Self Employed Bank Account Uk, Covid 19 Government Responds To Open Letter For Temporary Income Protection Fund For The Uk S Self Employed Design Council

Self employed bank account uk Indeed lately has been hunted by consumers around us, maybe one of you. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this article I will talk about about Self Employed Bank Account Uk.

- Coronavirus Uk Government Unveils Aid For Self Employed Bbc News

- Covid 19 Government Responds To Open Letter For Temporary Income Protection Fund For The Uk S Self Employed Design Council

- Opening A Uk Business Bank Account As A Non Resident

- How The Self Employed Will Drive The Future Of Banking In The Uk Future Of Banking And Fintech

- Add A New Business Help Center

- How To Open A Self Employed Business Bank Account Goselfemployed Co

Find, Read, And Discover Self Employed Bank Account Uk, Such Us:

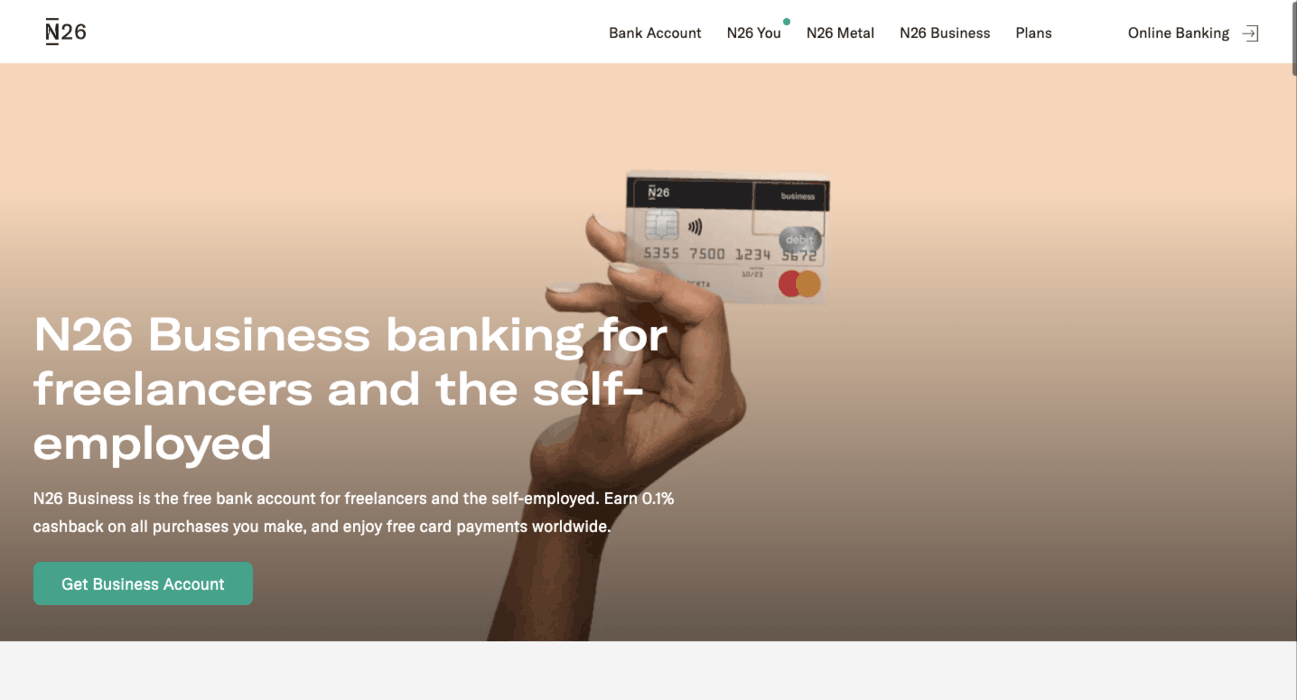

- N26 Business Banking 2020 Reviews Fees Charges

- Self Employed Invoice Template Free Download Send In Minutes

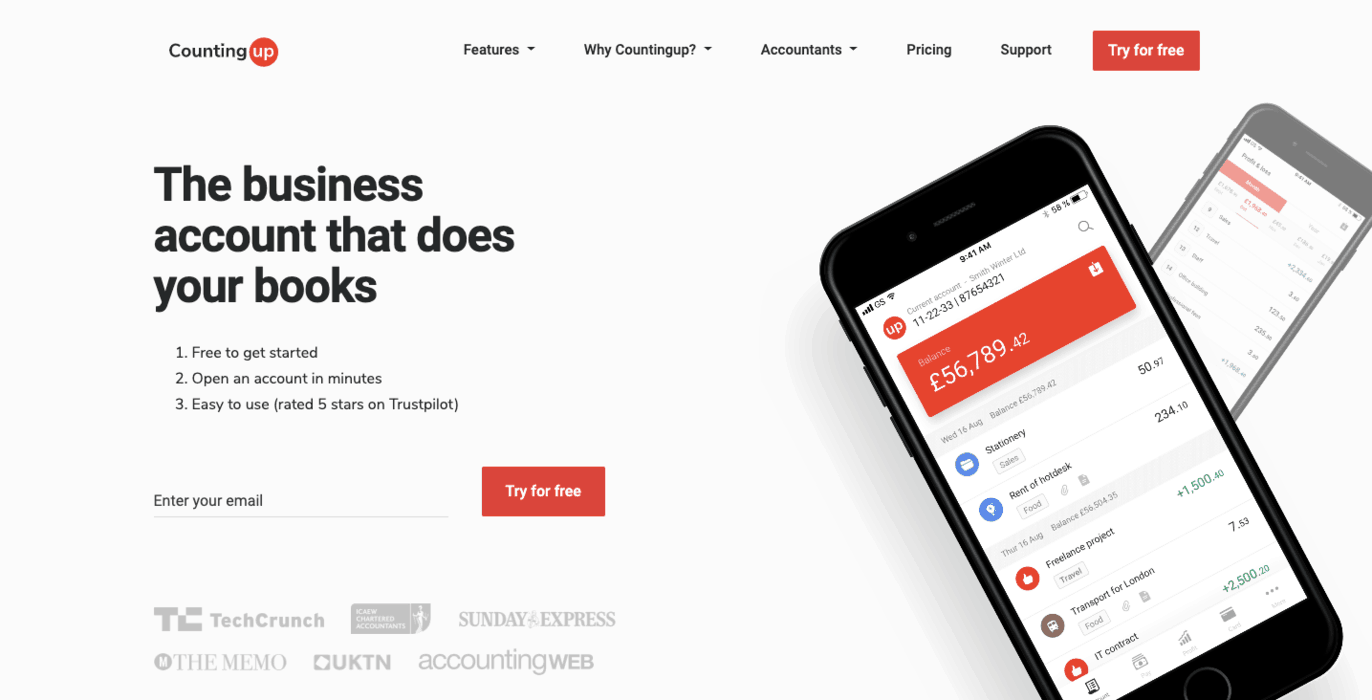

- Uk Challenger Business Bank Accounts Are Changing How Self Employed Individuals Do Their Banking But Is It Real In 2020 Business Bank Account Bank Account Banking App

- Self Employed Have One Week Left To Apply For Seiss Government Grant Of Up To 6 750 How To Apply

- Liquidate Your Limited Company

If you are looking for Self Employed Health Insurance Deduction Worksheet Instructions you've arrived at the right location. We ve got 104 images about self employed health insurance deduction worksheet instructions adding images, pictures, photos, backgrounds, and much more. In such webpage, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Bounce Back Loans Help For Small Businesses And Income Support For Those Missing Out Elsewhere Eg Limited Company Directors And Self Employed Self Employed Health Insurance Deduction Worksheet Instructions

The business account comes with a debit mastercard iban for international transfers and the option to add a euro account for 2 monthly andor us dollar account for 5 monthly.

Self employed health insurance deduction worksheet instructions. Refer a friend new. A self employed business bank account is a business bank account aimed at people who are self employed. Knowyourmoneycouk is a trading style of notice media ltd registered office.

Money can be tight when starting out so its important to get it right if youre self employed the answer is probably. Fee structures for these accounts are typically different than fees for personal accounts so ask about fees for business accounts and describe how you plan to use your account. When it comes to business bank accounts there may also be additional charges applied to different types of payments sending money abroad or even paying cash in.

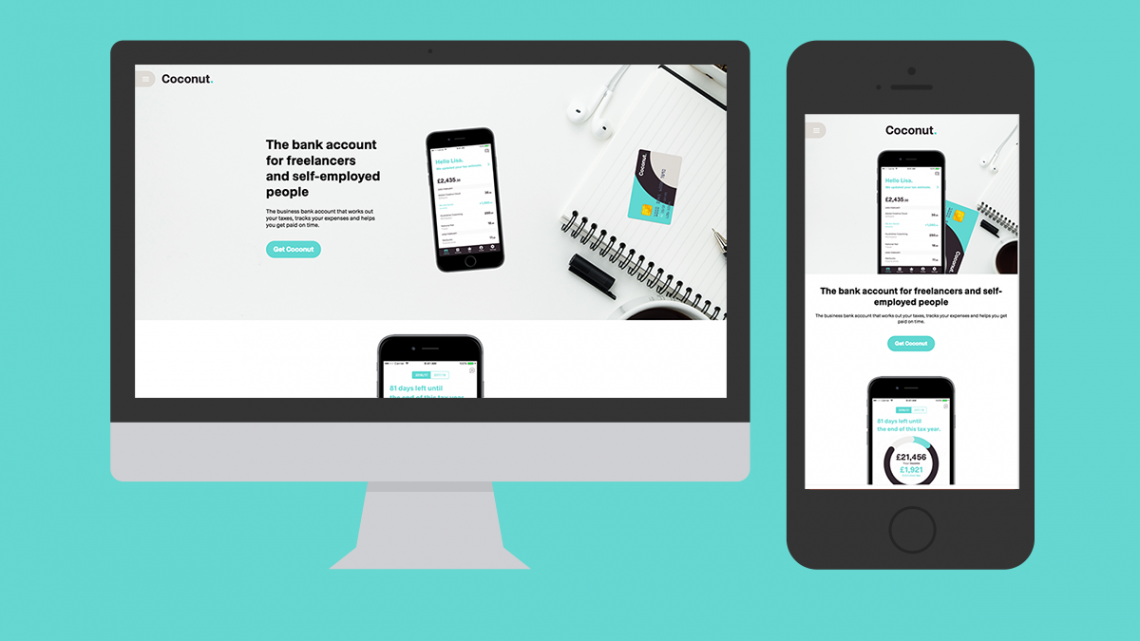

Uk self employed bank accounts often attract monthly charges whereas your personal account may very well be free. According to barclays uk freelancers and sole traders spend 15 days a year sorting business expenses from their personal accounts. This is because in the eyes of the law and for tax purposes your money and the money that belongs to the company are one and the same.

The best way to keep track of your business finance is to open a separate bank account. Floor 3 haldin house old. If you are self employed as a sole trader as opposed to having a limited company then its possible that you can use your personal bank account for business banking you need to check with your bank first to see if you can apply online what your finance options would be etc.

The quicker the process the sooner you can get on with the million and one other crucial tasks you need to tackle. Although it is not necessary it will reduce the risk of errors and make it easier to keep track of the business income and expenditure. Its worth comparing the best bank accounts for the self employed for ease of opening the account and getting started.

One of the most critical things in bookkeeping is getting. How to do accounts for self employed. This means they are not employed by another business instead they either work as a sole trader or have their own limited company through which they are employed.

Where to open bank accounts. This is removed the moment you set up a separate bank account for self employed income. Several banks and credit unions offer affordable accounts for self employed business owners.

It is one of the most advanced online banks in the uk offering different bank accounts including a free sole trader account specifically for self employed people. Us dollar and euro bank accounts currently available for uk businesses. Whether youre self employed or side hustling.

More From Self Employed Health Insurance Deduction Worksheet Instructions

- Us Government Furlough Scheme

- Government Procurement Card

- Government Zoom

- Government Nursing Jobs California

- Government Furlough Scheme Rules August

Incoming Search Terms:

- 2 Government Furlough Scheme Rules August,

- Mortgage Application Proofs Guide Nationwide Government Furlough Scheme Rules August,

- Coconut Smart Accounting For Self Employed People Government Furlough Scheme Rules August,

- Information For Cleaners Government Furlough Scheme Rules August,

- What To Expect As Launch Of Hong Kong Virtual Banks Nears South China Morning Post Government Furlough Scheme Rules August,

- The Business Spreadsheet Template For Self Employed Accounting Worksheet Pdf Maxresde Golagoon Government Furlough Scheme Rules August,