Self Employed Ppp Loan Forgiveness Application, Ppp Loan Forgiveness Overview The Hechtman Group

Self employed ppp loan forgiveness application Indeed recently is being sought by users around us, maybe one of you. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the article I will discuss about Self Employed Ppp Loan Forgiveness Application.

- A Complete Guide To Ppp Loan Forgiveness For The Self Employed Alignable

- Applying For Ppp Loan Forgiveness Read This Advice From Experts First Dayton Business Journal

- Sba Releases Loan Forgiveness Application And Instructions Armanino

- Sba Simplifies Small Business Applications For Ppp Loan Forgiveness Newsday

- Sba And Treasury Release Paycheck Protection Program Loan Forgiveness Application Mychesco

- Sba Releases Paycheck Protection Program Loan Forgiveness Application A Deep Dive

Find, Read, And Discover Self Employed Ppp Loan Forgiveness Application, Such Us:

- Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

- Ppp Loan Forgiveness Application For Self Employed Youtube

- Paycheck Protection Program Ppp Loan Forgiveness Q A S Crippen

- Ppp Loan Forgiveness Application Guidance For The Self Employed Freelancers And Contractors

- Streamlined Sba Application Makes Loan Forgiveness Easier For Self Employed Ppp Borrowers News Break

If you re searching for What Is Extended Furlough you've reached the ideal place. We ve got 100 graphics about what is extended furlough including pictures, photos, pictures, backgrounds, and more. In such page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Sba Releases New Ppp Forgiveness Applications And Ez Form Cpa Practice Advisor What Is Extended Furlough

1 1 30 2020.

What is extended furlough. This is everything we know based on information directly from the sba and the 19th interim final rule ifr filed on june 19th 2020. If you do have payroll expenses then you can use the standard forgiveness application. Below are some facts that are 100 sole proprietor specific and some that.

This can be confirmed in your bank account activity. Yesterday evening the small business administration sba dropped another one. For a self employed individual independent contractor or a sole proprietor the self employed individual independent.

Small business administration sba guidance covering sole proprietors with insight to some forgiveness provisions of the paycheck protection program ppp can be found here. Ppp self employed loan forgiveness as of 6102020 payroll providers are developing ppp compliant reports to track both payroll and benefits some lenders are requiring ppp loan proceeds be put into a separate bank account. We created a comprehensive comprehensible guide all about ppp loan forgiveness for the self employed sole proprietors and independent contractors.

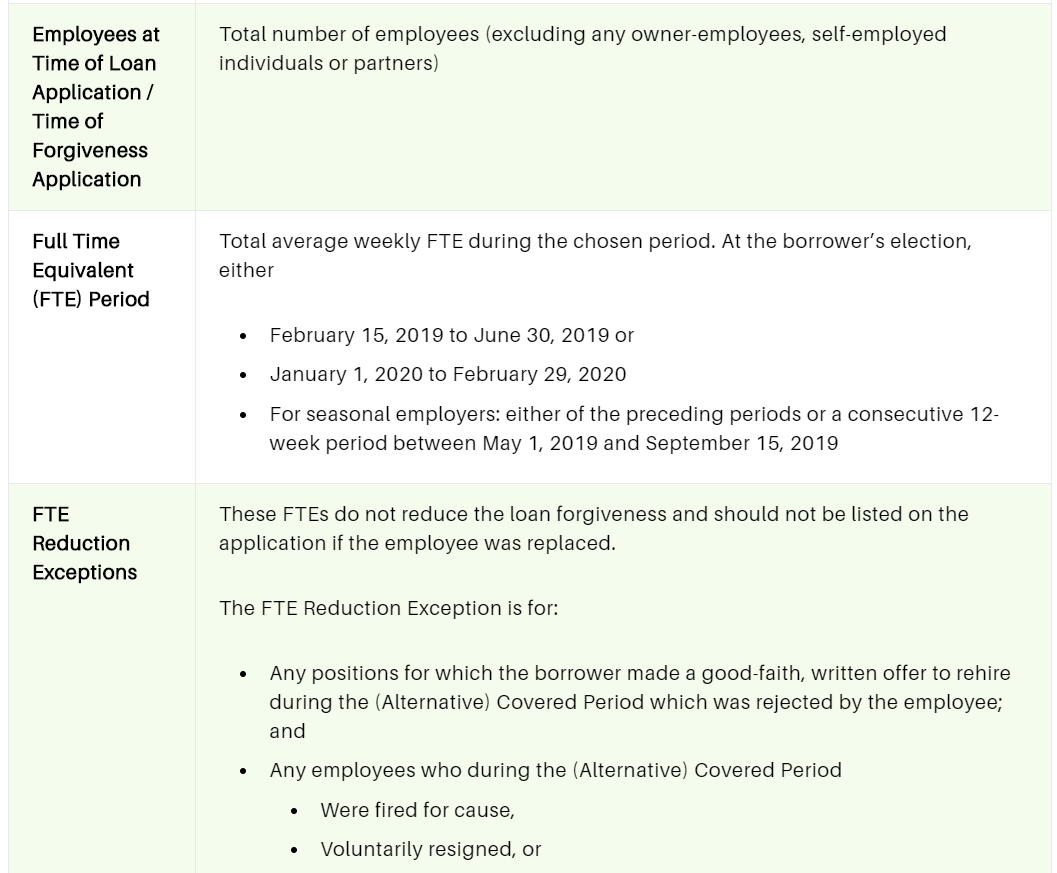

Employees at time of loan applicationemployees at time of forgiveness application. This article was updated june 17 2020 with information from the new ppp forgiveness application 3608ez and the 19th interim final rule. Ppp loan forgiveness application guidance for the self employed freelancers and contractors brian thompson senior contributor opinions expressed by forbes contributors are their own.

If you have not yet read our previous post on the general information regarding the paycheck protection program loans click here. Self employed individuals can use a simplified forgiveness application we call the ez form. The actual amount of employees not full time equivalents fte.

When it comes time to apply for forgiveness of the ppp loan as a self employed individual the sba says you can use the following information as documentation. If you received the funds in stages enter the first date. This form applies to you as long as you dont have employees on payroll.

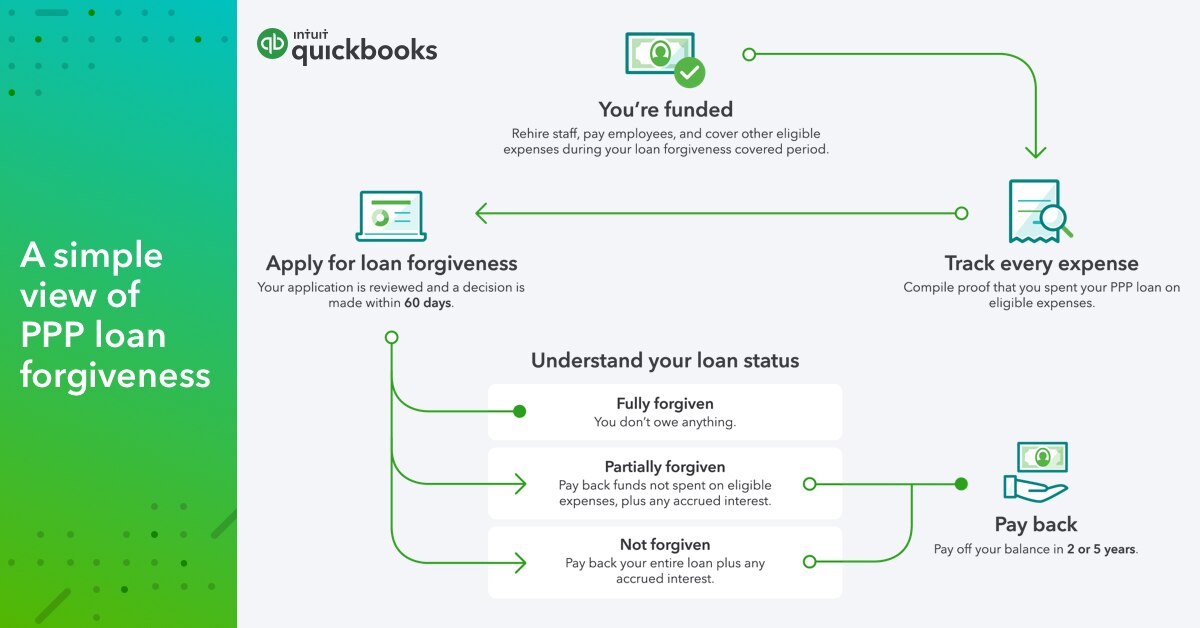

When the application for loan forgiveness is completed the documentation such as payroll reports payroll tax returns. If youre self employed and qualified for a paycheck protection program ppp loan then no doubt you are hoping you can get as much of it forgiven as possible. The 2019 form 1040 schedule c that was provided at the time of the ppp loan application must be used to determine the amount of net profit allocated to the owner for the eight week.

This application is only for those who received. It released a third ppp loan forgiveness application form 3508s. We expect the big lenders will set up their own online application process so you may not need to fill out.

More From What Is Extended Furlough

- What Is Furlough Cut Off Date

- Furlough Scheme Announcement Uk

- Furlough Rules Early Years

- Covid 19 Uk Government Signs

- Government Island Park Virginia

Incoming Search Terms:

- Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments Government Island Park Virginia,

- Ppp Loan Forgiveness Application Updated For The Flexibility Act Scheffel Boyle Government Island Park Virginia,

- Ppp Loan Forgiveness Application Guidance For The Self Employed Freelancers And Contractors Government Island Park Virginia,

- Ppp Loan Forgiveness Application Guide Updated Gusto Government Island Park Virginia,

- Navigating Ppp Loan Forgiveness Government Island Park Virginia,

- Https Www Bancorpsouth Com Media Bancorpcom Alerts Website Ppp Loan Forgiveness Instructions And Application Form Ez Ashx Government Island Park Virginia,