Self Employed Can I Furlough Myself, Hiia2tdbagbk2m

Self employed can i furlough myself Indeed recently has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this post I will talk about about Self Employed Can I Furlough Myself.

- Update To The Self Employed Income Support Scheme Seiss

- Martin Lewis Nine Things The Chancellor Could Tweak To Help People Through This Furlough The Vulnerable

- What The August Furlough And Self Employed Grant Changes Mean For You Your Money

- What The Self Employment Income Support Scheme Seiss Grant Extension Means For You The Accountancy Partnership

- Coronavirus Job Retention Scheme Can Directors Furlough Themselves Insights Bishop Fleming

- Employed Or Self Employed Which Is Better

Find, Read, And Discover Self Employed Can I Furlough Myself, Such Us:

- 2

- Hvca3y1izpt Gm

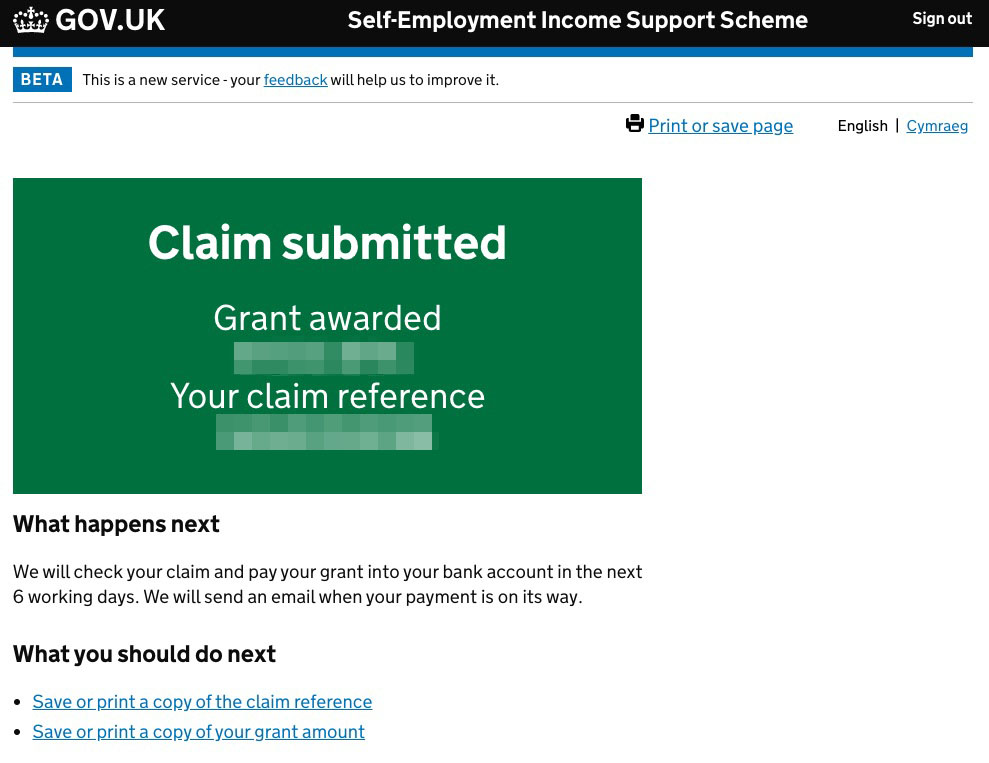

- Round Two Of The Self Employment Income Support Scheme Available To Claim From 17th August 2020 Rpg Chartered Accountants

- Are Directors Employed Or Self Employed Make An Impact Cic

- Covid 19 Hub Help And Support Update

If you re looking for Furlough Scheme Scottish Government you've come to the ideal location. We have 100 images about furlough scheme scottish government including pictures, pictures, photos, backgrounds, and much more. In these webpage, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Furthermore the agreement i have signed says i a.

Furlough scheme scottish government. Payment holidays homeowners and landlords can apply for three month mortgage holidays weve explained exactly how this works in our news story. Due to covid 19 my employer intends to furlough me on the cjrs and advises during that time i am not allowed to do any work for them. Only employers company directors or anyone in a similar position can choose to furlough the whole.

Not all self employed people can get the seiss grant for example if you earn more than 50000 a year or if less than half of your income is from self employment. If a worker is self employed they wont qualify for furlough under the cjrs but they can seek support in the form of the self employed income support scheme seissthis scheme has been set up to help self employed people whose businesses have been adversely affected by the pandemic. Things are changing so fast that its difficult to get a clear picture of what i need to do in the coming days weeks and months.

Ive been self employed sole trader for years now and am eligible under the criteria for help for the self employed released last week. Self employed and gig economy workers can apply for universal credit or employment support allowance esa in lieu of statutory sick pay. Can self employed workers be furloughed.

As a single person service company ownerdirector and running a minimum paye scheme with dividends if i furlough myself for the paye part am i able to undertake the same work under my own name as self employed rather than putting it through the company. My self employment is such that i can work if i choose to deliveroo. The financial conduct authority fca has also ordered.

Can i furlough myself. Self employed via ltd confusion over whether i can furlough myself as an employee im self employed who takes a mix of dividends and salary through their limited company. If you do furlough yourself you cant then work for the firm but you can continue to perform your statutory obligations as directors eg official legal filings in the.

Martin lewis told the emma barnett show that self employed people who own a paye company can furlough themselves and receive 80 percent of their salary up to 2500 a month. Or maybe youre self employed and pay yourself through. The reason i ask is that there may be a few dribs and drabs of work coming through and i wouldnt want to upset the client by not being.

More From Furlough Scheme Scottish Government

- Furlough Scheme Scotland October

- Government Guaranteed Bonds

- Voluntary Sss Payment Slip Form For Self Employed

- Self Employed Sss Payment Center

- Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They

Incoming Search Terms:

- What The August Furlough And Self Employed Grant Changes Mean For You Your Money Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,

- Are Directors Employed Or Self Employed Make An Impact Cic Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,

- Furlough And Self Employed Income Schemes To Close In October Mortgage Solutions Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,

- Uk S Self Employed Feeling Hung Out To Dry While Scottish Will Get Vital Lifeline Charity Today News Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,

- What To Do About Coronavirus If You Are Self Employed Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,

- Coronavirus Self Employed Small Limited Company Help Self Employed Business Owners Frequently Overestimate Their Profit Levels Because They,