Self Employed Health Insurance Deduction 2019 Medicare Premiums, Seniors Can You Deduct Medicare Premiums Adam Traywick Cpa

Self employed health insurance deduction 2019 medicare premiums Indeed recently is being sought by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Self Employed Health Insurance Deduction 2019 Medicare Premiums.

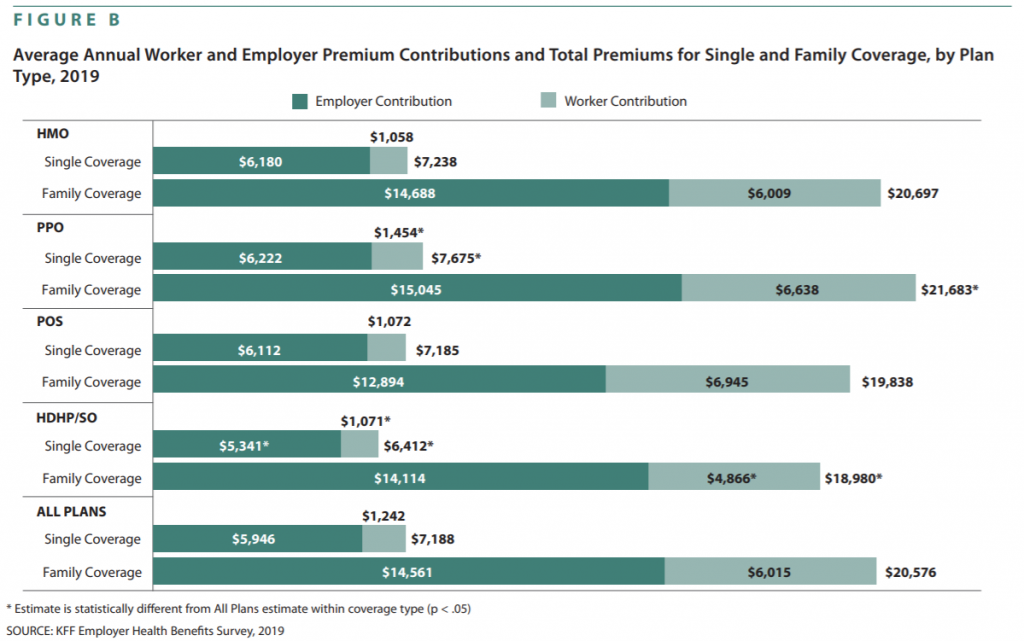

- Maximizing Premium Tax Credits For Self Employed Individuals

- Affordable Self Employed Health Insurance Options 2019

- Small Business Hra Strategy Guide

- Federal Insurance Contributions Act Tax Wikipedia

- Medicare United States Wikipedia

- Self Employment Tax Deductions Reducing Your Tax Liability

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Medicare Premiums, Such Us:

- Figuring Out The Best Healthcare Option For Early Retirees

- Maximizing Premium Tax Credits For Self Employed Individuals

- Seniors Can You Deduct Medicare Premiums Adam Traywick Cpa

- Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

- Are Health Insurance Premiums Tax Deductible

If you are looking for Self Employed Help Ni you've reached the right place. We have 104 images about self employed help ni including images, photos, pictures, wallpapers, and much more. In such page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

I recently heard that i also can deduct his medicare part a part b part c and part d premiums.

Self employed help ni. You can deduct all medical expenses that are more than 75 percent of your adjusted gross income. If you qualify the deduction for self employed health insurance premiums is a valuable tax break. Is this really true.

In 2012 the irs ruled that medicare insurance premiums can be counted. Self employed health insurance deduction for medicare premiums. Yes you can deduct the health insurance premiums paid for your spousehowever if you want these premiums to be part of the self employed health insurance deduction dont enter your medicare premiums when entering the information from your ssa 1099 social security benefitsinstead enter these premiums in your business expense section.

The first is with the self employed health insurance deductionwhen you enter the expenses related to your self employment enter your medicare premiums in the less common expenses section not the ssa 1099 section. Members of the employed workforce take medical expenses as an itemized deduction on schedule a. Medicare premiums are an allowable deduction if youre self employed and there are two ways to do this.

They can subtract that portion of medicare premiums and other health costs that. And that will help to keep you healthyand happyin 2020 and beyond. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

This comes as unexpected good news because before 2010 the irs said that medicare premiums were not deductible under the self employed health insurance deduction. But now the irs says that premiums for all forms of medicare are deductible parts a b c and d. Under the ruling medicare premiums covering the self employed individual as well as his.

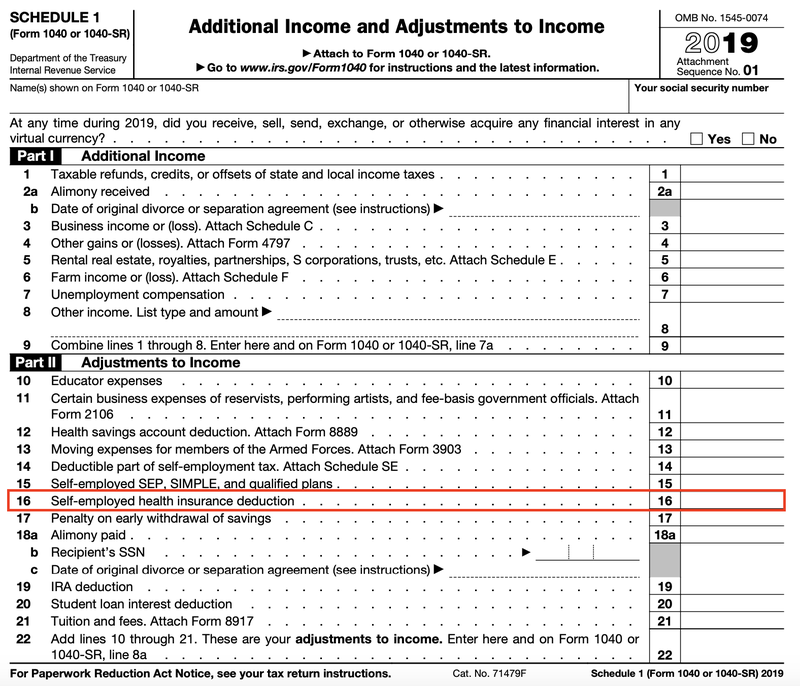

I deduct my health care premiums on my income tax. Then in 2010 the irs said that only premiums for medicare part b were deductible. This deduction will show up on schedule 1 line 16.

Medicare expenses including medicare premiums can be tax deductible. Self employed people who earn a profit from their self employment are allowed to deduct their health insurance premiums on schedule 1 of the 1040 as an above the line deduction which means it lowers their agi. That includes premiums for medicare part b part d and any medicare supplement insurance plan also called medigap that you may have.

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. In 2012 the irs ruled that medicare recipients who are self employed may deduct out of pocket health insurance costs that exceed 10 of your adjusted gross income agi for the year.

More From Self Employed Help Ni

- Government Forms For Job Application

- Branches Of Government Functions

- Government Update On Coronavirus Today

- Self Employed Canada Immigration

- Furlough Extension Date Uk

Incoming Search Terms:

- Self Employment Health Insurance Premiums Furlough Extension Date Uk,

- Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy Furlough Extension Date Uk,

- Self Employment Tax Deductions Reducing Your Tax Liability Furlough Extension Date Uk,

- I M Self Employed Can I Deduct My Spouses Health Insurance Premiums Blog Overnightaccountant Com Furlough Extension Date Uk,

- Tiny Tax Moves Can Save You Big On Medicare Premiums Furlough Extension Date Uk,

- New Irmaa Medicare Premium Surcharges Taking Effect In 2018 Furlough Extension Date Uk,