Self Employed Retirement Plans Irs, Help Small Businesses Choose The Right Employee Retirement Plans Journal Of Accountancy

Self employed retirement plans irs Indeed lately is being sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the article I will talk about about Self Employed Retirement Plans Irs.

- Irs Announces 2021 Retirement Plan Contribution Limits For 401 K S And More

- The Qbi Deduction Reduction On Small Business Retirement Plans

- Https Www Irs Gov Pub Irs News Fs 08 24 Pdf

- Full Comparison Of Retirement Accounts Solo 401k Sep Ira And Simple Ira For The Self Employed My Solo 401k Financial

- Https Www Irs Gov Pub Irs Tege Forum15 Sep Simple Avoiding Pitfalls Pdf

- Retirement Plan Options For The Self Employed Retirable

Find, Read, And Discover Self Employed Retirement Plans Irs, Such Us:

- What Is An Independent Contractor Independent Contractor Definition Napkin Finance

- Understanding Ira Based Retirement Plans Cst Group Cpas Northern Virginia Accounting Firm Serving The Dc Area

- Sep Ira Pica Pica

- Retirement Plan Options For Self Employment Income Stokes Family Office

- Traditional Vs Roth Ira Real World Made Easy

If you are looking for Highest Paid Government Jobs In India For Freshers you've arrived at the right place. We have 101 images about highest paid government jobs in india for freshers including pictures, photos, photographs, backgrounds, and more. In such web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

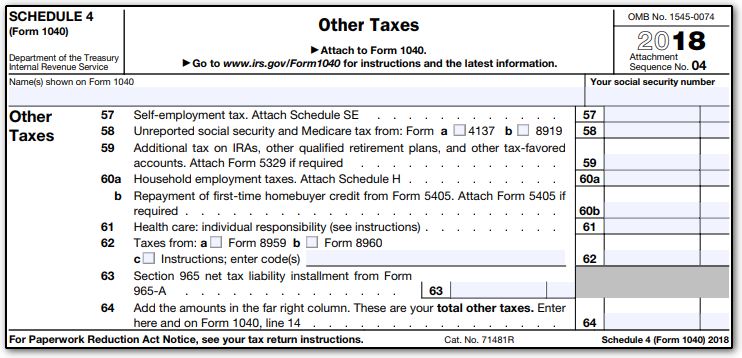

Plan contributions for a self employed individual are deducted on form 1040 on the line for self employed sep simple and qualified plans and not on the schedule c.

Highest paid government jobs in india for freshers. See also calculating your own retirement plan contribution. For additional guidance on retirement plans for the self employed see irs publication 560. As bobby whitlock songwriter and one time member of derek and the dominos sang.

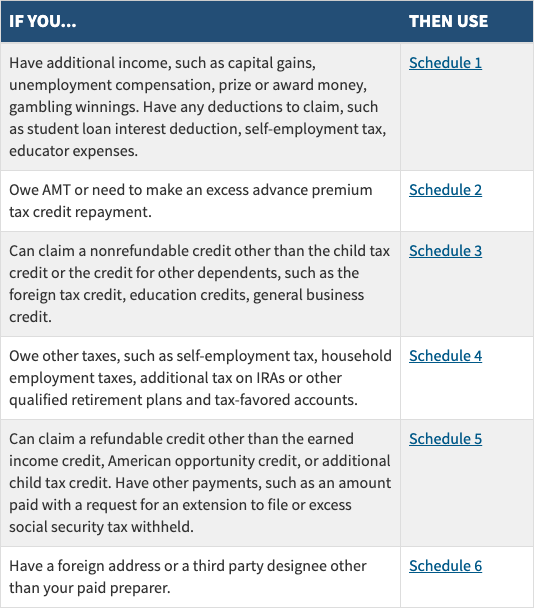

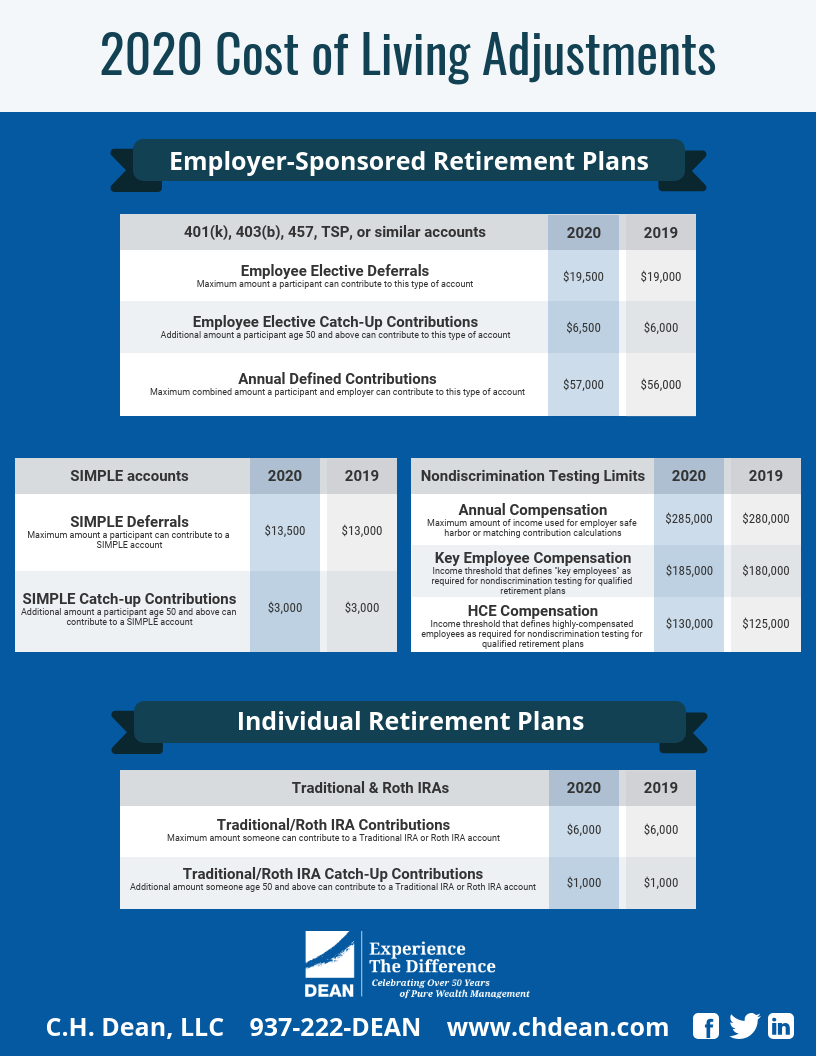

All of the plans we will discuss offer tax advantages for contributions but each plan has different rules requirements and contribution limits. Retirement plan participants including self employed individuals who make contributions to their plan may qualify for the retirement savings contribution credit. 24 2020 by emily brandon senior editor feb.

If you made the deduction on schedule c or made and deducted more than your allowed plan contribution for yourself you must amend your form 1040 tax return and schedule c. Sep plans that are not sarseps only allow employer contributions. For a self employed individual contributions are limited to 25 of your net earnings from self employment not including contributions for yourself up to 57000 for 2020.

Since the law no longer distinguishes between corporate and other plan sponsors the term is seldom used. The maximum contribution eligible for the credit is 2000. If theres a will.

To take the credit use form 8880 credit for qualified re tirement savings contributions. Use the rate table or worksheets in chapter 5 of irs publication 560 retirement plans for small business for figuring your allowable contribution rate and tax deduction for your 401k plan contributions. Pick the best self employed retirement plan.

Get details on coronavirus relief for retirement plans and iras. The maximum contribution eligible for the credit is 2000. One half of your self employment tax and.

These retirement accounts for self employed workers provide retirement saving tax breaks. To take the credit use form 8880 credit for qualified retirement savings contributions. You can calculate your plan contributions using the tables and worksheets in pub.

Can be included in income over 3 years. Retirement plan participants including self em ployed individuals who make contributions to their plan may qualify for the retirement savings contribution credit. Plan loan limits and repayments may be extended.

24 2020 at 1033 am. By emily brandon senior editor feb.

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs8dtigq Yyo9 Ufxtilyrzh9tg4o9xxegfjw Usqp Cau Highest Paid Government Jobs In India For Freshers

More From Highest Paid Government Jobs In India For Freshers

- Self Employed Furlough Maternity

- Government Update On Coronavirus Today

- Government Budget Deficit Equation

- Government University In Canada

- Government Issued Photo Id Card

Incoming Search Terms:

- The Qbi Deduction Reduction On Small Business Retirement Plans Government Issued Photo Id Card,

- Fidelity Solo 401k A Step By Step Guide To Setting Up Your Self Employed Retirement Plan Financial Panther Government Issued Photo Id Card,

- 2020 Retirement Plan Contribution Limits 2020 401k Contribution Limit Government Issued Photo Id Card,

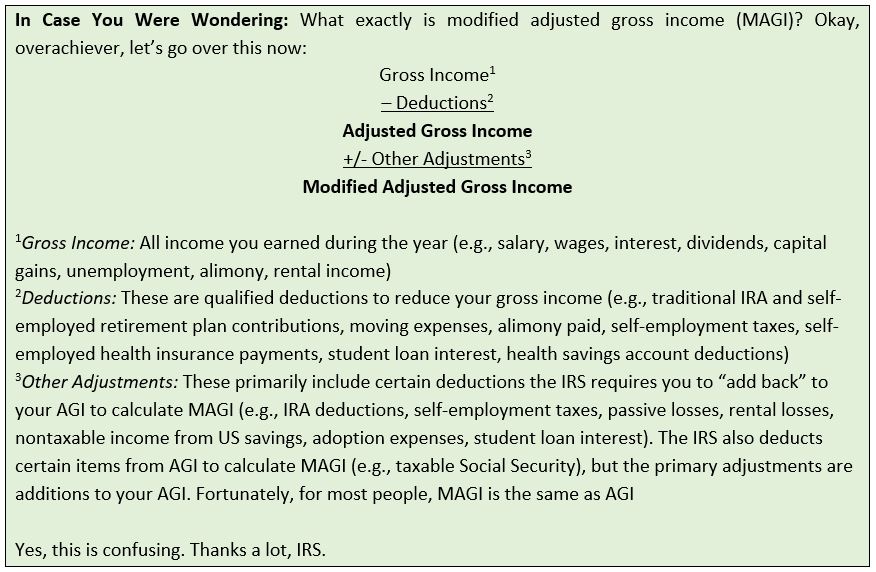

- How To Calculate Your Modified Adjusted Gross Income Government Issued Photo Id Card,

- Irs Increases Eligibility For Covid 19 Related Retirement Plan Withdrawals Doeren Mayhew Cpas Government Issued Photo Id Card,

- The Best Retirement Plans For The Self Employed Government Issued Photo Id Card,