Self Employed Pension Contributions Tax Deductible, Pensions And Self Employment Low Incomes Tax Reform Group

Self employed pension contributions tax deductible Indeed recently is being hunted by consumers around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this post I will discuss about Self Employed Pension Contributions Tax Deductible.

- Self Employed National Insurance Class 2 And Class 4 Rates

- Are Funded Pensions Well Designed To Adapt To Non Standard Forms Of Work Pensions At A Glance 2019 Oecd And G20 Indicators Oecd Ilibrary

- Https Www Vanbreda Be Vrb Custom Uploads 2019 05 610010 Fiscaliteit En Pensioenopbouw Eng Pdf

- 2

- Ppt Chapter 3 Business Expenses Retirement Plans Powerpoint Presentation Id 2310418

- The Ultimate Guide To Pensions And Tax Pensionbee

Find, Read, And Discover Self Employed Pension Contributions Tax Deductible, Such Us:

- Pensions Tax Reliefs Pdf Free Download

- Topical Tax Issues For Reducing Your Irish Income Tax Liability

- Worldwide Personal Tax Guide Japan Local Information National Income Tax Rates Taxable Income Band National Income Tax Rates Pdf Free Download

- Ppt Chapter 16 Retirement Planning Powerpoint Presentation Free Download Id 5635554

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

If you re looking for Government Tyranny Drawing you've arrived at the right location. We ve got 100 graphics about government tyranny drawing adding pictures, photos, pictures, backgrounds, and more. In such webpage, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Employer takes workplace pension contributions out of your pay before deducting income tax rate of income tax is 20 your pension provider will claim it as tax relief and add it to your pension.

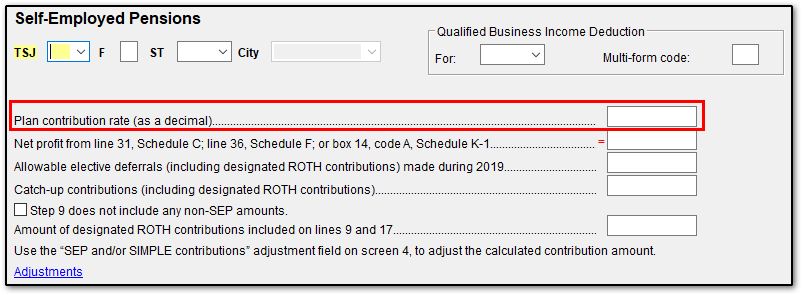

Government tyranny drawing. These are the options available. Plan contributions for a self employed individual are deducted on form 1040 on the line for self employed sep simple and qualified plans and not on the schedule c. Which is the best pension plan for self employed person.

You can deduct your pension contributions from your taxable income. Therefore annual premium 96000 actual pension contribution 120000. You can claim any higher rate tax relief through your end of year tax assessment.

Additionally the evergreen small business blog explains how using an ira may easily let that you join the top ten percentile. For every premium payment of say 8000 the actual contribution will be 10000 with the effective tax relief at source coming from the government. Tax relief at source is normally received on contributions to a pension scheme at the basic rate currently 20.

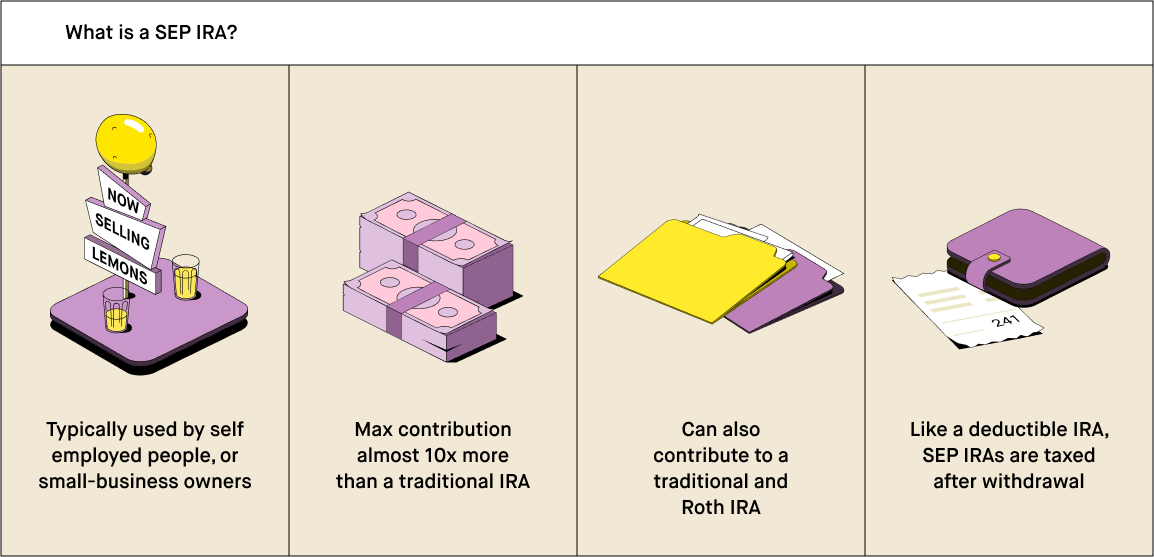

Usually your employer deducts the contributions directly from your pay and will give you the tax relief due. People below 50 can make. Self employment external website is a great choice for many people but you need to take steps to plan and save for your later lifeyou dont get automatically enrolled into a workplace pension or have extra contributions paid in to your pension by an employer.

It is the gross premium which is entered on the self assessment tax return. This could allow you or your company to contribute more than 40000 in a tax year by using allowance from the past three tax years. Typically the answer will depend up on how much free cash flow you have to put aside in the pension plan.

In summary if you are self employed and making personal pension contributions you will usually get 20 tax relief in the form of this being added to your pension by the government and in addition to this you will get income tax relief through your personal tax return if your earnings are above the basic tax band. For example if your annual earnings were 50000 and you contribute 2000 into your pension this reduces your total taxable income to 48000. If you are self employed.

This limit is 285000 in 2020 280000 in 2019 and is adjusted annually. In this situation you can opt for the soloindividual 401k plan. Yes most of the pension contributions made to a 401k profit sharing sep ira and defined benefit plan will be tax deductible.

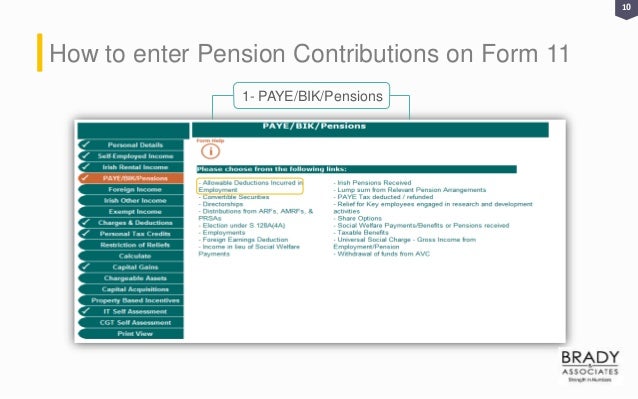

Sign in to ros to claim tax relief. Are self employed pension contributions tax deductible.

More From Government Tyranny Drawing

- Government Accounting System In Bangladesh

- Government Accounting Millan Solution Manual Chapter 4

- Types Of Government Quiz

- Is Furlough Extended For Everyone

- Government Regulation Of Business Examples

Incoming Search Terms:

- Self Employed Tax Changes 2020 21 Government Regulation Of Business Examples,

- How Best To Extract Profits From Your Business Government Regulation Of Business Examples,

- A Guide To Sources Of Data On Income And Earnings Office For National Statistics Government Regulation Of Business Examples,

- Tax And Self Employment Visual Artists Ireland Government Regulation Of Business Examples,

- Self Employed Sep Ira Tax Deduction Sep Contribution Limit And Maximum Benefit Depends On Taxable Income Government Regulation Of Business Examples,

- Swiss Pillar 3a And 3b Pension System A Complete Guide Government Regulation Of Business Examples,