Self Employed Vat Rate Ireland, Oecd Tax Database Oecd

Self employed vat rate ireland Indeed lately is being sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Self Employed Vat Rate Ireland.

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Taxation In The Republic Of Ireland Wikipedia

- Vat Advice For Amazon Sellers In The Uk

- Self Employed Tax Changes In April 2018 Explained Which News

- Self Employed Tax As A Freelancer In The Uk Expatica

- Freelance Tax In Luxembourg For The Self Employed Expatica

Find, Read, And Discover Self Employed Vat Rate Ireland, Such Us:

- 2019 20 Tax Rates And Allowances Boox

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Self Employed Hmrc Tax Help How Workers Can Spread Out Tax Bills With Rishi Sunak S Time To Pay Scheme

- Vat Between The Uk And Belgium Vat Uk And Belgium Accotax

- Foreign Self Employment Tax Guidance Tolley

If you re looking for What Is Furlough Grant you've reached the ideal location. We ve got 104 images about what is furlough grant adding images, photos, photographs, wallpapers, and much more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

You need to register for vat if your company sells services and your sales are over 37500 in a year.

What is furlough grant. This measure will also be applied for the 2020 tax year. This one page guide guide covers the tax codes and legislation which affect how self employed are taxed in ireland. If you sell goods then the limit is 75000.

Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. If youre self employed or receive income from non paye sources you must register for self assessmentself assessment is where you calculate the income tax you owe for the tax year yourself and it needs to be done every year when you file your tax returns. Self employment tax rates 2018.

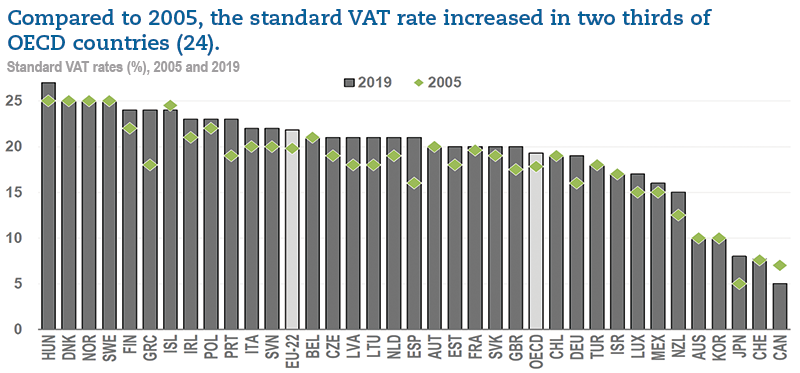

80000 minus 11220 equals 68780. Michael can reduce his turnover figure by the 11220 when determining whether he has breached the threshold. The rates of vat are the standard rate 23 or reduced rates 9 and 135 and.

An extra charge of 3 applies to any self employed income over 100000 regardless of age. It was announced in budget 2021 that the earned income tax credit for the self employed will increase from 1500 to 1650. There have been a few temporary changes to vat rates in 2020 to try and help businesses affected by covid 19 these are the current vat rates in ireland that are in place for 2020.

Certain items are charged at lower rates for example childrens clothing is charged at the rate of 0 whereas household fuel for example gas and electricity is charged at the reduced rate of 5. The standard rate of vat is 20. When do i need to register for vat as self employed.

Much of the process of preparing for self employment is about starting a business. It is brought to you by liam burns a chartered tax adviser with the irish taxation institute and principal of liam burns and co accountants. Its possible to file a tax return for example form 11 or form 12 yourself through revenue online service ros.

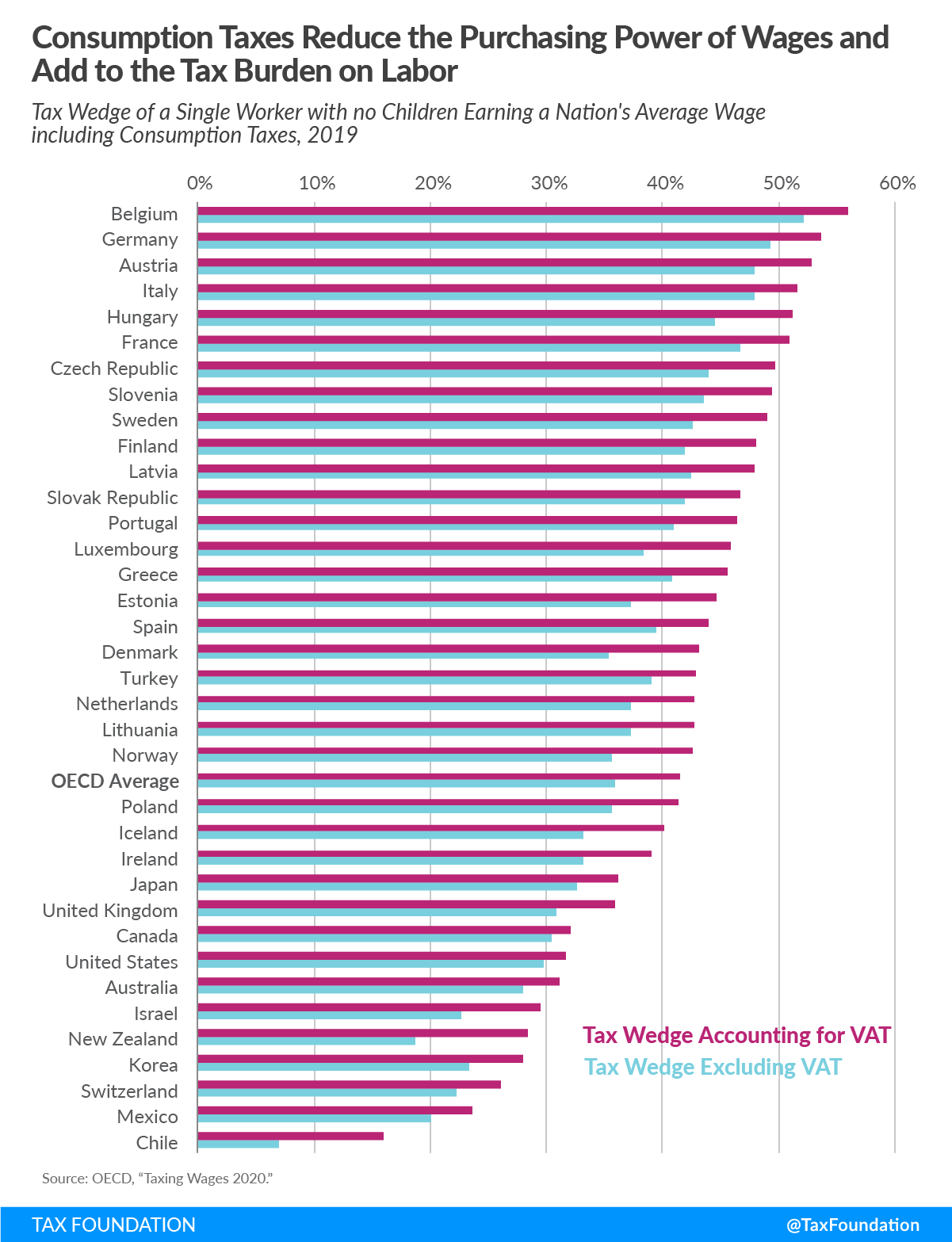

Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year. Universal social charge prsi and vat. Below is a table which includes a brief summary of the main vat schemes that self employed businesses choose.

Vat is charged at different rates for various goods and services. Newly built where the construction is subject to value added tax vat in ireland. This means that self employed people pay a total of 11 usc on any income over 100000.

Guide to 10 tax deductions for the self employed in ireland. He has incurred vat on his stock purchased for re sale in the amount of 11220. Value added tax vat is a tax charged on the sale of most goods and services in ireland.

More From What Is Furlough Grant

- Party Whips Government

- When Does The New Furlough Scheme Start

- Functions Of Local Government In Zambia

- Karnataka State Government Holidays 2020

- Government Types Of Democracy

Incoming Search Terms:

- Guide To Self Employment In Ireland 2019 Government Types Of Democracy,

- Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained Government Types Of Democracy,

- Https Www Grantthornton Ie Globalassets 1 Member Firms Ireland Insights Factsheets Grant Thornton Tax Risks And Opportunities Jan 2014 Pdf Government Types Of Democracy,

- Are You In Low Paid Self Employment And Considering Becoming Vat Registered Low Incomes Tax Reform Group Government Types Of Democracy,

- The Latest Tax Policy Reforms Tax Policy Reforms 2019 Oecd And Selected Partner Economies Oecd Ilibrary Government Types Of Democracy,

- Hmrc Changes To Self Employed Taxes In 2020 21 Which News Government Types Of Democracy,