Self Employed Tax Allowance Working From Home, Taxes Vpns And Office Hours The Ultimate Forbes Guide To Working From Home

Self employed tax allowance working from home Indeed recently has been sought by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of this post I will talk about about Self Employed Tax Allowance Working From Home.

- Working From Home Tax Deductions Covid 19

- Working From Home How To Cut Your Tax Bill Bbc News

- Do You Qualify For A Home Office Tax Deduction While Working At Home

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart

- Rishi Sunak Urged To Introduce Tax Breaks For People Working From Home

- Supporting People And Companies To Deal With The Covid 19 Virus Options For An Immediate Employment And Social Policy Response

Find, Read, And Discover Self Employed Tax Allowance Working From Home, Such Us:

- Simplified Expenses A Guide For The Self Employed

- Working From Home How To Cut Your Tax Bill Bbc News

- Self Employed Working From Home Jf Financial

- How To Claim The Use Of Home As Office Allowance Go Self Employed Business Tax Deductions Home Office Expenses Small Business Tax

- How To Claim 120 In Tax Relief For Working From Home For Just One Day

If you are looking for Government Employee Id Government Of Gujarat Identity Card you've come to the right location. We have 100 graphics about government employee id government of gujarat identity card including pictures, pictures, photos, wallpapers, and much more. In such page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Guide To Home Office Tax Deduction Taxes Us News Government Employee Id Government Of Gujarat Identity Card

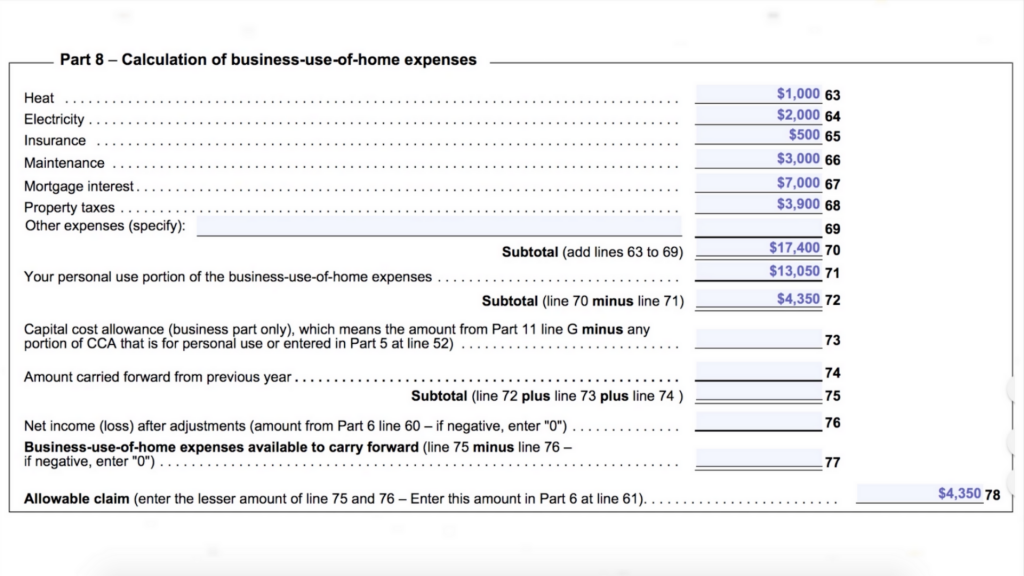

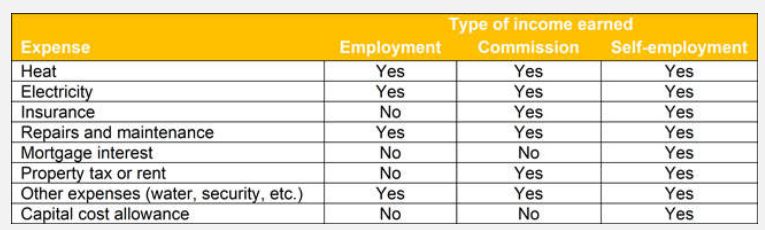

If you are self employed and work from home understanding and calculating the expenses youre allowed to claim can be a murky area.

Government employee id government of gujarat identity card. A taxpayer working 180 days in total during the year of which 90 days are from home can claim expenses of 1750 on electricity and heat and 430 on broadband. Working from home govuk skip to main content. Due to covid 19 many employees are now working from home.

Check if you can claim previous. For example if you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 120 per week in tax relief 20 of 6. Use a simpler calculation to work out income tax for your vehicle home and business premises expenses simplified expenses if youre self employed.

If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10. If you are working from home for your employer you may be entitled to claim the working from home allowance. Working from home allowances for the self employed updated for 2021 this article was published on 03082020 self employed guide to claiming allowances for working at home.

Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. Working from home allowances for the self employed this article was published on 14122017 if you work from home understanding and calculating the expenses you claim can be a murky area. Capital gains tax cgt your employee might use part of their home for eworking.

Note this article is regarding employees working from home and is very different to allowances for the self employed who work from home. In some instances your employer may provide a special allowance to cover the costs of thisyour employer will need to determine if this allowance is taxable or not. At 312 a year tax free it is worth finding out if you qualify.

Covid 19 employment allowances and reimbursements however in many cases you will be expected to bear these additional costs. Local property tax lpt your eworking employee will not receive a reduction on lpt due if they use a room in their home to carry out work related activities. The home office allowance is a simple tax free allowance that you can claim if youre self employed and working from home.

What Are Payments On Account For The Self Employed Do I Pay Them Government Employee Id Government Of Gujarat Identity Card

More From Government Employee Id Government Of Gujarat Identity Card

- Is The Furlough Scheme Changing To 60

- What Is Being Furloughed From A Job Mean

- Government Guidelines Covid 19 Update

- Top 10 Government Jobs In India

- Government Projects Examples

Incoming Search Terms:

- Self Employed Expenses Which Allowable Expenses Can I Claim With List Government Projects Examples,

- Sole Trader Tax A Guide For Start Ups The Newly Self Employed Bytestart Government Projects Examples,

- Home Expenses To Claim When You Re Self Employed Faqs Money Donut Government Projects Examples,

- Work From Home Tax Deduction Only Applies To Self Employed Workers Business Insider Government Projects Examples,

- Tax Tips For Employees Who Work At Home Turbotax Tax Tips Videos Government Projects Examples,

- Home Office Tax Write Off Prerequisites And Tips Ionos Government Projects Examples,