Central Government Loans, Government Guarantees 6 9b In Working Capital Loans For Msmes Thejakartapost Com Line Today

Central government loans Indeed lately has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this article I will talk about about Central Government Loans.

- Https Www Bi Go Id En Iru Economic Data External Debt Documents Eds 20desember 2014 Pdf

- Understanding China S Financial Policy Systemic Risk And Systematic Value

- Good News For Central Employees They Can Get Cheaper Loans To Build Houses Here S How

- Bank Credit Risks And Government Ratings A Government Ratings B Download Scientific Diagram

- Central Government Banks And Finance Corporations In Japan Download Table

- Boe Eases Funding Terms As Government Launches Bounce Back Loans Central Banking

Find, Read, And Discover Central Government Loans, Such Us:

- Japan Jp Budgetary Central Government Net Incurrence Of Liabilities By Instrument Loans Economic Indicators

- 2

- Https Www Bi Go Id En Iru Economic Data External Debt Documents Eds 20desember 2014 Pdf

- Federal Government Agricultural Fgn Loan Requirements And Application Details Opera News

- Ppt Andrew Jackson Powerpoint Presentation Free Download Id 1851174

If you re looking for New Furlough Scheme Eligibility you've reached the perfect location. We ve got 100 images about new furlough scheme eligibility including images, photos, photographs, wallpapers, and much more. In these page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

This credit scheme has been designed for people who want financial assistance for starting small or micro business ventures.

New furlough scheme eligibility. Cgs for small and micro businesses the central government with help from the sidbi offers cgs or credit guarantee fund scheme. On march 27 the reserve bank of india had announced a three month moratorium on terms loans from march 1. Data on central government debt for the quarter ending june 2020 q2 download 12039 kb 18th september 2020.

On friday central government announced to approved the scheme for granting of ex gratia payment of the difference between compound interest and simple interest for next six months of loans more than rs 2 crore. Title details published date. Availing government loans for small scale businesses will not cause you much sweat.

Banks and financial organizations would offer the loans. The minimum age criterion to apply for a government business loan is 18 years. Government loans are offered to individuals start up enterprises sole proprietorship and partnership firms business owners smes msmes private limited companies large enterprises etc.

Since most government loans are dispensed through banks and financial institutions you can directly approach them to avail loans. The three most important loan schemes offered by the central government are as follows. You can visit the nearest branch of the bank or financial institution who will guide you on the loan application process.

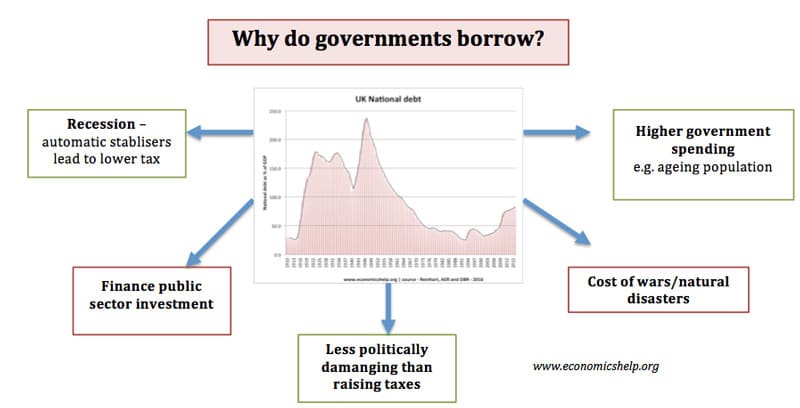

Loans are provided through the banks central government issues the guarantee to the banks which in turn provide guaranteed loans to companies. In practice this means that central government compensates the bank for up to 70 per cent of any loss arising on a loan thus guaranteed.

More From New Furlough Scheme Eligibility

- Functions Of Rural Local Self Government

- China Government Debt To Gdp

- Difference Between Furlough And Layoff For Unemployment

- Does The Furlough Scheme Cover Holiday Pay

- Government Anarchy Picture

Incoming Search Terms:

- Imf Policy Paper First Review Under The Extended Arrangement Under The Extended Fund Facility And Request For Modification Of Performance Criterion Press Release Staff Report And Statement By The Executive Director For Sri Government Anarchy Picture,

- Https Www Bi Go Id En Iru Economic Data External Debt Documents Eds 20desember 2014 Pdf Government Anarchy Picture,

- Central Banks And Securities Lending A Lever For Monetary Policy And Liquidity Management Central Banking Government Anarchy Picture,

- Http Www Djppr Kemenkeu Go Id Uploads Files Dmodata In 5statistik 1posisi Utang 4bspun Bspun 20 Govt 20debt 20profile 20edisi 20mei 202014 Eng Pdf Government Anarchy Picture,

- Ppt Local Finance Powerpoint Presentation Free Download Id 4578012 Government Anarchy Picture,

- Central Government Approves Interest Free Soft Loans For Sugarcane Industry The Economic Times Government Anarchy Picture,