodging car rentals and so much more. The deduction which youll find on line 16 of schedule 1 attached to your form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

Premiums for health insurance. If you qualify for the deduction claiming it will reduce your adjusted gross income or agi. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

Another thing that self employed individuals have to foot the bill for that an employer may have use to pay for is health insurance. Deducting health insurance premiums if youre self employed accessed dec. Publication 554 page 2.

If you qualify this deduction will reduce your adjusted gross income agi. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not. And that will help to keep you healthyand happyin 2020 and beyond.

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. This includes dental and long term care coverage. Self employed health insurance deduction.

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

Deducting Health Expenses Self Employed Health Insurance Deduction More Stride Blog What Is Furlough Leave In Ireland

More From What Is Furlough Leave In Ireland

- Government Company List In Pune

- Furlough Extension Letter Example

- Self Employed Furlough If Still Working

- Government College University Lahore Admission 2020

- Government Covid Relief Programs

Incoming Search Terms:

- Self Employed Health Insurance Deduction What To Know Credit Karma Tax Government Covid Relief Programs,

- Can You Deduct Medicare Premiums On Your Tax Return Medicareresources Org Government Covid Relief Programs,

- Re How To Deduct My Health Insurance Premiums Wit Government Covid Relief Programs,

- Self Employed Health Insurance Deduction Healthinsurance Org Government Covid Relief Programs,

- Health Insurance Tax Deduction Fy 2019 20 Ay 2020 21 Section 80d Government Covid Relief Programs,

- The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto Government Covid Relief Programs,

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)