Self Employed National Insurance Threshold, Tax Rates For 2019 20 What The Taxman Gets Liquid Friday

Self employed national insurance threshold Indeed recently has been hunted by users around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the article I will discuss about Self Employed National Insurance Threshold.

- What Are National Insurance Contributions Low Incomes Tax Reform Group

- Self Employed Working From Home Jf Financial

- Self Employed Or Limited Company 18 19 Tax Year

- Paper F6 Uk Taxation United Kingdom Tuesday 2 June Fundamentals Level Skills Module The Association Of Chartered Certified Accountants Pdf Free Download

- Selfemployment Tax Transparent Background Png Cliparts Free Download Hiclipart

- National Insurance Shake Up Delayed Saving Millions Of Self Employed Workers Saved From 150 Tax Bill

Find, Read, And Discover Self Employed National Insurance Threshold, Such Us:

- How Much Health Insurance Cost For Self Employed

- What Boris Johnson S Conservative Election Win Means For Your Money From Tax Cuts To Boosting Your Pension Pot

- National Insurance Threshold Raised Meaning Tax Cut For 31m What Is The New Threshold Weimarhostel Com

- Tax Rates For 2019 20 What The Taxman Gets Liquid Friday

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf

If you re looking for Furlough Extension Labour you've reached the ideal place. We have 100 images about furlough extension labour including pictures, photos, pictures, backgrounds, and much more. In these page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Selfemployment Tax Transparent Background Png Cliparts Free Download Hiclipart Furlough Extension Labour

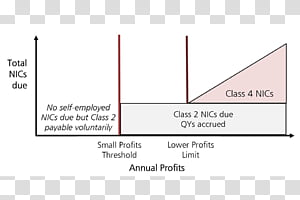

You currently pay two different classes of nic if you are self employed class 2 and class 4 these different.

Furlough extension labour. If youre over this threshold you will pay 9 on profits between 8632 and 50000 in the 201920 tax year 9500 and 50000 202021. Unless your profits from self employment tax return are below the threshold the small profit threshold of 5965 for 2015 16 or the small earnings exception level for earlier years 5885 for 2014 15 you will have to pay class 2 national insurancethis does not affect your liability to receive a cis tax rebate or a self. Class 2 and class 4 national insurance self employed 4.

This is up from 3 a week on profits over 6365 in 2019 20. Class 1 national insurance rates. Class 1 national insurance thresholds.

National insurance contributions nics are contributions which pay for certain benefits including the state pension and universal credit. You can find out your state pension age by using the calculator on govuk. While self employed people will have 78 cut from their bill.

People with profits of less than the small profit threshold 6475 for 202021 will not have to pay any class 2 national insurance. Although not technically a tax allowance we thought it was worth covering what the rate of national insurance contributions are for self employed people for the tax year 201920. What national insurance do i pay on self employed income.

Class 2 national insurance contributions. You usually pay 2 types of national insurance if youre self employed. Self employed national insurance rates.

Around 31m taxpayers will benefit from a rise in the national insurance threshold starting next month. Class 4 if your profits are 9501 or more a year. The payment thresholds for ni contributions in 2020 21 are 305 a week for class 2 contributions on profits over 6475this totals 15860 for the year.

Class 2 and class 4 nics are charged at different rates. Class 4 national insurance contributions are only charged if your profits are above 9500 a yearthe rate is nine per cent of profits between 9501. Self employed ni rates have been a bit confusing in the past few years as changes were proposed to scrap class 2 ni and subject people only to continue reading self employed ni rates 201920.

The class 2 national insurance contribution is a fixed amount of 305 a week and its only charged if your annual profits are 6475 or more. You only pay national insurance contributions nic between the ages of 16 and state retirement age. National insurance contributions if youre self employed.

This totals 156 for the year. Most people will pay class 2 national insurance along with class 4 national insurance and income tax in january self assessment payments.

More From Furlough Extension Labour

- Perbedaan Government Dan Governance

- Furlough Scheme Extend Uk

- Furlough Scheme Rules Govuk

- Self Employed Pension Plans

- Government Jobs Near Me 2020

Incoming Search Terms:

- Payroll Tax Wikipedia Government Jobs Near Me 2020,

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf Government Jobs Near Me 2020,

- Are You Employed Are You Self Employed Kbm Financial Focus Facebook Government Jobs Near Me 2020,

- Spring Budget Summary For Motor Industry Government Jobs Near Me 2020,

- National Insurance Archives Uk Tax Allowances Government Jobs Near Me 2020,

- Http Researchbriefings Files Parliament Uk Documents Cbp 7918 Cbp 7918 Pdf Government Jobs Near Me 2020,