Government Revenue From Tariff Graph, Https Are Berkeley Edu Fally Courses Econ181lecture8b Pdf

Government revenue from tariff graph Indeed lately is being sought by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the post I will discuss about Government Revenue From Tariff Graph.

- Jacob Viner And The Ambiguous Welfare Effects Of Preferential Trade Agreements Utopia You Are Standing In It

- Tariffs And Quotas

- Tariffs Archives A Star Economics

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs2rrjqmcssiziefskiuh15 Bcsealjobrnimu7u1mcfsogtqfe Usqp Cau

- Does Lowering Taxes Increase Government Revenue Tax Foundation

- Tariffs And Quotas Economics Online Economics Online

Find, Read, And Discover Government Revenue From Tariff Graph, Such Us:

- How To Calculate The Impact Of Import And Export Tariffs Youtube

- International Trade Trade Protection Tariff

- Quota Intelligent Economist

- Economic Benefits Of International Trade

- Trade Chapter 90 11 Welfare Effects Of A Tariff Small Country

If you re searching for Has Furlough Been Extended After October you've arrived at the ideal location. We have 104 images about has furlough been extended after october including images, photos, pictures, backgrounds, and more. In these webpage, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

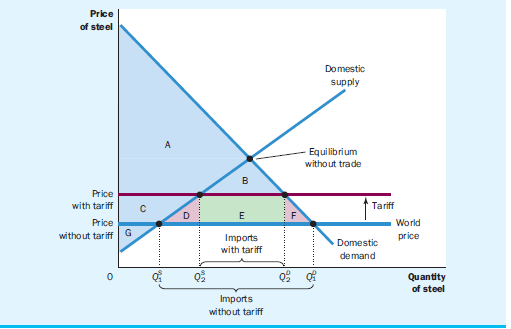

The benefits of tariffs are uneven.

Has furlough been extended after october. Therefore someone within the country will be the likely recipient of these benefits. Government revenues in australia averaged 1489027 aud million from 1973 until 2020 reaching an all time high of 53576 aud million in may of 2019 and a record low of 510 aud million in september of 1973. Government revenues in the united states averaged 15273754 usd million from 1980 until 2020 reaching an all time high of 563496 usd million in july of 2020 and a record low of 33111 usd million in march of 1980.

How does a tariff impact efficiency. The governments 300 million gain more than offsets the 175 million of lost consumer surplus. A hundred years after wilsons address his tax bill remains the foundation of the american tax system augmented a bit by estate taxes and a lot by payroll taxes.

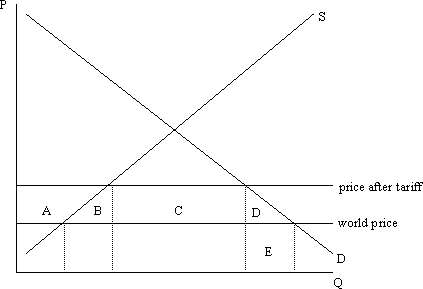

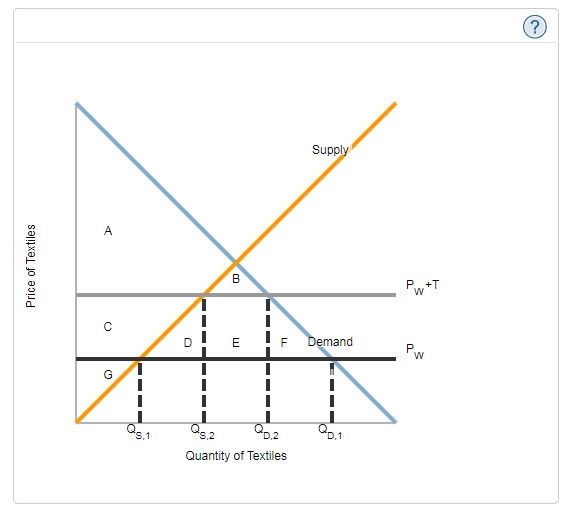

Hence here the revenue collected equals p 1 p 2 xq 3 q 4 the area r in the figure. Because a tariff is a tax the government will see increased revenue as imports enter the domestic market. If a tariff of 10 per unit is introduced in the market then the government will raise in tariff revenue.

Foreign producers finally lose. This page provides australia government revenues actual values historical data forecast chart statistics economic calendar and news. Tariff revenues always equal the amount of duty times the quantity of goods imported under it.

The tariff will increase producer surplus and will bring in tax revenue for the government perhaps to produce public goods but consumers will have to pay a higher price and their consumer surplus will be reduced. Government revenues in the united states increased to 373169 usd million in september from 223221 usd million in august of 2020. This represents that part of the loss in consumer surplus which is transferred to the government in the form of money the revenue effect a tariff.

The tariff will also create deadweight loss. Within five years tariff revenue had fallen to about 5 percent of government revenue and never recovered. Domestic industries also benefit from a reduction in.

D none of the above. A tariff is not considered efficient as a result. Tariff effects on the importing countrys government.

Who will benefit from the revenue depends on how the government spends it. These funds help support diverse government spending programs. If a tariff of 10 per unit is introduced in the market then the deadweight loss will equal.

More From Has Furlough Been Extended After October

- Government Regulation Of Business

- What Is Furlough Vs Layoff

- Government Regulation Economics

- Hmrc Self Employed Furlough Login

- Central Government Loans

Incoming Search Terms:

- Using An Appropriate Diagram Explain Who Gains And Who Loses From The Introduction Of A Tariff Amber S Economic Blog Central Government Loans,

- Based On Your Analysis As A Result Of The Tariff New Zealand S Consumer Surplus Increase Decrease By Homeworklib Central Government Loans,

- Trade Chapter 90 9 The Optimal Tariff Central Government Loans,

- How Much Free Trade Is Free Chronicles Of Delusion Central Government Loans,

- Tariffs And Quotas Economics Online Economics Online Central Government Loans,

- 4 A International Trade Central Government Loans,

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)