Self Employed Retirement Plans Vanguard, Ibm 401 K Plus Plan

Self employed retirement plans vanguard Indeed lately has been sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the post I will discuss about Self Employed Retirement Plans Vanguard.

- Retirement Accounts For The Self Employed Part 1 Of 5 The Sep Ira Dollars Sense Education

- Solo 401k Best Self Employed Retirement Plan For Aggressive Savers 50k 100k Income Example My Money Blog

- Vanguard Sep Ira Here S What They Don T Tell You

- Mcclatchy 401 K Mcclatchy Livewell

- How To Open Accounts With Vanguard Fidelity And Schwab Choosefi

- Vanguard Investor Uk Review Is It The Best In The Market Money To The Masses

Find, Read, And Discover Self Employed Retirement Plans Vanguard, Such Us:

- How To Sign Up For A Vanguard Brokerage Account A Step By Step Guide The Motley Fool

- Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

- The Best Retirement Plans Of 2020

- Sep Ira Possibly The Best Retirement Plan For The Self Employed Cloud Friday

- Straight From Vanguard Retirees 6 Retirement Planning Tips Vanguard

If you re searching for Government Types Map you've reached the right place. We ve got 103 images about government types map including pictures, photos, photographs, backgrounds, and more. In such page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Opportunities of the 2020 us.

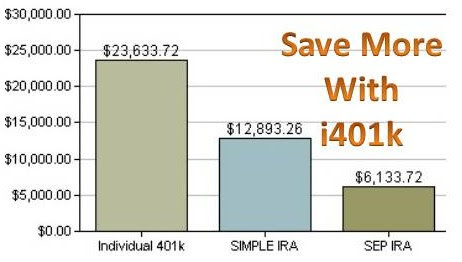

Government types map. Vanguards individual 401k is the best self employed plan because theres no cost to set up an account and the only investment fees you pay are fund expenses there are no sales loads or. Make sure you have your. Footnote self employed individuals must make a special computation to figure the maximum contribution amount.

All investing is subject to risk including the possible loss of the money you invest. Cares act helps plan participants. But if youre self employed or.

Who can participate employers are generally the sole contributors but employees may be able to make traditional ira contributions to the sep ira. For existing clients click here to start your digital experience. Advantages the plan allows both employer and employee contributions so employees have a chance to save the maximum.

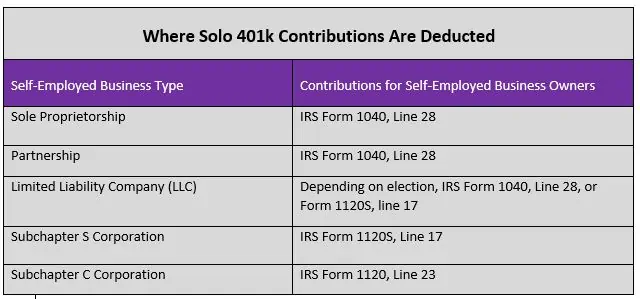

Consider this plan if you are self employed are a small business owner or have a business with 100 or fewer employees that doesnt maintain another retirement plan. Sign up for online access. This plan can be set up by self employed individuals small business owners and any business with 100 or fewer employees that doesnt maintain another retirement plan.

The vanguard individual 401k plan is a retirement plan for self employed individuals. Use the rate table or worksheets in chapter 5 of irs publication 560 external site retirement plans for small business or see a tax advisor. Its platform fee is just 015 a year and the average fund costs 024.

Join your retirement plan. Our program for small and mid sized businesses is a high quality easy to administer retirement offer for 401k plans 403b plans and other retirement plan types. For additional guidance on retirement plans for the self employed see irs publication 560.

This plan is available only to sole proprietors or partners in business who have no common law employees. Vanguards target retirement portfolios also offer excellent value for money. Enroll in your retirement plan.

The only other participant allowed in this plan would be a spouse of the business owner if he or she works for the business. As bobby whitlock songwriter and one time member of derek and the dominos sang. Focus on what you can control.

What the rules could mean for you.

More From Government Types Map

- Furlough And Unemployment Ma

- Self Employed Limited Company Grant

- Self Employed Or Limited Company

- Government Law College Mumbai Hostel Fees

- Government Of India Is Seriously Thinking To Allow Oil Marketing

Incoming Search Terms:

- 1 Government Of India Is Seriously Thinking To Allow Oil Marketing,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqmvtn1s4fdhwhlwjs 4jkdglhwtq Tj08o Izvci8 Usqp Cau Government Of India Is Seriously Thinking To Allow Oil Marketing,

- Backdoor Roth Ira 2020 A Step By Step Guide With Vanguard Physician On Fire Government Of India Is Seriously Thinking To Allow Oil Marketing,

- Solo 401k Faqs My Solo 401k Financial Government Of India Is Seriously Thinking To Allow Oil Marketing,

- Vanguard Review 2020 For The Buy And Hold Investor Government Of India Is Seriously Thinking To Allow Oil Marketing,

- Mcclatchy 401 K Mcclatchy Livewell Government Of India Is Seriously Thinking To Allow Oil Marketing,

/vanguard-personal-advisor-services-vs-etrade-core-portfolios-9d2897052e334bb294047e62032a8cd3.jpg)