Self Employed Insurance Deduction 2019, Deducting Health Expenses Self Employed Health Insurance Deduction More Stride Blog

Self employed insurance deduction 2019 Indeed lately is being hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the article I will discuss about Self Employed Insurance Deduction 2019.

- Tax Deductions For The Self Employed Cbs News

- How Do I Input Self Employed Health Insurance Dedu

- K3 Qkimiini7tm

- Solved Tax Drill Self Employment Tax In 2017 Miranda Rec Chegg Com

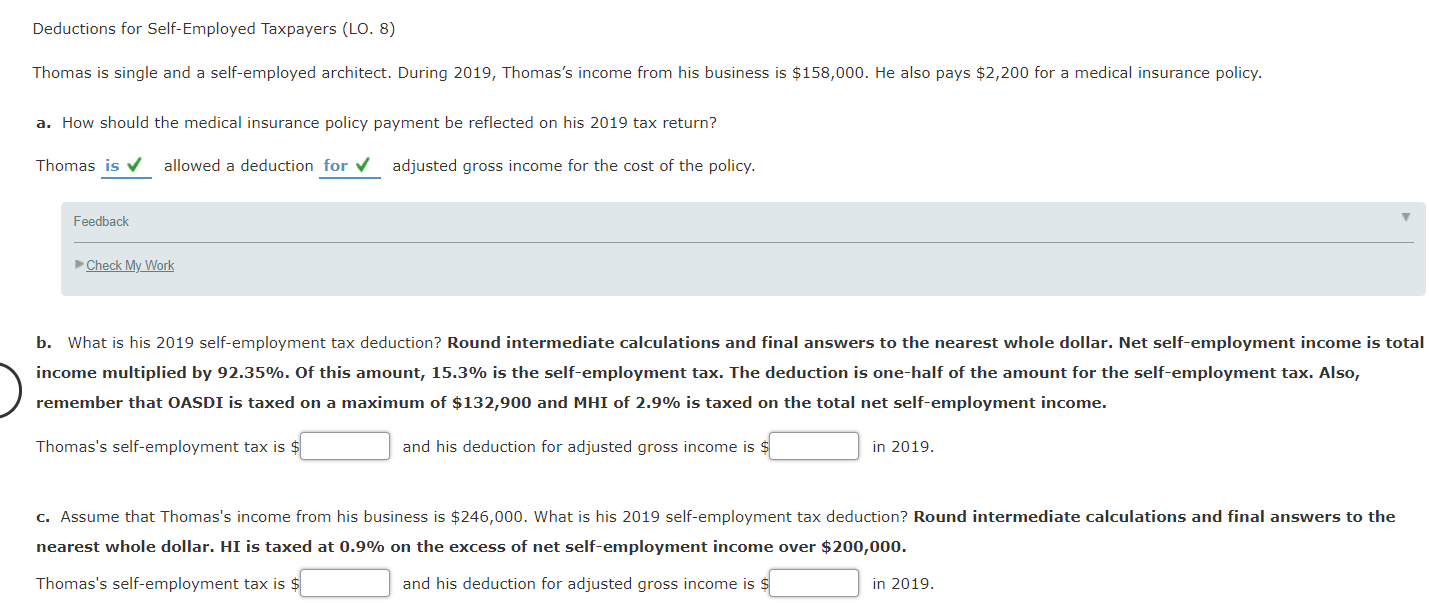

- Deductions For Self Employed Taxpayers Lo 8 Tho Chegg Com

- Self Employed Health Insurance Deduction Healthinsurance Org

Find, Read, And Discover Self Employed Insurance Deduction 2019, Such Us:

- K3 Qkimiini7tm

- Self Employed Disability Insurance Quote Bestdecorationmaison Cf

- 1

- Deductions For Self Employed Taxpayers Lo 8 Tho Chegg Com

- Resources Tax 29

If you are searching for Self Employed Support Scheme Extended you've come to the perfect place. We ve got 104 graphics about self employed support scheme extended adding images, photos, pictures, wallpapers, and much more. In such webpage, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

For the self employed health insurance premiums became 100 percent deductible in 2003.

Self employed support scheme extended. Unlike other tax deductions for self employed people the self employed health insurance deduction isnt taken on schedule c or on a business return. This health insurance write off is entered on page 1 of form 1040 which means you benefit whether or not you itemize your deductions. The deduction that allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. Because its an adjustment to income you claim it on schedule 1 attached to your form 1040 federal income tax return. This includes dental and long term care coverage.

Self employed health insurance deduction. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000. If you are self employed you may be eligible to deduct premiums that you pay for medical dental and qualifying long term care insurance coverage for yourself your spouse and your dependents.

If you qualify this deduction will reduce your adjusted gross income agi. In a nutshell the self employed health insurance deduction allows eligible self employed folks to deduct up to 100 of health dental and long term care insurance premiums for themselves and for their spouses dependents and non dependent children under age 27. A child includes your son daughter stepchild adopted child or.

If you have an s corp you should be aware of a 2015 notice regarding reimbursement for health premiums. Your self employment income is calculated on schedule c or f and it must be equal to or exceed the amount of your health insurance deduction.

More From Self Employed Support Scheme Extended

- What Is Furlough Scheme In Uk Employment

- Indonesian Government Departments

- Will Furlough Be Extended For Aviation

- Online Government Quiz With Certificate Free

- New Furlough Scheme Northern Ireland

Incoming Search Terms:

- Deduction U S 80d For Medical Insurance Expenses Mediclaim New Furlough Scheme Northern Ireland,

- Self Employed Health Insurance Deduction Healthinsurance Org New Furlough Scheme Northern Ireland,

- Solved Problem 10 25 Lo 2 For Calendar Year 2019 Jean Chegg Com New Furlough Scheme Northern Ireland,

- Self Employed Disability Insurance Quote Bestdecorationmaison Cf New Furlough Scheme Northern Ireland,

- Tax Savings For The Self Employed New Furlough Scheme Northern Ireland,

- Top Ten 1099 Deductions Stride Blog New Furlough Scheme Northern Ireland,