Self Employed Income Tax Calculator Uk, The Summer Of Tax Calculations Tax Adviser

Self employed income tax calculator uk Indeed recently has been sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the post I will discuss about Self Employed Income Tax Calculator Uk.

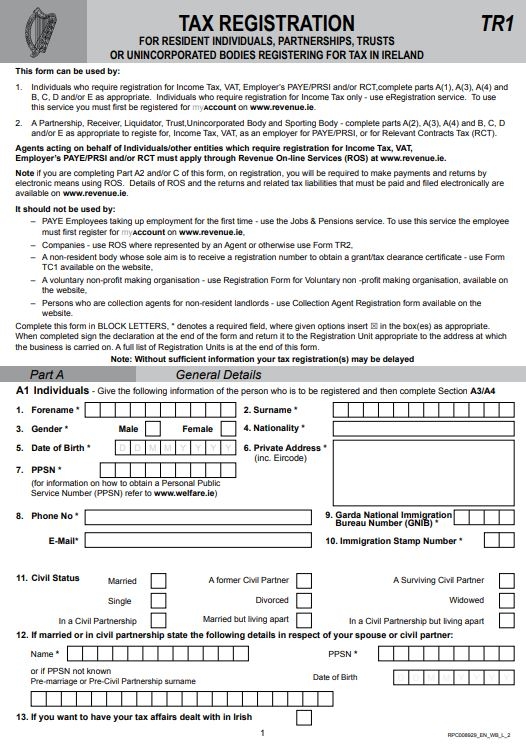

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

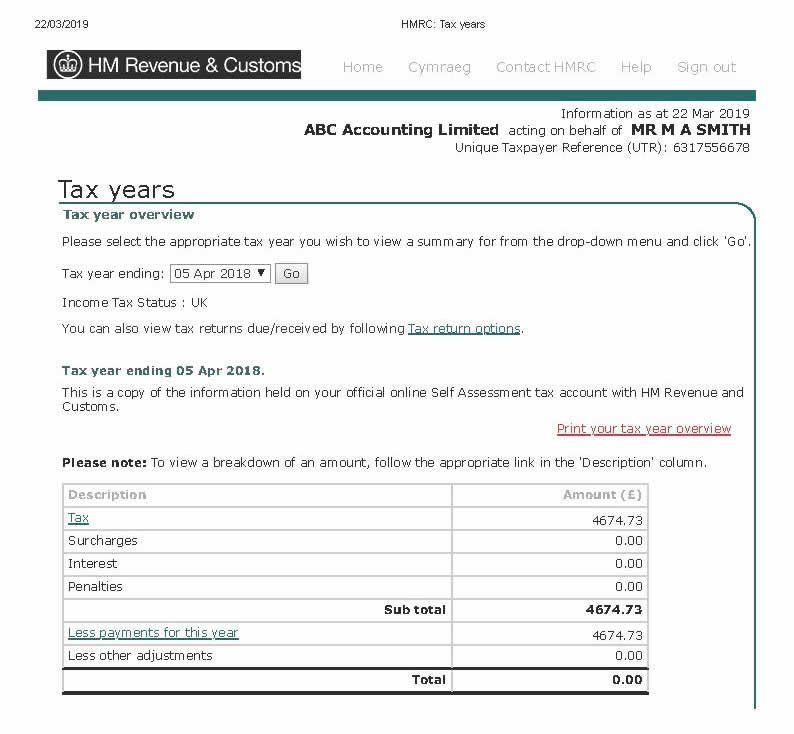

- How To File Tax Return Online In The Uk

- Self Employed Income Tax Calculator 2020 21 Transferwise

- Home Triginta Self Employed Tax Calculator

- Your Bullsh T Free Guide To Taxes In Germany

- How To File Tax Return Online In The Uk

Find, Read, And Discover Self Employed Income Tax Calculator Uk, Such Us:

- Income Tax Flow Chart 1 Tax Notes Equity And Trusts Studocu

- Self Employment Guide Archives Triginta Self Employed Tax Calculator

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsoivijwscoabsqsdiqlgprylxn0cnbket2lsrnhn16yjbbkhkx Usqp Cau

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

- Nuihipbmlp1wem

If you are searching for Representative Government Definition History you've reached the right location. We ve got 104 graphics about representative government definition history adding pictures, pictures, photos, wallpapers, and more. In such page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Self Assessment Income Tax Calculator And Dates Money Donut Representative Government Definition History

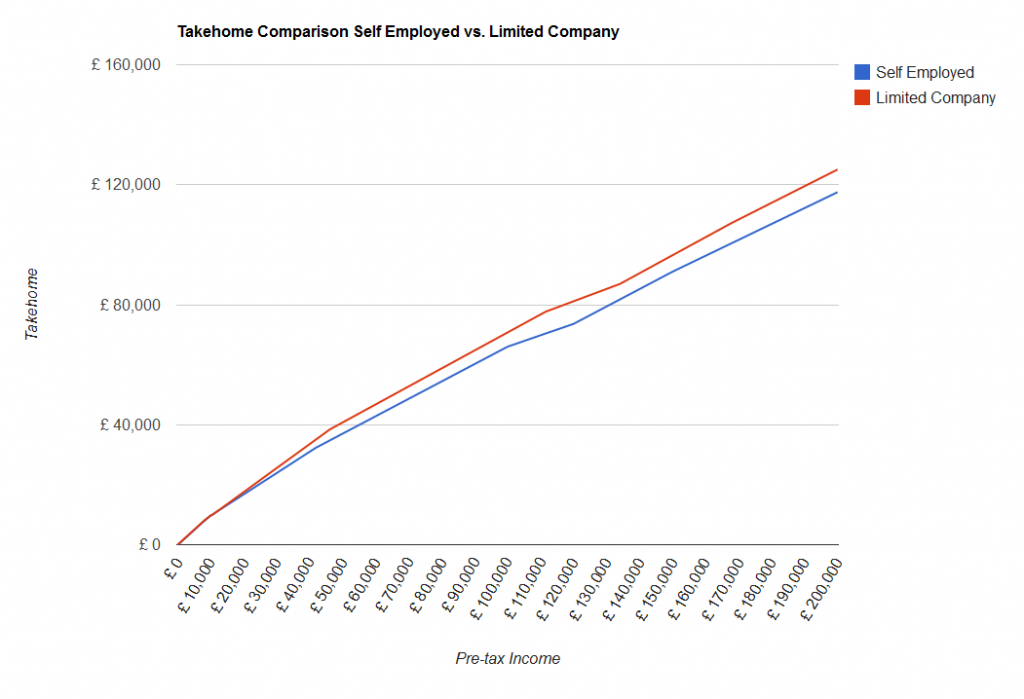

When you check employed checkbox the calculator will calculate tax on the remaining personal allowance from the employed income.

Representative government definition history. How your income tax is calculated. See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. The calculator uses tax information from the tax year 2020 2021 to show you take home pay.

Employed and self employed tax calculator. Student loan plan 1 plan 2 employed calculate. More information about the calculations performed is available on the details page.

If youre self employed it can sometimes be difficult to work out exactly what your take home pay is once youve covered all of your business costs. You pay 7200 40 on your self employment income between 10000 and 28000. Start now on the hmrc website.

Uk self employed tax calculator. You will need to pay class 2 ni worth 159. Enter your self employed income and expenses to find out an estimate of your deductions and potentially how much you will take home.

You pay 2000 20 on your self employment income between 0 and 10000. Employed self employed or construction industry. This calculator gets you a full breakdown of the deductions on your profits with minimum inputs required.

If youre self employed the self employed ready reckoner tool can help you budget for your tax bill. Our calculator helps you quickly assess how much payment is due. Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment.

Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay. Whether youre employed self employed or a combination of both working out your take home pay after tax can be tricky. However knowing your income is an important first step in dealing with any personal debts you might have.

This tax calculator can provide accurate tax calculations for three different types of employment structure. With our employed and self employed tax calculator you can very quickly find out how much income tax and national insurance you should expect to pay as well as the impact this will have on your pension. As a self employed you have to pay your income tax and national insurance contributions yourself during your annual self assessment.

You may be able to claim a refund if youve paid too much tax. However you may be eligible for a tax refund when. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

More From Representative Government Definition History

- Self Employed Meaning In Punjabi

- Self Employed Tax Calculator Nyc

- Government Furlough Scheme Criteria

- Sri Lanka Government Gazette 2020 August 07

- Self Employed Sss Contribution Payment Form

Incoming Search Terms:

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co Self Employed Sss Contribution Payment Form,

- How To File Tax Return Online In The Uk Self Employed Sss Contribution Payment Form,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsoivijwscoabsqsdiqlgprylxn0cnbket2lsrnhn16yjbbkhkx Usqp Cau Self Employed Sss Contribution Payment Form,

- Income Tax In Turkey Self Employed Sss Contribution Payment Form,

- Coronavirus Self Employment Income Support Scheme How Hmrc Will Calculate Total Income And Trading Profits For The Scheme Johnston Smillie Self Employed Sss Contribution Payment Form,

- Nationwide S Guide To Hmrc Tax Calculation Overview Requirements Home Self Employed Sss Contribution Payment Form,