Self Employed Furlough Claim, Over One Million Self Employed Are Not Eligible For Government S Coronavirus Income Support Scheme

Self employed furlough claim Indeed lately is being hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Self Employed Furlough Claim.

- Coronavirus Updates For The Furloughed And Self Employed Prima Group

- Coronavirus Self Employed Grant Claims Top One Million Bbc News

- Nuihipbmlp1wem

- How To Claim Your Self Employment Grant

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- What S Happening With Furlough We Explain What Sunak S New Flexible Furlough Means For Workers This Is Money

Find, Read, And Discover Self Employed Furlough Claim, Such Us:

- Freelancers The Self Employed Community Community

- 2

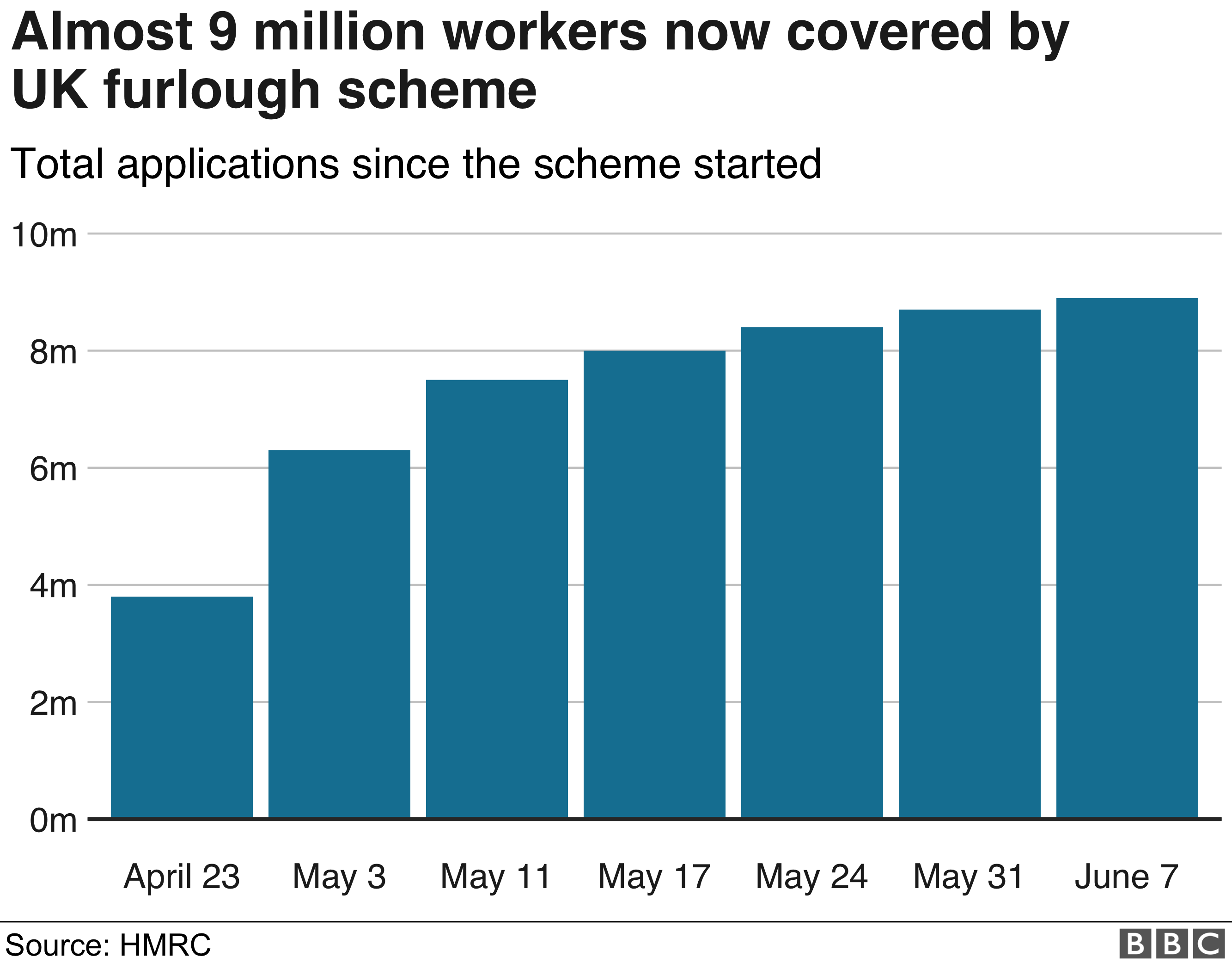

- Coronavirus Self Employed Grant Claims Top One Million Bbc News

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- 5fxa4loej59rrm

If you are searching for Us Government Budget 2020 Pie Chart you've arrived at the right location. We ve got 100 images about us government budget 2020 pie chart including images, photos, photographs, wallpapers, and more. In these web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Financial Support For Self Employed Extended In Line With Employee Furlough Scheme Lexology Us Government Budget 2020 Pie Chart

Self employed workers could be given additional financial support after the furlough scheme was extended for the duration of the new national lockdown michael gove has hinted.

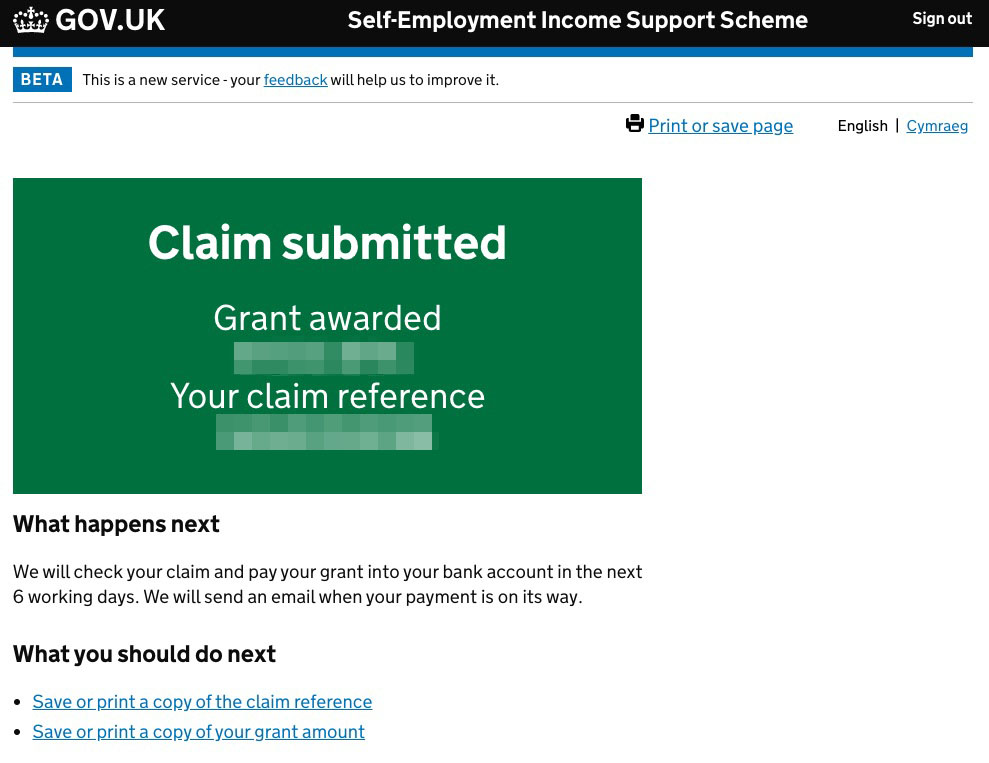

Us government budget 2020 pie chart. The self employment income support scheme claim service is now open. Part of support for businesses and self employed people during coronavirus. The self employed could face financial calamity if the government does not expand its support scheme further bringing them closer in line with the latest furlough changes it has been claimed.

On 27 march the chancellor announced an additional raft of measures to help self employed workers see our dedicated story that explains whats on offer and who is eligible to claim help. If youre self employed or a member of a partnership and have been adversely affected by coronavirus covid 19 find out if you can use this scheme to claim a grant. Those eligible under the self employment income support scheme seiss which has so far seen 23 million claims worth 68 billion will be able to claim a second and final grant in august.

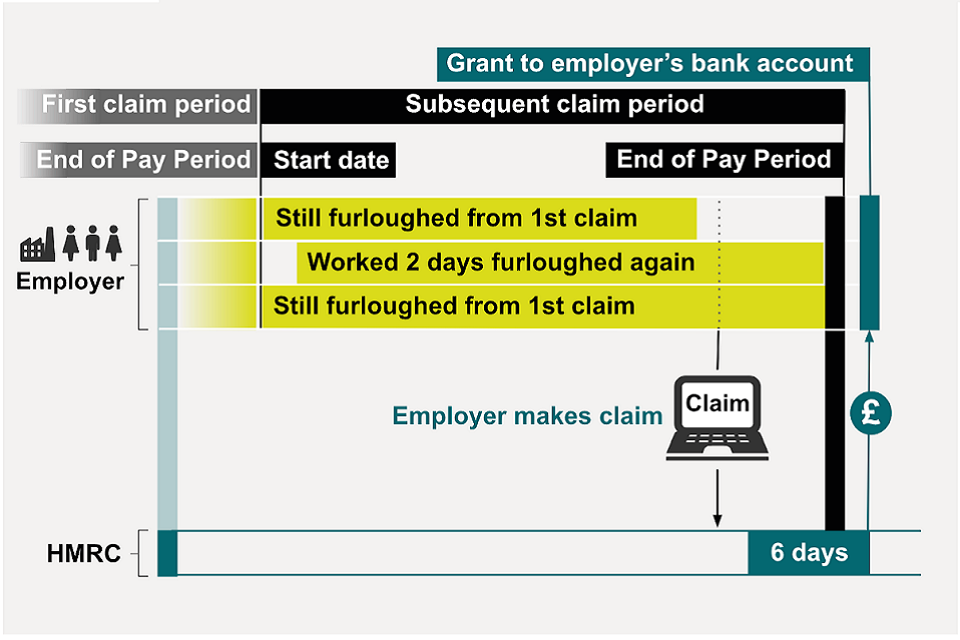

Getty read more related articles. Claim for some of your employees wages if you have put them on furlough or flexible furlough because of coronavirus. Furlough extension explained who can claim and whats happening to self employed.

As part of seiss those who pay tax by payment on account were allowed to defer their july 2020 payment to 31 january 2021 when they would have to. If you are self employed therefore taxed through self assessment and not paye you wont be eligible for furlough or the job support scheme but you may be eligible for the self employment income support scheme grants or be able to claim benefits. Meanwhile the self employed will get a grant worth 80 of past profits but only for the month of november.

More From Us Government Budget 2020 Pie Chart

- Health Insurance For Self Employed Cost

- Furlough Extension Vote

- Limited Government Definition Quizlet

- Government Quota In Private Medical Colleges In Tamilnadu Quora

- Government Agency Logos

Incoming Search Terms:

- Your Income And Coronavirus Covid 19 Policy In Practice Government Agency Logos,

- Taylorcocks Bournemouth Chamber Of Trade And Commerce Government Agency Logos,

- Coronavirus Wales Has 316 000 Workers On Furlough Bbc News Government Agency Logos,

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom Government Agency Logos,

- Over One Million Self Employed Are Not Eligible For Government S Coronavirus Income Support Scheme Government Agency Logos,

- Hmrc Emails 24 000 Self Employed In Covid Support Probe Ftadviser Com Government Agency Logos,