Self Employed Letter For Mortgage, Stated Income Loan Mortgage Real Estate Forums

Self employed letter for mortgage Indeed recently is being hunted by users around us, maybe one of you. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of the article I will talk about about Self Employed Letter For Mortgage.

- How To Get A Mortgage When You Re Self Employed

- Delegated Underwriting Training Ppt Download

- How To Write A Letter For Proof Of Employment 11 Steps

- Proof Of Income Letter Lettering Letter Templates Formal Business Letter

- Stated Income Loan Mortgage Real Estate Forums

- Proof Of Income For Self Employed In 2020 Letter Template Word Lettering Letter Templates

Find, Read, And Discover Self Employed Letter For Mortgage, Such Us:

- 16 Proof Of Income Letters Pdf Doc Free Premium Templates

- Proof Of Income Letter Lettering Letter Templates Formal Business Letter

- Finance For The Self Employed

- 29 Verification Letter Examples Pdf Examples

- How To Get Pre Approved For A Mortgage

If you re searching for Self Employed Furlough November 2020 you've arrived at the perfect place. We have 104 graphics about self employed furlough november 2020 including pictures, photos, pictures, wallpapers, and more. In such web page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

To start youll need a history of uninterrupted self employment income usually for at least two years.

Self employed furlough november 2020. Heres some examples of documents a lender might ask for. Your letter of employment for a mortgage must be less than 6 weeks old at the time of your home loan application. The central theme of this set of.

Employment verification is proof that youre self employed. Writing an income verification is very usual to be asked to verify your income when inquiring about a loan rental agreement etc. To write income verification letter for self employed one must hire a person or human resource to write a letter for them but if you are self employed you definitely have to write it by yourself.

Lenders want some comfort that your business is generating enough income to service a loan. It could include emails or letters from the following. A letter of explanation or loe is commonly requested by a mortgage lender or underwriter to get specific information from the borrower and complete the loan application process.

This is especially so if youre in a start up business where cash flow is tight. If youre a contractor we have a template below that you can use. The mortgage process can be confusing but its especially daunting for self employed borrowers.

So if your letter is up to 2 months old you can simply ask your employer to sign and date a new copy. Other names on your credit report. This usually comes in form of the letter written by you or an.

Either an audited pl statement or an unaudited pl statement along with 2 months. In an industry where w 2 employees are often viewed as ideal candidates by traditional lenders self employed individuals dont fit into the conventional financial mold that the mortgage process was originally designed to accommodate. Your source of income needs explanation eg.

A letter of explanation might be requested if you have. The new rules require self employed borrowers to provide one or two new documents when applying for a mortgage. What if im self employed.

Fannie mae issued a lender letter in march that has since been updated several times describing new documentation requirements for self employed loan applicants.

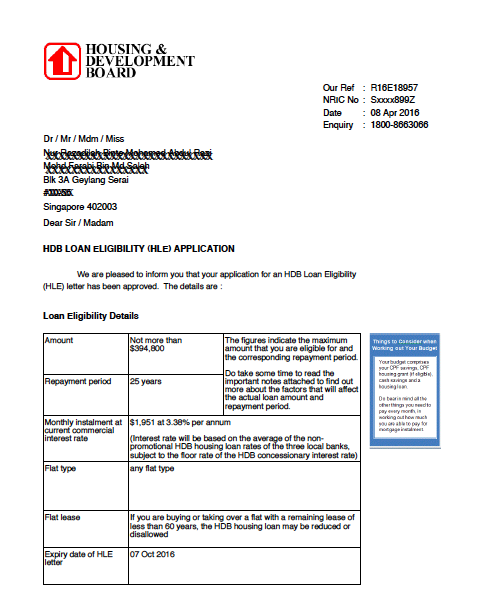

Hdb Concessionary Loan Know Your Eligibility How To Apply For Hle Self Employed Furlough November 2020

More From Self Employed Furlough November 2020

- Government Job Vacancies In Sri Lanka 2020 My Tutor

- Government Systems Influence The Lives Of Citizens

- Furlough Extended Until October

- Ronald Reagan Quotes Government Is The Problem

- Self Employed Grant Covid Ni

Incoming Search Terms:

- 22 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller Self Employed Grant Covid Ni,

- Delegated Underwriting Training Ppt Download Self Employed Grant Covid Ni,

- 9 Income Verification Letter Examples In Pdf Examples Self Employed Grant Covid Ni,

- How To Get A Mortgage When You Re Self Employed Rocket Mortgage Self Employed Grant Covid Ni,

- How To Get A Mortgage When You Re Self Employed Self Employed Grant Covid Ni,

- Employment Verification Letter Letter Of Employment Samples Template Self Employed Grant Covid Ni,