Local Government Taxes In Tanzania, Pdf Local Government Taxation Reform In Tanzania A Poverty And Social Impact Analysis Psia

Local government taxes in tanzania Indeed lately has been hunted by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Local Government Taxes In Tanzania.

- Policy Implementation Under Stress Central Local Government Relations In Property Tax Administration In Tanzania The International Centre For Tax And Development Ictd

- Https Www Jstor Org Stable 41954684

- Taxation In The Republic Of Ireland Wikipedia

- Pdf Dilemmas Of Fiscal Decentralisation A Study Of Local Government Taxation In Tanzania

- The Impact Of Intergovernmental Transfers On Local Revenue Generation In Sub Saharan Africa Evidence From Tanzania Sciencedirect

- Informal Sector Taxation In Tanzania Economic And Social

Find, Read, And Discover Local Government Taxes In Tanzania, Such Us:

- Chr Michelsen Institute Bergen Academia Edu

- Local Government Revenues Sources Challenges And Reforms

- A Study Of Local Government Taxation In Tanzania

- Ppt Local Government Taxation Reform In Tanzania Poverty And Social Impact Analysis Powerpoint Presentation Id 3766001

- African Property Tax Initiative The International Centre For Tax And Development Ictd

If you are looking for Furlough Extension Past October you've reached the perfect location. We ve got 100 graphics about furlough extension past october including images, pictures, photos, backgrounds, and much more. In these web page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

However the large number of these taxes together with their unsatisfactory nature means that their economic.

Furlough extension past october. Local government authority h farms employers. First revenue performance depends on the degree of coercion involved in tax enforcement. Local taxes represent less than 5 per cent of total tax revenues in tanzania.

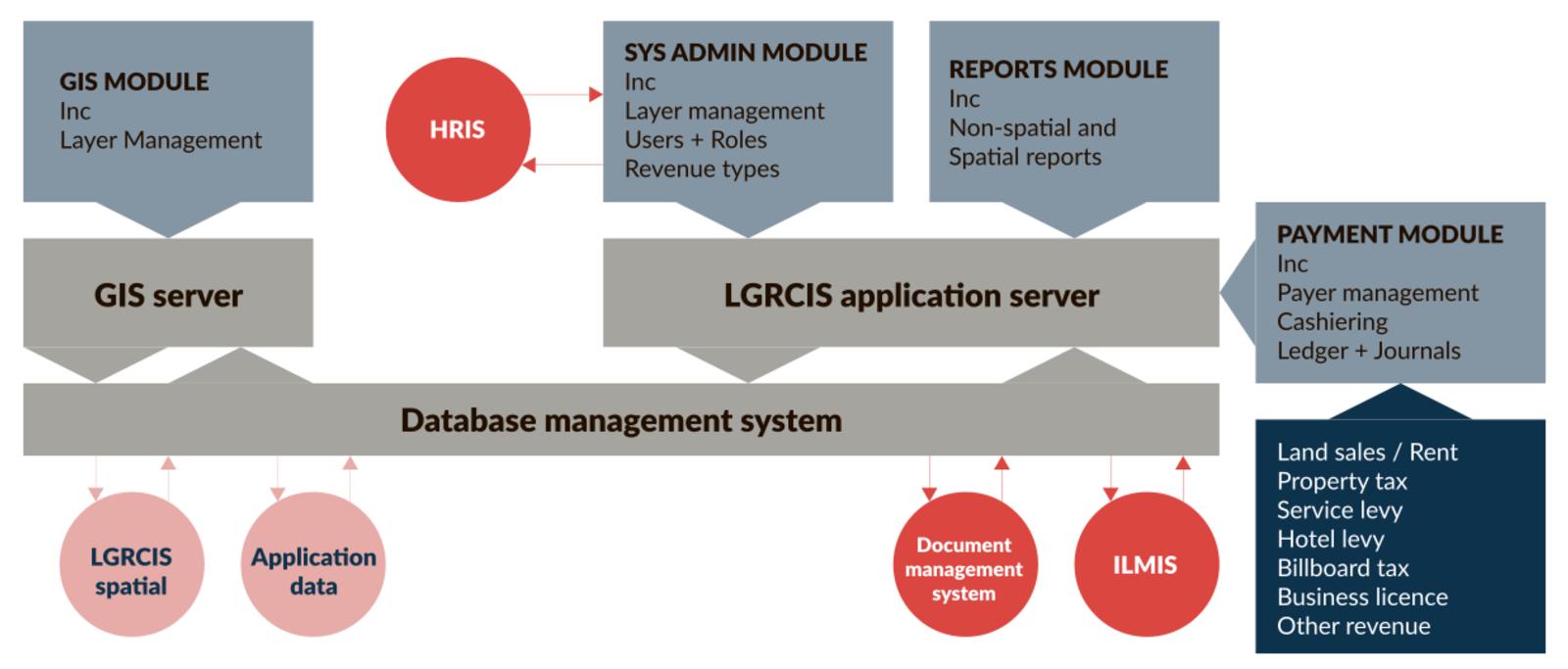

The tra is in a process of planning and strategizing for how it will manage property taxation expand the number of municipalities to collect. Reciprocity does not seem to be an inherent component of the statesociety relationship in connection with local government taxation. The tax regime in tanzania consists of a number of direct and indirect taxes including income tax value added tax import duty excise duty and stamp duty.

However the large number of these taxes together with their unsatisfactory nature means that their economic political and social impacts are considerably more significant than their figure implies. Gives recognition to local government and is supported by the local government district authorities act 1982 and the local government urban authorities act 1982. A common critique of local government revenues in tanzania is that local government revenue sources are low yielding inequitable form an obstacle to local economic growth are inefficiently administered and impose high compliance costs on taxpayers.

The tanzania revenue authority act cap399 re2019. It is clear that there are problems with the current system of local government revenues in tanzania. This paper presents three propositions about tax collection by local authorities in tanzania.

All central government taxes are administered by the tanzania revenue authority tra. The tax administration registration of small vendors and service providers regulations gn. There are also taxes levied at the local government level.

Local taxes represent less than 5 per cent of total tax revenues in tanzania. The ministry for regional administration and local government is responsible for local government in mainland tanzania and currently sits within the prime ministers office. The commissioner general for tanzania revenue authority holding a trophy posing for a group photo with some of the tanzania revenue authority tra staff during the best presented financial statements gala event hosted by nbaa for the year 2018.

The local government authorities rating collection of property rates regulations gn. Penalties for failure to file tax return.

More From Furlough Extension Past October

- Government Procurement Images

- What Is Flexi Furlough Uk

- Government To Government Relationship

- Quickbooks Self Employed App Free

- Self Employed Furlough Scheme Hmrc August

Incoming Search Terms:

- 2 Self Employed Furlough Scheme Hmrc August,

- Policy Implementation Under Stress Central Local Government Relations In Property Tax Collection In Tanzania Self Employed Furlough Scheme Hmrc August,

- Oecd Tax Database Oecd Self Employed Furlough Scheme Hmrc August,

- Pdf Local Government Taxation And Tax Administration In Tanzania Self Employed Furlough Scheme Hmrc August,

- Local Government Taxation Reform In Tanzania A Poverty And Social Impact Analysis Psia Report On Economic And Sector Work Self Employed Furlough Scheme Hmrc August,

- Http Article Sciencepublishinggroup Com Pdf 10 11648 J Ss 20180701 13 Pdf Self Employed Furlough Scheme Hmrc August,