Government Tax Revenue Econ Graph, Who Pays Income Taxes Average Federal Income Tax Rates 2017

Government tax revenue econ graph Indeed lately has been hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this article I will discuss about Government Tax Revenue Econ Graph.

- It S Not Only You Falling Taxes Mean Modi Government Too Is Feeling The Slowdown Pinch

- At A Glance Treasury Gov Au

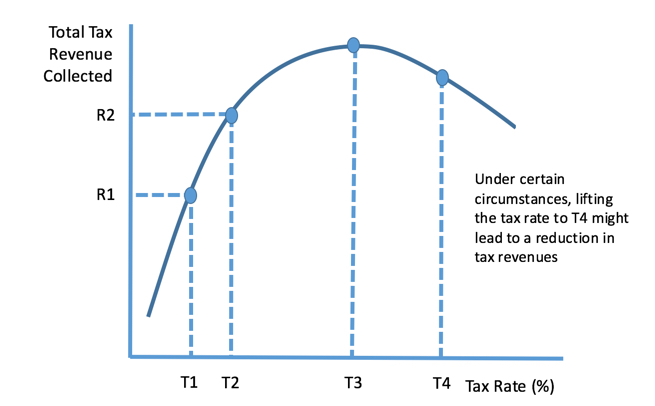

- Laffer Curve Economics Tutor2u

- Government Revenue Since The Recent Tax Reform The Big Picture

- Total Tax Revenues Government Spending And Gross Public Debt As A Download Scientific Diagram

- Sources Of Government Revenue In The Oecd 2014 Tax Foundation

Find, Read, And Discover Government Tax Revenue Econ Graph, Such Us:

- Per Unit Tax Graph Ap Microeconomics Youtube

- What Are The Sources Of Revenue For The Federal Government Tax Policy Center

- How Do Us Taxes Compare Internationally Tax Policy Center

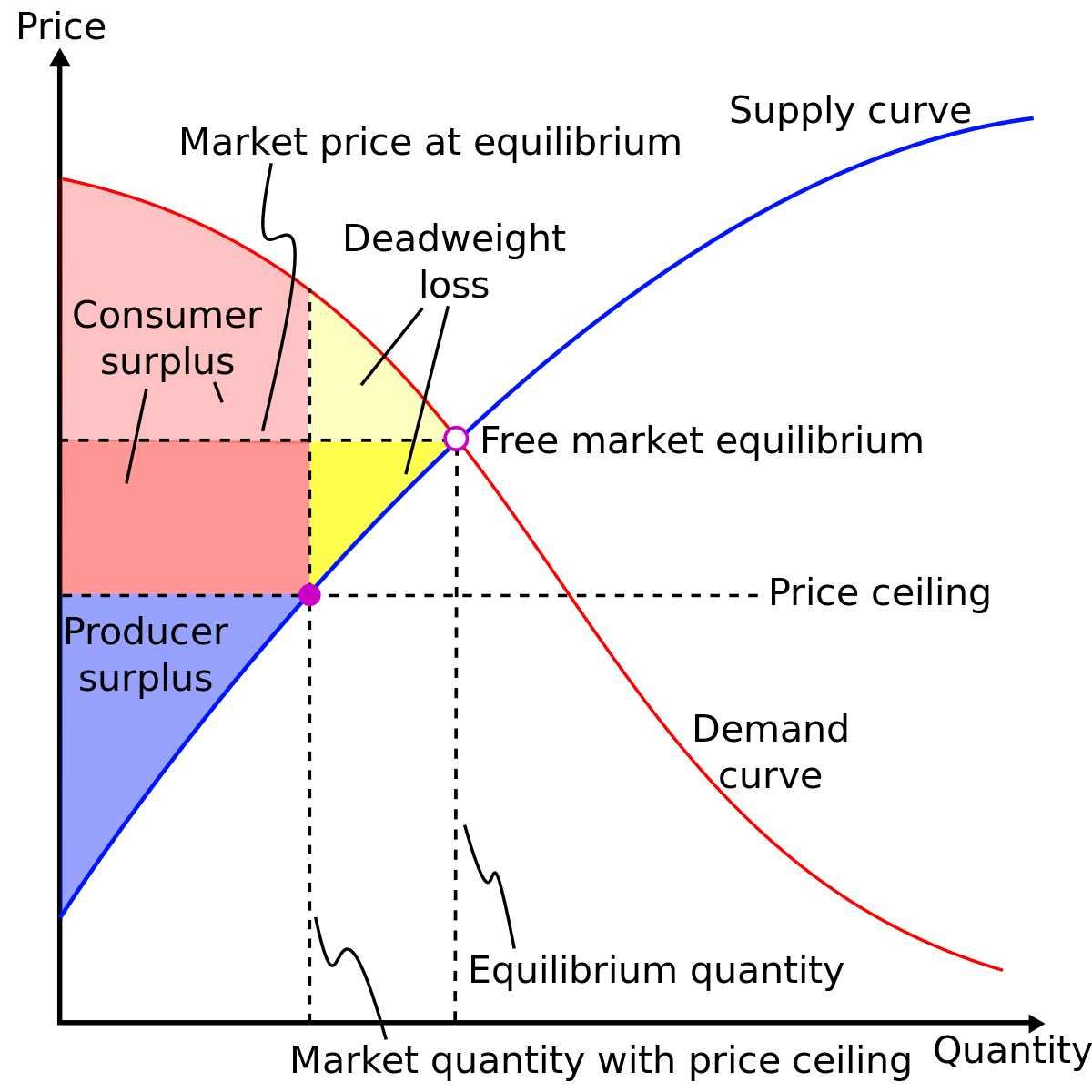

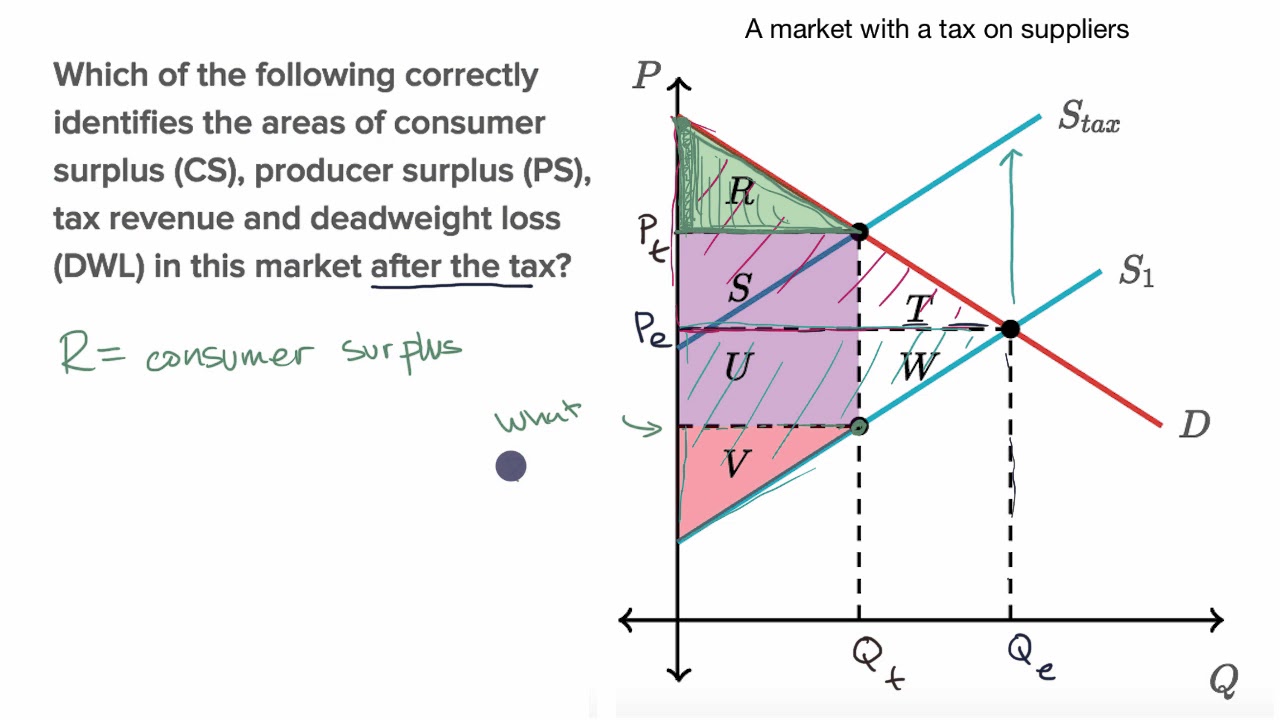

- Deadweight Loss Intelligent Economist

- Government Revenue Since The Recent Tax Reform The Big Picture

If you are looking for Best Government Law Colleges In Delhi you've arrived at the perfect place. We have 104 images about best government law colleges in delhi adding images, photos, photographs, backgrounds, and more. In such page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

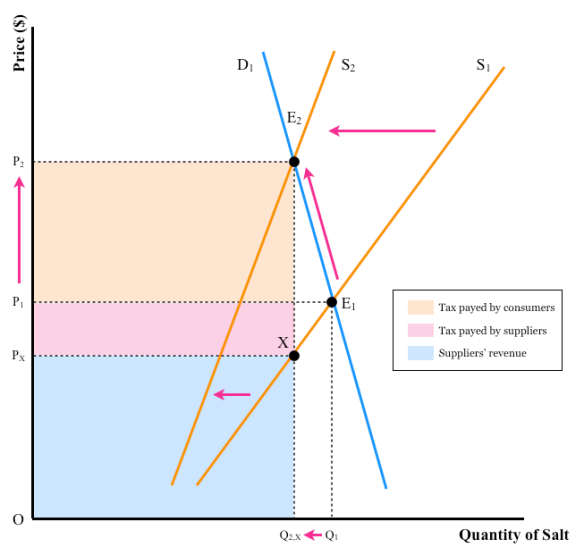

How to graph a per unit tax and its effects in ap microeconomics.

Best government law colleges in delhi. Most of it is paid either through income taxes or payroll taxes. Assume that the tax on beer is 20 per unit a unit is a carton of drinks assume the demand and supply functions for cartons of beers per week are. Raise revenue for the government.

In the uk the basic rate of income tax is 20. Determinants of price elasticity and the total revenue rule our mission is to provide a free world class education to anyone anywhere. Income tax is a levy on income earned.

Government revenues in the united kingdom is expected to be 3387000 gbp million by the end of this quarter according to trading economics global macro models and analysts expectations. Looking forward we estimate government revenues in the united kingdom to stand at 3820000 in 12 months time. Generate tax revenue for a government.

Federal tax revenue is the total tax receipts received by the federal government each year. This is the imposed tax per gallon of gas. Calculate the amount of tax revenue collected by the government and the distribution of tax payments between buyers and.

Australian government has imposed a tax on beer. Indirect taxes are those imposed by a government on goods and services in contrast to direct taxes such as income and corporation tax which are levied on incomes of households and firms. In fiscal year fy 2021 income taxes will account for 50 payroll taxes make up 36 and corporate taxes supply 7.

The main purpose of tax is to raise income for the government which can lead to higher spending on health care and education. The purpose of indirect taxes is to. P200 05q and p05q.

If there is an increase in income tax what impact does it have. The government would rather place indirect taxes on commodities where demand is inelastic because the tax causes only a small fall in the quantity consumed and as a result the total revenue from taxes will be greateran example of this is the high level of duty on cigarettes and petrol. Khan academy is a 501c3 nonprofit organization.

Write your answer at the bottom of the page and identify the specific color used to show total tax revenue. Indirect taxes are also called expenditure taxes. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes.

Total tax revenue as a percentage of gdp indicates the share of a countrys output that is collected by the.

More From Best Government Law Colleges In Delhi

- Self Employed Furlough Payment Application

- When Does The Furlough Scheme End In Northern Ireland

- Government Quota In Private Medical Colleges In Tamilnadu 2020

- Government Guidelines For Covid 19 Patients

- Government Budget Deficit Definition Economics

Incoming Search Terms:

- Deadweight Loss Examples How To Calculate Deadweight Loss Government Budget Deficit Definition Economics,

- Chapter 5 Econ Vineet S Blog Government Budget Deficit Definition Economics,

- Tax Rates Vs Tax Revenues Mercatus Center Government Budget Deficit Definition Economics,

- Deadweight Loss Wikipedia Government Budget Deficit Definition Economics,

- Laffer Curve Wikipedia Government Budget Deficit Definition Economics,

- Economics In Plain English Economic Arguments For And Against A Carbon Tax Government Budget Deficit Definition Economics,