Self Employed Health Insurance Deduction 2019 Irs, Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

Self employed health insurance deduction 2019 irs Indeed recently is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the post I will talk about about Self Employed Health Insurance Deduction 2019 Irs.

- Irs Issues Final Qbi Deduction Regulations

- 3

- Publication 463 2019 Travel Gift And Car Expenses Internal Revenue Service

- Self Employed Health Insurance Deduction Healthinsurance Org

- Federal Insurance Contributions Act Tax Wikipedia

- Section 106 Health Insurance Tax Deduction For Employer Groups

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Irs, Such Us:

- Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

- Publication 587 2018 Business Use Of Your Home Internal Revenue Service

- Are Health Insurance Premiums Tax Deductible

- 1040 2019 Internal Revenue Service

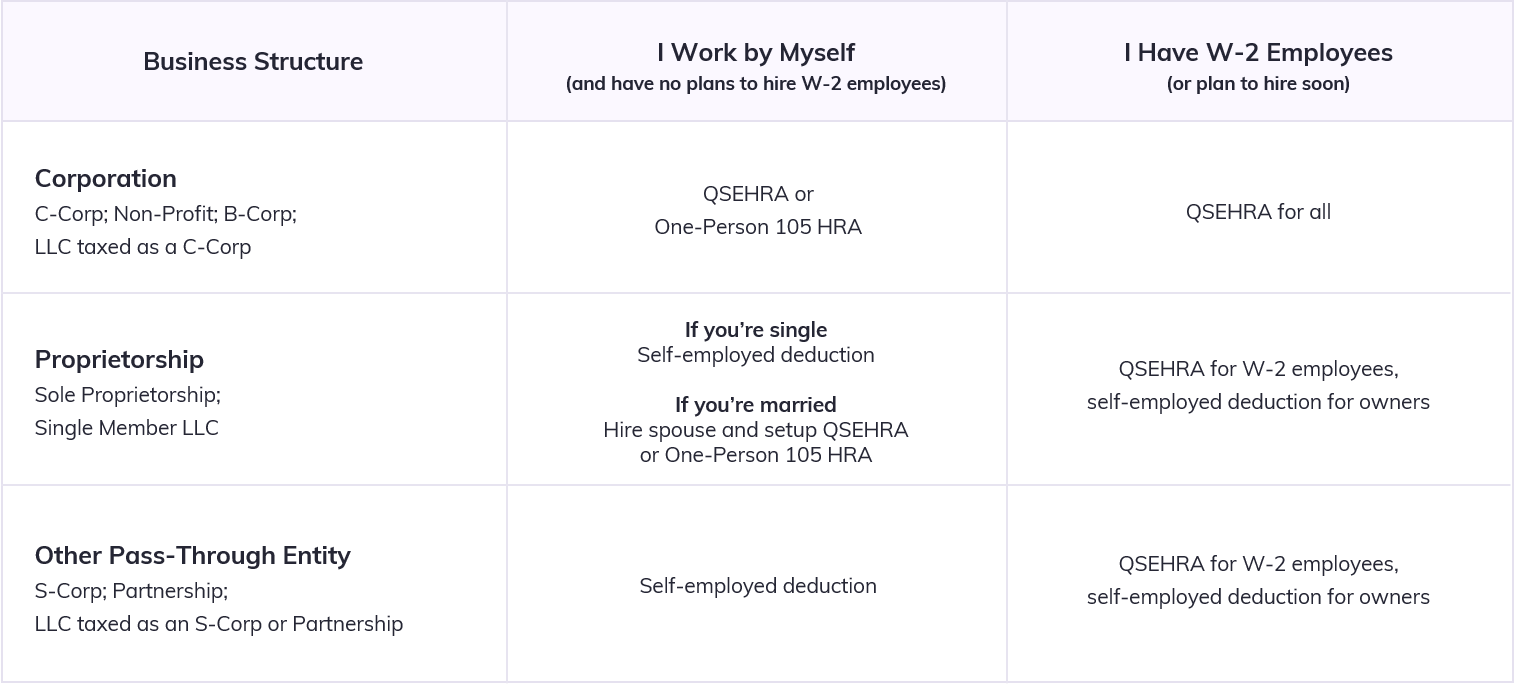

- Small Business Hra Strategy Guide

If you re searching for Self Employed Tax Worksheet you've reached the ideal location. We have 104 graphics about self employed tax worksheet including pictures, photos, photographs, backgrounds, and much more. In such webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Qualified long term care services.

Self employed tax worksheet. This includes dental and long term care coverage. Self employed health insurance deduction. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

Effect on itemized deductions. And that will help to keep you healthyand happyin 2020 and beyond. You are living apart from your spouse at the time you file your 2019 tax return.

Qualified long term care insurance. If you are completing the selfemployed health insurance deduction worksheet in your tax return instructions and you were an eligible trade adjustment assistance taa recipient alternative taa ataa recipient reemployment taa rtaa recipient or pension benefit guaranty corporation pbgc payee you must complete form 8885 before. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not.

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. Self employed health insurance deduction worksheet. Publication 554 page 2.

If youre self employed. Selfemployed health insurance deduction worksheet. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

If you qualify the deduction for self employed health insurance premiums is a valuable tax break. Self employed health insurance deduction. If youre self employed and have a net profit for the year you may be eligible for the self employed health insurance deduction.

Self employed persons can take a deduction for health insurance premiums they pay for themselves and their dependents directly on line 16 of the 2020 schedule 1. For the tax year 2019 the irs considers an hdhp an individual insurance policy with a deductible of at least 1350 or a family policy with a deductible of at least 2700. Qualified long term care insurance contract.

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your. This is another above the line adjustment to income. The internal revenue service is a proud partner with the national center for missing exploited children.

Deducting health insurance premiums if youre self employed accessed dec. Effect on self employment tax. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

Publication 559 2019 Survivors Executors And Administrators Internal Revenue Service Self Employed Tax Worksheet

More From Self Employed Tax Worksheet

- Government Gazette

- Self Employed Mortgage Broker

- Upcoming Government Exams 2020 For 12th Pass

- Furlough Pay Scheme Extended

- Government Tyranny Quotes

Incoming Search Terms:

- The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto Government Tyranny Quotes,

- Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents Government Tyranny Quotes,

- Health Insurance And Tax Deduction Claims Quotewizard Government Tyranny Quotes,

- How To Deduct Health Insurance Costs If Self Employed Godaddy Blog Government Tyranny Quotes,

- Self Employed Health Insurance Deduction Premium Tax Credit Pub 974 Aca Atx Community Government Tyranny Quotes,

- Work From Home Tax Deduction Only Applies To Self Employed Workers Business Insider Government Tyranny Quotes,