Self Employed Cerb Net Income, How To Apply For The Canada Emergency Response Benefit Cerb

Self employed cerb net income Indeed lately has been hunted by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Cerb Net Income.

- Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

- As Cerb Winds Down Labour Group Asks Liberals To Rethink Ei Abbotsford News

- Apply For Canada Emergency Response Benefit Cerb With Cra Todayville Edmonton

- After Cerb What Comes Next Rcc S Guide To New Income Support Programs Retail Council Of Canada

- Transitioning From Cerb To Ei Could Leave Millions Worse Off Behind The Numbers

- Ckl Small Businesses Sole Proprietors And Self Employed Your Cheat Sheet For Your Eligibility For Government Support The New Cerb Wage Subsidies And 40 000 Line Of Credit

Find, Read, And Discover Self Employed Cerb Net Income, Such Us:

- How To Apply For The 2k Month Cerb And Cerb Extension Savvy New Canadians

- As Cerb Winds Down Labour Group Asks Liberals To Rethink Ei Abbotsford News

- Coronavirus Cerb Payments How Much Who S Eligible How To Apply As Com

- How To Apply For The Canada Emergency Response Benefit Cerb

- Information Guide Employment Insurance And The New Canada Emergency Response Benefit Clas

If you are looking for Us Government Spending Pie Chart 2019 you've arrived at the right location. We ve got 104 graphics about us government spending pie chart 2019 adding images, photos, photographs, wallpapers, and much more. In these page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Covid 19 End Of Cerb And Transition To New Recovery Benefits Haroon Accounting Services Cpa Us Government Spending Pie Chart 2019

Are You Eligible To Qualify For Cerb And How To Apply Trufinancial Consultants Financial Help Cashflow Management Investment Risk Management Markham Gta Mississauga Oakville Us Government Spending Pie Chart 2019

Internet is full of people saying gross and people saying net.

Us government spending pie chart 2019. Sometimes more or less. Am i eligible for the cerb benefit. If the cerb eligibility is net you would not qualify.

The cra has removed this limit. I wonder if i am qualified for cerb. I just need to know if the 5k is gross or net as im close to the line.

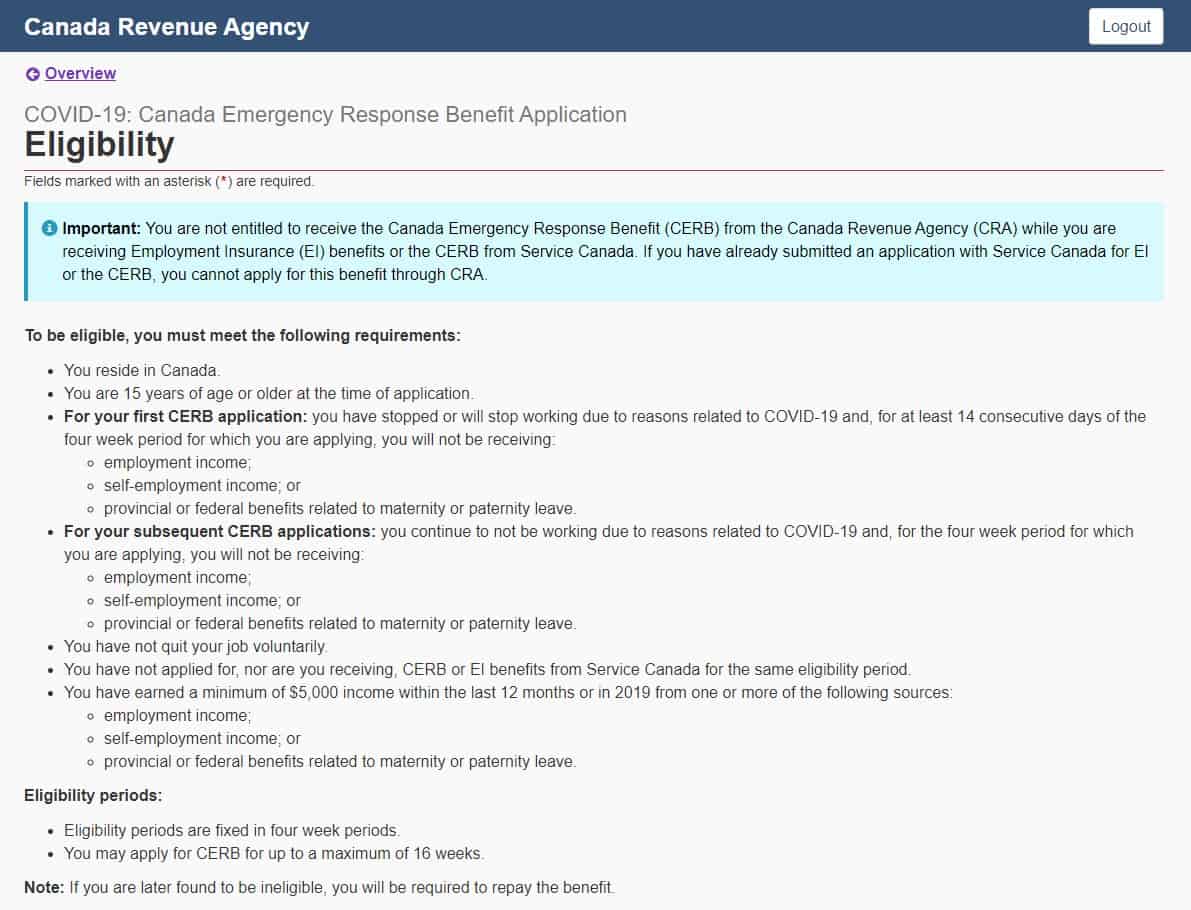

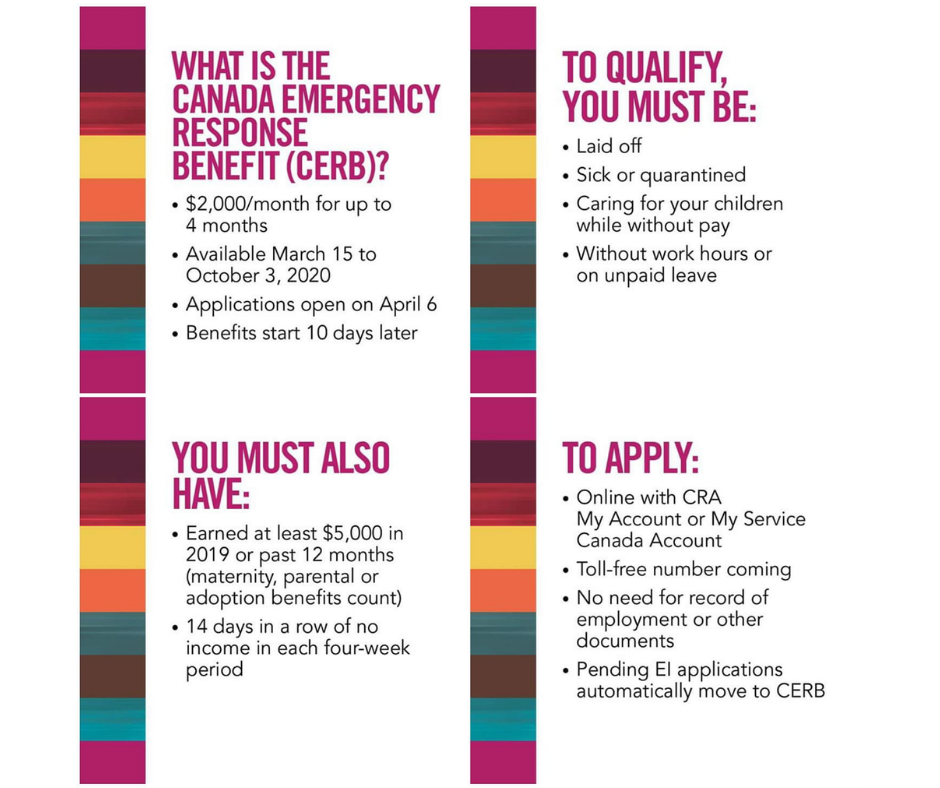

The canada emergency response benefit cerb gives financial support to employed and self employed canadians who are directly affected by covid 19. If you are eligible you can receive 2000 for a 4 week period the same as 500 a week. In order to be eligible for cerb you can have up to 1000 of self employment or employment income during the period of application.

Many self employed try to reduce their tax by having business expenses. I received the email below from one of our grads who said i could share it in case it might help other people who are self employed. If you had say 10000 of gross self employed income and expenses of 6000 youre at 4000.

Individuals can work and earn money while also receiving the crb. However eligible individuals collecting the cerb and receiving 2000 for a 4 week period may earn up to 1000 in employment andor self employment income in each of their benefit periods from march 15 2020 to october 3 2020 while continuing to receive the cerb. I have rental income but after my expenses i only profit about 150 monthly.

I am self employed and earned a few thousands during 14 consecutive days out of the first four week period but after subtracting the expenses i paid during the 14 days my net income is below 1000. If net incomes excluding the crb exceeds 38000 in the calendar year half of every crb payment will need to be repaid. My self employment income has gone to 0 for the foreseeable future.

I filed 2018 and will file 2019. I was wondering if cerbs 5000 2019 income threshold for the self employed is gross or net. Have had employment andor self employment income of at least 5000 in 2019 or in 2020.

The cerb application stated to qualify an individual cannot have earned more than 1000 in employment andor self employment income without specifying if that was gross or net income. Cra guidance was not easy to find but here it is.

More From Us Government Spending Pie Chart 2019

- Government Of India Act 1858 Features

- Furlough Extension Europe

- Majority Party Definition Government

- Furlough Extension For Vulnerable

- Federal Government Budget Pie Chart 2020

Incoming Search Terms:

- Cerb And Other Coronavirus Benefits Won T Last Forever Or Will They What A Universal Basic Income Could Look Like Social Policy In Ontario Federal Government Budget Pie Chart 2020,

- Trudeau Promises More Canadians Will Be Covered By Covid 19 Emergency Benefit Cbc News Federal Government Budget Pie Chart 2020,

- Covid 19 Ei Benefits And Cerb Updates Q A From Social Media Askross Federal Government Budget Pie Chart 2020,

- Blog Samuel J Esaw Federal Government Budget Pie Chart 2020,

- Brandon Friendship Centre Gambar Facebook Federal Government Budget Pie Chart 2020,

- New Rules For Cerb Federal Government Budget Pie Chart 2020,