Self Employed Tax Rates, Self Employed 401k Top Car Release 2020

Self employed tax rates Indeed recently is being hunted by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Self Employed Tax Rates.

- How To File Taxes As A Freelancer Chime

- Presented By Xtrategy Ltd Ppt Download

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Iv Probit Estimation Of The Probability Of Becoming Self Employed Using Download Table

- Self Employment Tax What Is The Self Employment Tax Community Tax

- Self Employed In Ireland A Guide To Your Taxes Part 2

Find, Read, And Discover Self Employed Tax Rates, Such Us:

- 4 Reducing The Personal Tax Burden Pocket Dentistry

- Listentotaxman Mobile Uk Salary Tax Calculator 2020 2021 Hmrc

- How To File Taxes As A Freelancer Chime

- Ppt An Introduction To Taxation Powerpoint Presentation Free Download Id 527899

- A Penny Saved Is Nearly Two Pennies Earned Provident Planning

If you are looking for Federal Government Meaning In Hindi you've come to the right place. We have 104 graphics about federal government meaning in hindi including images, photos, photographs, backgrounds, and much more. In these page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year.

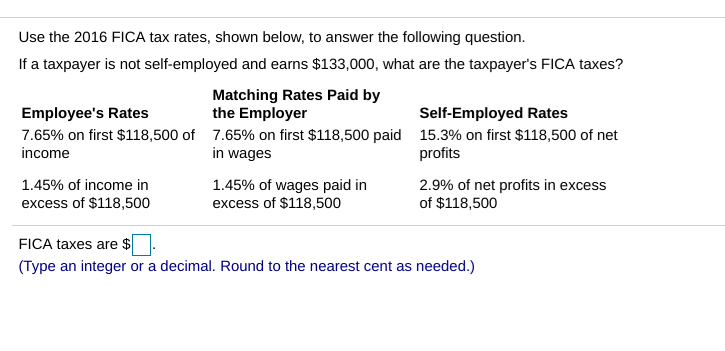

Federal government meaning in hindi. 29467 plus 37 cents for each 1 over 120000. 5092 plus 325 cents for each 1 over 45000. You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly.

And the self employment tax rate is 124 for social security on the first 132900 of net income or earnings anything above that amount is not taxed plus an additional 29 on the net earnings. In the 2020 21 tax year self employed and employees pay. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees.

51667 plus 45 cents for each 1 over. All money you earn in the business goes towards your total income earned on line 15000. What this means is that the income tax rates for sole proprietors are the same as for individuals.

Brackets are assigned based on taxable income and applied at each bracket. If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. This means that self employed people pay a total of 11 usc on any income over 100000.

An extra charge of 3 applies to any self employed income over 100000 regardless of age. Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in. Universal social charge prsi and vat.

Resident tax rates 202021. 0 on the first 12500 you earn. The table shows the tax rates you pay in each band if you have a standard personal allowance of 12500.

That rate is the sum of a 124 social security tax and a 29 medicare tax on net. When you are self employed as a sole proprietorship there is actually no difference between you and your business as far as the cra is concerned. You can use our 2020 21 income tax calculator to find out how much youll pay.

As noted the self employment tax rate is 153 of net earnings. The irs states that the self employment tax 2019 rate is 153 percent on the first 132900 of net income plus 29 percent on the net income in excess of 132900. 19 cents for each 1 over 18200.

Income tax rates and bands. Tax on this income. The self employment tax rate for 2019 and 2020.

Business and self employed childcare and parenting. Tax rates for self employed canadians.

More From Federal Government Meaning In Hindi

- Self Employed Income Support Grant Application

- Government Budget Graph

- Government

- Government Universities In Lahore For D Pharmacy

- Furlough Scheme End Date Scotland

Incoming Search Terms:

- How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub Furlough Scheme End Date Scotland,

- Tax Calculations And Tax Year Overviews For Self Employed Mortgages Amortgagenow Furlough Scheme End Date Scotland,

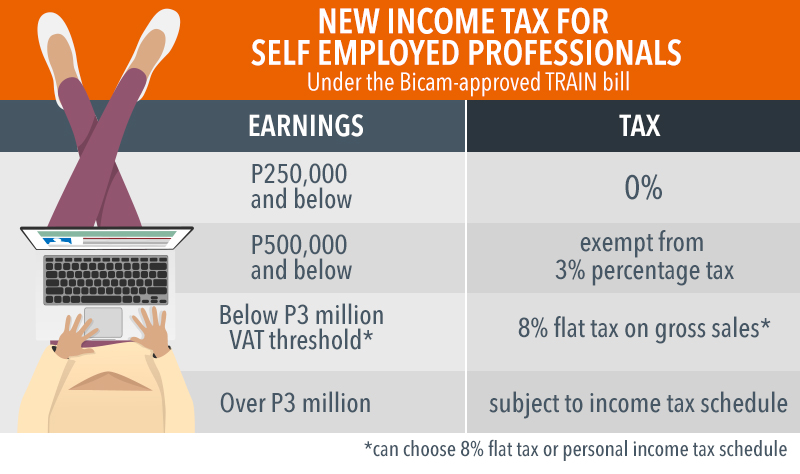

- How To Compute Income Tax In The Philippines Single Proprietorship Business Tips Philippines Furlough Scheme End Date Scotland,

- Summary Of Recent Research On Entrepreneurship And Taxes Download Table Furlough Scheme End Date Scotland,

- Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips Furlough Scheme End Date Scotland,

- Philippine Tax Code Amendments Passed Zico Furlough Scheme End Date Scotland,