Self Employed Tax Allowance 201920, What Is Tax Allowance For Pensioners Personal Tax Free Allowance 2019 20 Amount Explained Personal Finance Finance Express Co Uk

Self employed tax allowance 201920 Indeed lately is being hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about Self Employed Tax Allowance 201920.

- Limited Company Vs Sole Trader 2019 20 Jf Financial

- Self Employment Page Sole Traders Short Version Freeagent

- Optimum Salary And Dividends 2019 20 Limited Company Directors Jf Financial

- Pttswtiyk0nmsm

- Coronavirus Self Employed Scheme Get The Details Right Accountingweb

- Income Tax And Ni Basics 2020 Clear House Accountants

Find, Read, And Discover Self Employed Tax Allowance 201920, Such Us:

- Tax Allowances A Relief For Many Taxpayers Ionos

- Https Taxvol Org Uk Wp Content Uploads 2019 10 Completing Your Online Tax Return 2020 Pdf

- Your Bullsh T Free Guide To Income Tax In The Uk

- Limited Company Vs Sole Trader 2019 20 Jf Financial

- Tax Rates And Allowances For Small Businesses 2019 20

If you re looking for Self Employed Tax Rates you've reached the perfect place. We have 104 images about self employed tax rates including images, pictures, photos, wallpapers, and more. In these page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

6th april 2019 to 5th april 2020 tax return deadline.

Self employed tax rates. 201920 tax rates for self employed in the uk. Self employed ni rates have been a bit confusing in the past few years as changes were proposed to scrap class 2 ni and subject people only to continue reading self employed ni rates 201920. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year.

Here are self assessment changes tax for 2019 20 tax year. As a self employed person you will usually fall within the self assessment system. However the personal allowance margin for higher earners will be reduced.

2019 20 self employed allowance tax. The previous figure was gbp 11850. Add this to your.

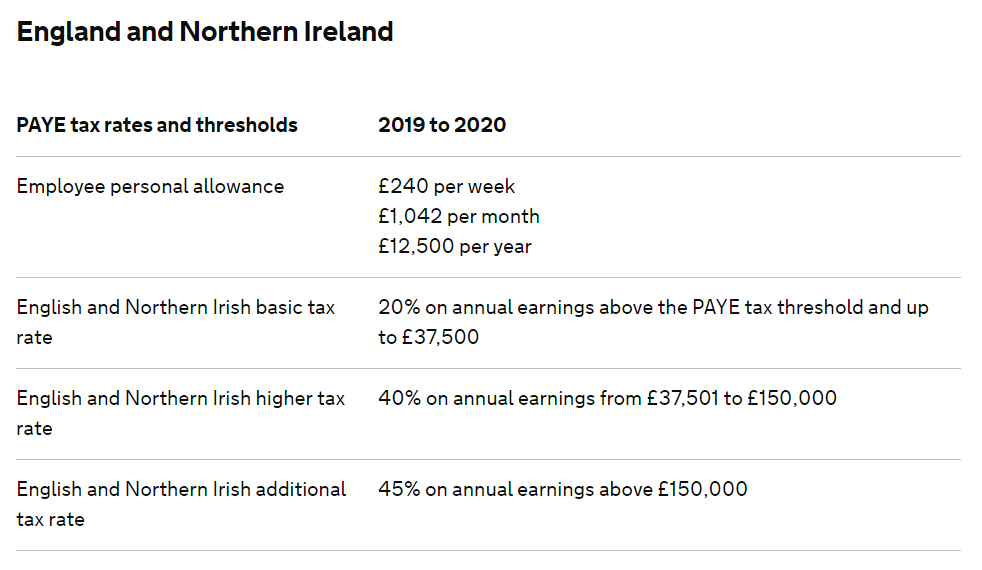

The reduction in income tax for higher rate taxpayers will be offset however by an increase in national insurance rates for the self employed. These figures are mostly taken from the 2018 uk budget published 29 october 2018 and are subject to change. You get 3000 in dividends in the 201920 tax year.

This measure increases the personal allowance to 12500 for 2019 to 2020. Although child benefits are not means tested if you or your partner earns over 50000 you may need to pay a tax charge called the high income child benefit tax charge. The basic rate limit will be increased to 37500 for 2019 to 2020.

Your other taxable income is 35000. The net profit margin or your personal tax free allowance before you become a uk taxpayer rises by 5 to gbp 12500 by 06 th april. This charge claws back child benefits paid at a rate of 1 for every 100 you earn over 50000.

The dividend allowance is 2000 so this means you pay tax on 1000 of your dividends. Band taxable income tax rate. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year.

As a result the higher rate threshold will be 50000 in 2019 to 2020. Although not technically a tax allowance we thought it was worth covering what the rate of national insurance contributions are for self employed people for the tax year 201920. 20 12501 50000 higher tax rate.

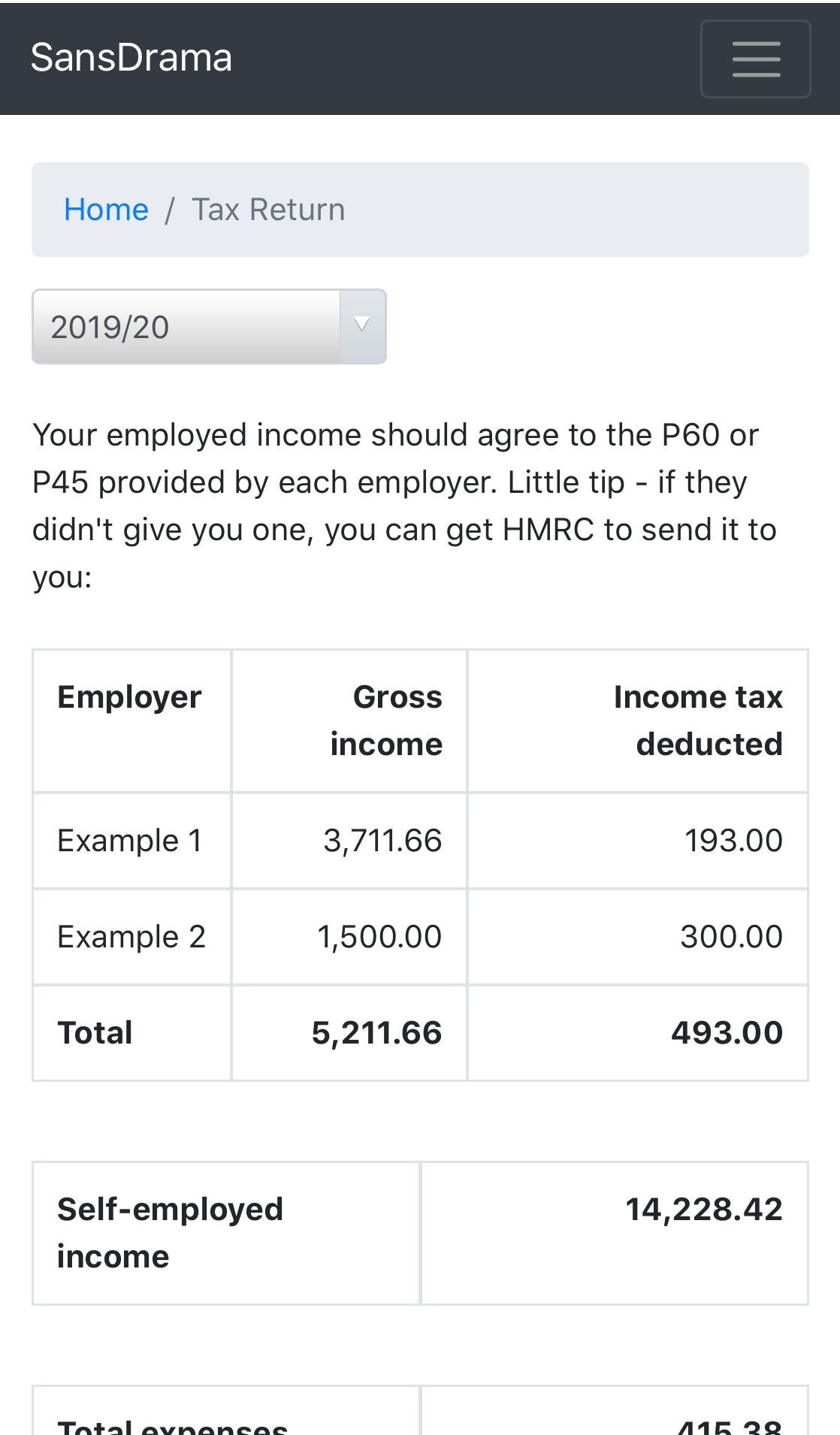

Self employed national insurance hikes. 31st january 2021 personal allowance. Example your turnover is 40000 and you claim 10000 in allowable expenses.

You only pay tax on the remaining 30000 known as your taxable profit.

More From Self Employed Tax Rates

- Self Employed Working From Home Covid

- Government Nursing College Ahmedabad Gujarat

- Government Job Vacancies 2020

- Local Government Bodies In Tamil Nadu

- Self Employed Scheme Extension Uk

Incoming Search Terms:

- Uk Self Employed Income Tax A Simple Guide Self Employed Scheme Extension Uk,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs91eil9j1fm7hka0is56utybnaxlsl2aatdbjgvy4p6emb Zce Usqp Cau Self Employed Scheme Extension Uk,

- Do I Need To Complete A Tax Return Low Incomes Tax Reform Group Self Employed Scheme Extension Uk,

- Sansdrama Self Employed Scheme Extension Uk,

- Limited Company Vs Sole Trader 2019 20 Jf Financial Self Employed Scheme Extension Uk,

- Self Employment Page Sole Traders Short Version Freeagent Self Employed Scheme Extension Uk,