Self Employed Van Driver Tax, City Link S Army Of Self Employed Workers Count Cost Of Business Failure Business The Guardian

Self employed van driver tax Indeed lately is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this article I will talk about about Self Employed Van Driver Tax.

- Closing The Legal Loophole Around Mobile Phones And Driving

- How To Become A Courier A Simple Guide

- Small Business Guide To Buying A Van Rac

- Self Employed 5 Things You Need To Know About Tax Reform

- Company Van Tax Understanding The Rules Auto Express

- Company Van Tax Understanding The Rules Auto Express

Find, Read, And Discover Self Employed Van Driver Tax, Such Us:

- Amazon Delivery Drivers Reveal Claims Of Disturbing Work Conditions Business Insider

- Amazon Courier Drivers Being Ripped Off With Large Deductions To Their Wages Daily Record

- What If I Use My Own Car For Business Purposes Low Incomes Tax Reform Group

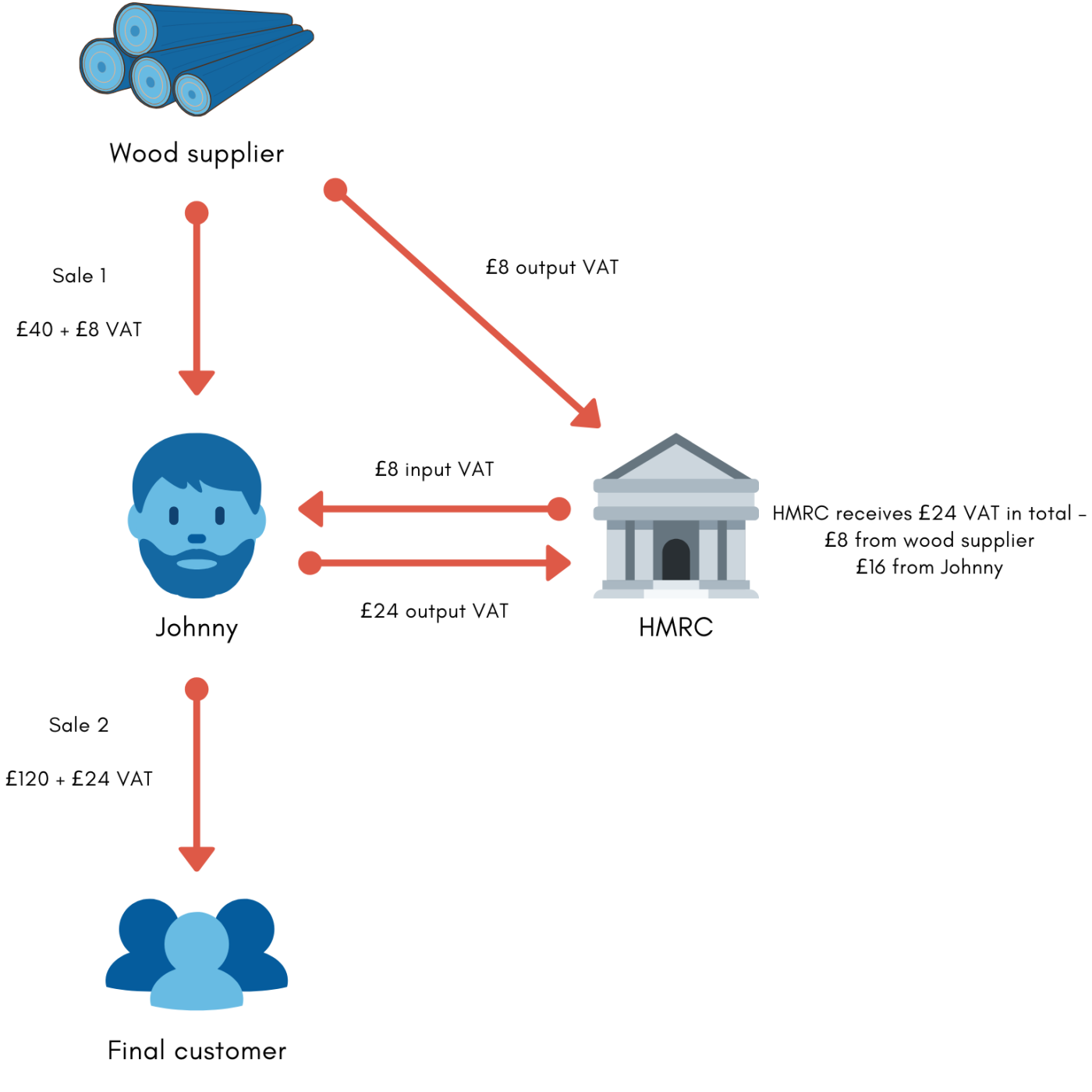

- Are You In Low Paid Self Employment And Considering Becoming Vat Registered Low Incomes Tax Reform Group

- Darryl On Twitter The Gig Economy Joshbannable Jdunne

If you re searching for Us Government Spending Pie Chart 2020 you've come to the right place. We have 101 graphics about us government spending pie chart 2020 including pictures, photos, photographs, wallpapers, and more. In these page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Included with all turbotax deluxe premier self employed turbotax live or prior year plus benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312021.

Us government spending pie chart 2020. If you are a self employed courier you will need to complete a tax return so that you can declare your earnings to hmrcthis article will help to highlight some key things to remember for your tax return and how to save tax. For van expenses i am thinking of claiming the mileage expenses ie 45p25p rather than making a claim on his petrol receipts which give lower expense. Tax return guide for couriers what allowances and expenses can i claim.

Glassdoorcouk lists a range of different courier jobs with different organisations and hourly rates of pay appear to range from 5 per hour to 11 pound per hour. You can also earn more if you have a van instead of a car as you will be able to deliver bigger loads. Also included with turbotax free edition after filing your 2019 tax return.

According to the national careers service couriers earn between 14500 and 40000 a year. If the van is used for business purposes then you can offset the. Theres more information about tax relief for vehicles and self employed drivers on the.

Whilst wages will be low to begin with it increases over time and you can still work in your day job whilst being a courier driver. If youre looking to start your own delivery business there are a number of things you need to organise before you can be considered legitimately self employed and suitably covered for the type of courier work you want to take on. Completing annual tax return for a self emplyed courier driver.

You may receive form 1099 misc miscellaneous income or form 1099 k with the income paid to you that is to be reported on your schedule c. There are also some tax advantages. Begin by visiting the hmrcs website and.

If you are a self employed driver whether you drive a yellow cab uber via or lyft you must report your income on schedule c. We can prepare your tax return online for just 9900.

I Was An Amazon Delivery Driver What It S Like To Work In The Tech Giant S Citizen Package Brigade Geekwire Us Government Spending Pie Chart 2020

More From Us Government Spending Pie Chart 2020

- Government Budget Graph

- The New Furlough Scheme

- Up Government Logo Png

- Indonesian Government Bonds Fr Series

- Self Employed Unemployment Benefits California

Incoming Search Terms:

- Https Ec Europa Eu Social Blobservlet Docid 20207 Langid En Self Employed Unemployment Benefits California,

- Government Changes To New Mot Rules What You Need To Know Self Employed Unemployment Benefits California,

- Driving For Amazon Full Options For Amazon Van Leasing Autoease Self Employed Unemployment Benefits California,

- Van Tax Relief With Pick Ups And Kombis Ttr Barnes Self Employed Unemployment Benefits California,

- Download App Eve Accountants Self Employed Unemployment Benefits California,

- Drivers May Be Eligible For Small Business Support Covid 19 The Hub Self Employed Unemployment Benefits California,