Self Employed Tax Allowance 202021, Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqt8vdwgoc0a1gmyk3yfiwn 5bzyp2too6s1s7ocoo1viqrvqsi Usqp Cau

Self employed tax allowance 202021 Indeed recently is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of the article I will talk about about Self Employed Tax Allowance 202021.

- What S New For The 2020 2021 Tax Year How Does It Affect You

- Budget 2020 National Insurance Tax Boost Which News

- 2019 20 Tax Rates And Allowances Boox

- Https Www Oecd Org Ctp Tax Policy Personal Income Tax Rates Explanatory Annex Pdf

- Self Employed Ni Rates 2019 20 Uk Tax Allowances

- Budget 2020 National Insurance Threshold To Rise From April Financial Times

Find, Read, And Discover Self Employed Tax Allowance 202021, Such Us:

- Employed And Self Employed Tax Calculator Taxscouts

- Personal Tax Allowance What Is The Personal Tax Allowance 2020 Personal Finance Finance Express Co Uk

- Rates Thresholds 2020 21 Brightpay Documentation

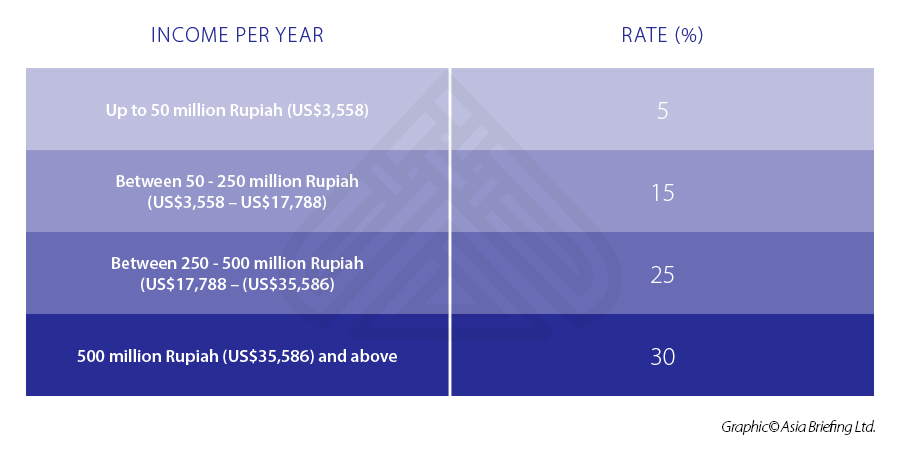

- Personal Income Tax In Indonesia For Expatriate Workers Explained

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

If you re searching for Up Government Logo Png you've reached the ideal place. We ve got 104 images about up government logo png including images, photos, pictures, wallpapers, and much more. In such page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

This is to give you the opportunity to apply for the self employed income support scheme.

Up government logo png. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year. Inheritance tax increase 202021 march 30 2020. Band taxable income tax rate.

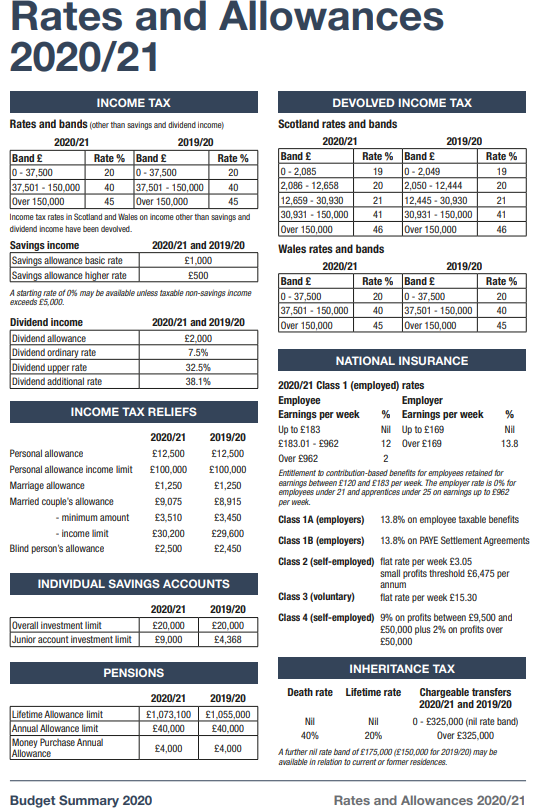

And while the income tax brackets and personal tax allowance wont be changing in 202021 chancellor rishi sunaks highly anticipated budget speech on 11 march had good news for both the employed and self employed. The national insurance threshold has increased to 9500 up from 8632 in 2019 20. Uk tax rates for employers small businesses and the self employed in 202021.

Self employed national insurance threshold rise. Your personal tax allowance is how much income youre allowed to earn before you start paying tax on it. 40 50001 150000 personal savings allowance.

The new tax year in the uk starts on 6 april 2020. 6th april 2020 to 5th april 2021. The government says this works out on average as a 78 cut in self employed tax.

Both employed workers and self employed workers who pay class 4 contributions will be able to earn up to 9500 in 2020 21 up from 8632 in 2019 20 before they have to pay. 202021 personal allowance november 6 2020. 20 12501 50000 higher tax rate.

202021 tax rates for self employed in the uk. Amid the uncertainty caused by covid 19 freelancers contractors and the uks wider self employed population could be forgiven for overlooking the significance of 6th april and what was the beginning of the 202021 tax year. Self employed ni rates 201920 april 6 2019.

2020 21 tax cut as national insurance threshold rises. 1000 visit this page. A guide to tax changes impacting freelancers contractors and the self employed.

The personal allowance tax threshold for 202021 is 12500. Is the seiss payment taxable. 1000 visit this page trading allowance.

Heres what you need to know about the 202021 income tax rates and a rundown of how new budget measures will affect your. Landlords tax rates and allowances for 2021 updated 290620 tax rates and allowances relevant to landlords for 202021 self employed expenses made simple 290620 this guide explains what expenses can be used to reduce your tax bill. Changes to rent a room rules march 20 2019.

More From Up Government Logo Png

- Self Employed Sign In

- Self Employed Mortgage Requirements

- Government Issued Identification Number Texas

- Self Employed Tax Rates Malta

- Self Employed Workers

Incoming Search Terms:

- Income Tax Deductions List Fy 2019 20 How To Save Tax For Ay 20 21 Self Employed Workers,

- Decoding Your Tax Code Royal London Self Employed Workers,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctjchivpxsgityvdude I8wnqah0beborzudgrkjqr8bh4ayiwb Usqp Cau Self Employed Workers,

- Covid 19 Personal Tax Self Assessment French Duncan Professional Chartered Accountants Self Employed Workers,

- What Is The Trading Allowance Low Incomes Tax Reform Group Self Employed Workers,

- Uk Income Tax Rates And Bands 2020 21 Freeagent Self Employed Workers,