Self Employed Tax Allowance 2019, Ey Nwgkkilwcim

Self employed tax allowance 2019 Indeed lately has been sought by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this article I will talk about about Self Employed Tax Allowance 2019.

- Turbotax Self Employed Online 2019 File Self Employment Taxes

- Election 2019 Your Questions Answered What S Being Done For The Self Employed Bbc News

- Self Employment Tax Deductions Taxes Us News

- Wc4xk 3p5q74wm

- 2019 20 Tax Rates And Allowances Boox

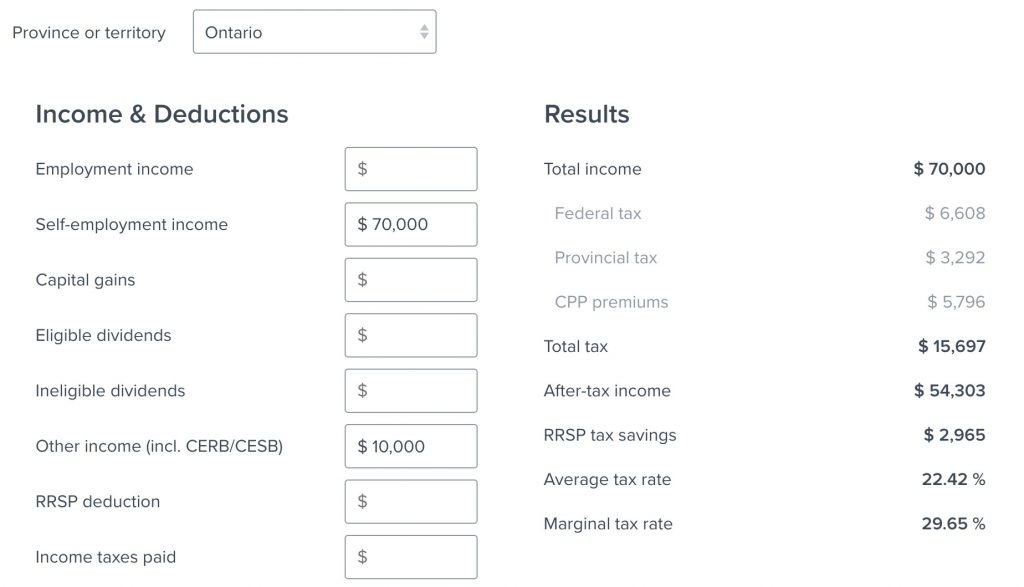

- Https Ec Europa Eu Social Ajax Blobservlet Docid 21736 Langid En

Find, Read, And Discover Self Employed Tax Allowance 2019, Such Us:

- Self Employment Tax Everything You Need To Know Smartasset

- Publication 970 2019 Tax Benefits For Education Internal Revenue Service

- Publication 929 2019 Tax Rules For Children And Dependents Internal Revenue Service

- Tax For Foster Carers Goselfemployed Co

- What Is Schedule Se The Tax Form For The Self Employed

If you are looking for Government Number Plate Punjab you've reached the ideal location. We have 104 images about government number plate punjab adding images, photos, pictures, backgrounds, and more. In these webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year.

Government number plate punjab. There are also parts of this guide which address more. In 2019 20 this is 12000 up from 11700 the previous year. Your tax free personal allowance the standard personal allowance is 12500 which is the amount of income you do not have to pay tax on.

This is firstly charged at the higher rate of 40 on the income above the basic rate limit. 1000 visit this page. Although child benefits are not means tested if you or your partner earns over 50000 you may need to pay a tax charge called the high income child benefit tax charge.

2019 20 self employed allowance tax. The basic rate limit will be increased to 37500 for 2019 to 2020. The earned income tax credit for the self employed will increase from 1500 to 1650.

201920 tax rates for self employed in the uk. The current tax year is from 6 april 2020 to 5 april 2021. Important words and phrases 96.

You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. It was announced in budget 2021 that the tax debt warehousing scheme will be extended to taxpayers who self assess for income tax that are adversely impacted by covid 19. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year.

The basic rate band for 201920 is 37500. This measure will also be applied for the 2020 tax year. This measure increases the personal allowance to 12500 for 2019 to 2020.

12500 visit this page basic tax rate. 40 50001 150000 personal savings allowance. This charge claws back child benefits paid at a rate of 1 for every 100 you earn over 50000.

If youre self employed your business will have various running costs. Impacted taxpayers who cannot pay their 2019 balance and preliminary tax for 2020 can defer payment for 12 months. This means that in 201920 you pay tax at the rate of 40 on taxable earned income above the limit of 37500.

Which comes into effect during 2019. Some important tax allowances and rates 91 some important tax dates 93 glossary. 20 12501 50000 higher tax rate.

If you have taxable earned income that exceeds the basic rate limit you must pay more tax.

More From Government Number Plate Punjab

- Hm Government Covid 19 Posters

- 2021 Calendar With Government Holidays

- Mp Government Job Vacancy 2020

- Furlough Extension England

- Sri Lanka Government Gazette 2020 August 7

Incoming Search Terms:

- Self Employed Tax Changes 2020 21 Sri Lanka Government Gazette 2020 August 7,

- Income Tax Calculator Calculate Taxes Online Fy 2019 20 Sri Lanka Government Gazette 2020 August 7,

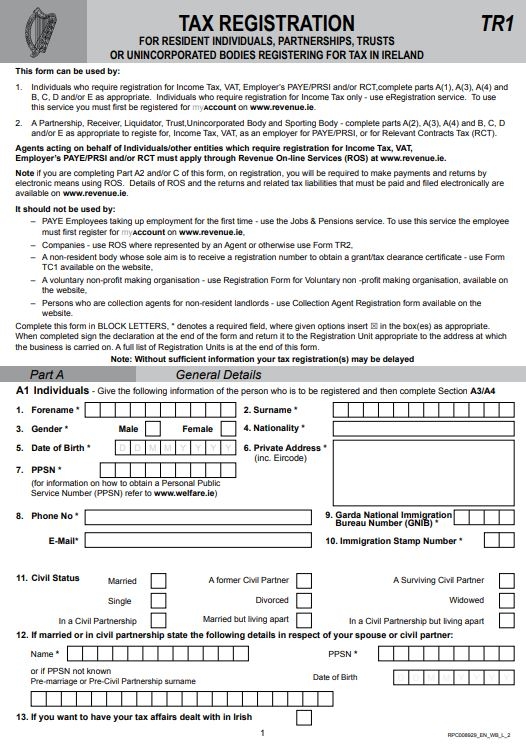

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Sri Lanka Government Gazette 2020 August 7,

- Https Www2 Deloitte Com Content Dam Deloitte Id Documents Tax Id Tax Indonesian Tax Guide 2019 2020 En Pdf Sri Lanka Government Gazette 2020 August 7,

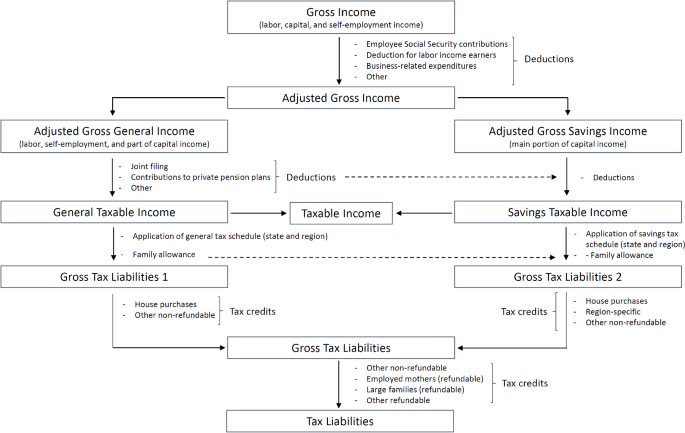

- The Spanish Personal Income Tax Facts And Parametric Estimates Springerlink Sri Lanka Government Gazette 2020 August 7,

- Home Office Deductions For Self Employed And Employed Taxpayers 2020 Turbotax Canada Tips Sri Lanka Government Gazette 2020 August 7,