Self Employed Form, Self Employed Taxpayers How To Avoid A Large Irs Bill Ils

Self employed form Indeed lately has been hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this article I will discuss about Self Employed Form.

- Example 1040 Form Filled Out Unique Self Employed Tax Return Form Example Unique Tax Return Spreadsheet Models Form Ideas

- 2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas

- Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf

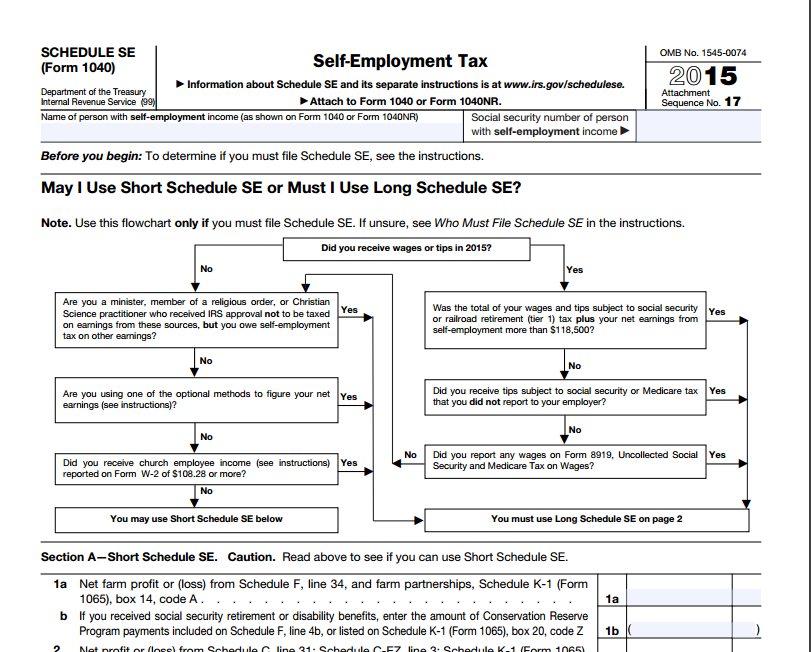

- How To Fill Out Schedule Se Irs Form 1040 Youtube

- Pin On Freight Broker Business

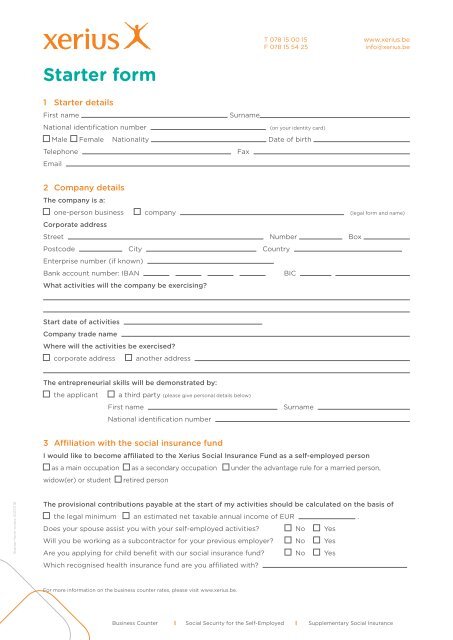

- Apply Self Employed Website Pdf Permanent Residence United States Travel Visa

Find, Read, And Discover Self Employed Form, Such Us:

- How To Register As A Self Employed Person In Singapore Lancerx

- 免费self Employment Profit And Loss Statement Form 样本文件在allbusinesstemplates Com

- Independent Sales Advisor Self Employment Guide

- I Have An Idea For Self Employment But I Still Live At Home With My Parents How Will I Handle Taxes Quora

- Self Employment Ledger

If you are looking for Australian Government Budget 2020 21 Immigration you've reached the ideal place. We ve got 104 graphics about australian government budget 2020 21 immigration adding images, photos, pictures, wallpapers, and more. In these webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Freelance Writer Taxes Self Employment Tax Arcticllama Com Australian Government Budget 2020 21 Immigration

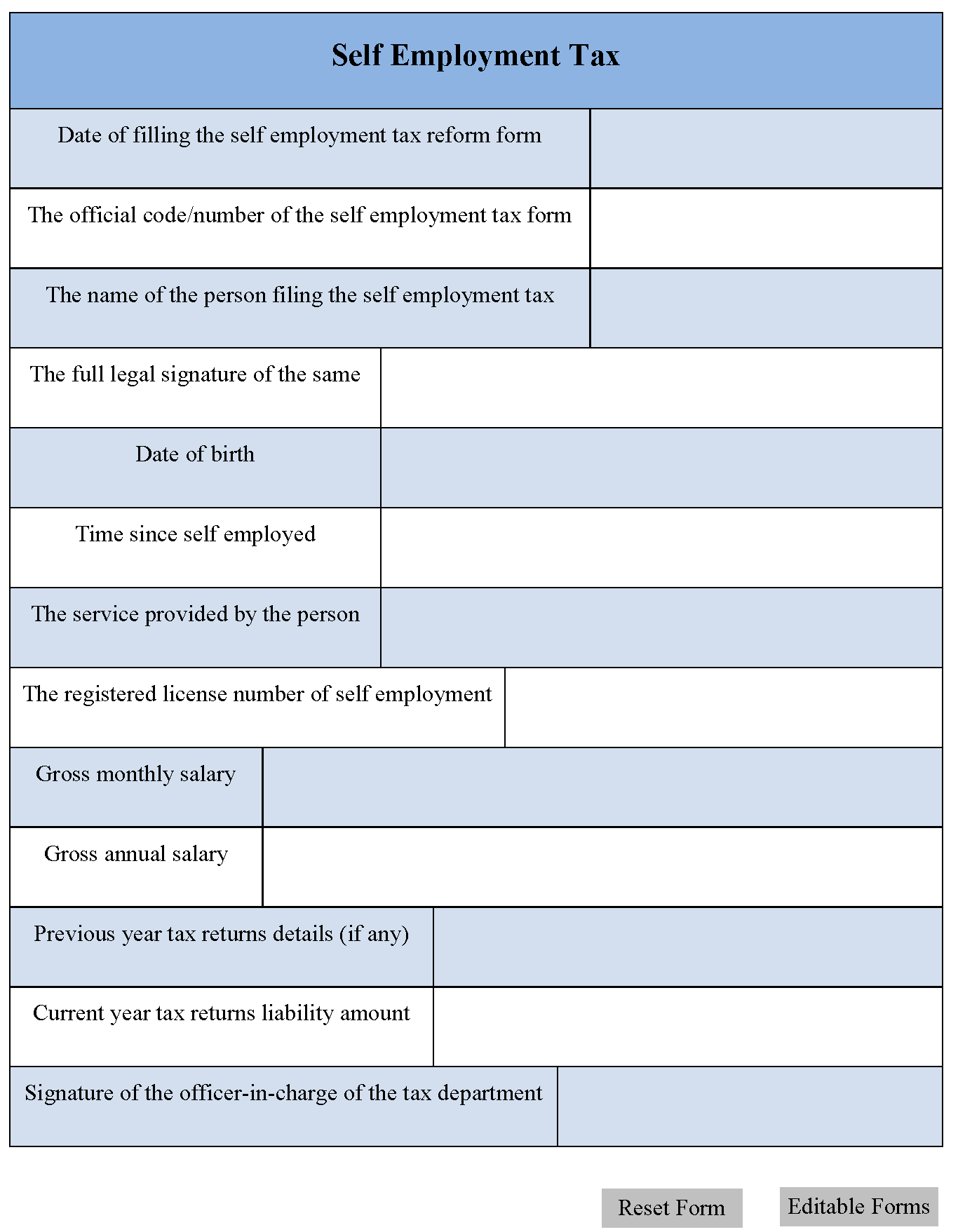

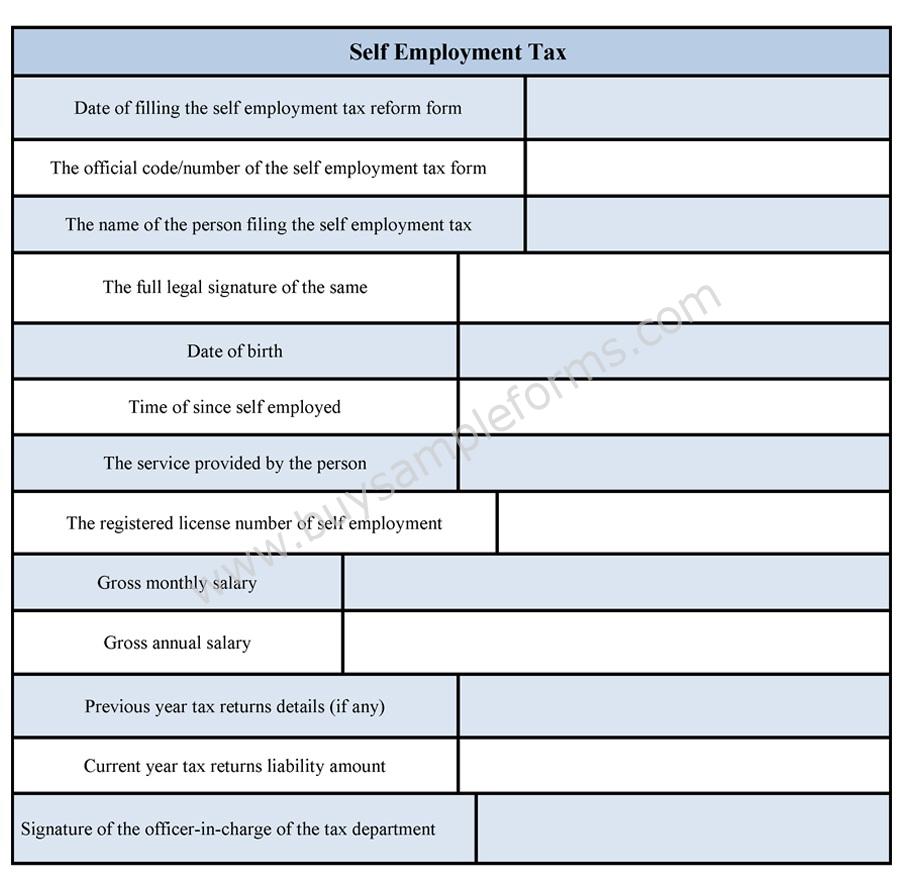

This form shall be attached to either forms 1040 1040nr or 1041.

Australian government budget 2020 21 immigration. This letter declares the intention of the declarant to inform in a form of a document his or her work and the nature of the business he or she is in as well as the gross income for the past two years. The self employment contract form is easy to fill out. It includes payments on major purchases.

The self employment short form and notes have been added for tax year 2019 to 2020. Whether you are a freelance staff or a self employed individual this form is for you. This usually comes in form of the letter written by you or an.

Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment. The social security administration uses the information from schedule se to figure your benefits under the social security program. The self employment short form and notes have been added for tax year 2018 to 2019.

This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. For further completing the self employment ledger form write down all accepted business expenses monthly expenditure. Use this template for verification.

Schedule se form 1040 or 1040 sr self employment tax pdf instructions for schedule se form 1040 or 1040 sr self employment tax pdf schedule k 1 form 1065 partners share of income credits deductions etc. This form shall be attached to either forms 1040 1040nr or 1041. Writing an income verification is very usual to be asked to verify your income when inquiring about a loan rental agreement etc.

Self employment expenses form. Accepted business expenses could be deducted from your self employment income. A self employment verification report is an information you provide the authority in the case where there is an urgent need for you to verify that you are self employed.

Register if youre self employed or a sole trader. Tools machinery or equipment used and other long lasting commodities and the rate of real work done. To write income verification letter for self employed one must hire a person or human resource to write a letter for them but if you are self employed you definitely have to write it by yourself.

A self employed sole proprietor has to declare in schedule c of form 1040 any income gain or loss from work.

Self Employed Assistance Scheme Mauritius Chamber Of Commerce And Industry Mcci Australian Government Budget 2020 21 Immigration

More From Australian Government Budget 2020 21 Immigration

- Furlough Extended To June

- Government Nursing Colleges In Kerala Admission 2020

- Government Policy Examples Philippines

- Hunger Games Government Type

- Government Spending Us Budget Pie Chart

Incoming Search Terms:

- Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com Government Spending Us Budget Pie Chart,

- Self Employed Taxpayers How To Avoid A Large Irs Bill Ils Government Spending Us Budget Pie Chart,

- Free 6 Sample Self Employment Tax Forms In Pdf Government Spending Us Budget Pie Chart,

- Self Assessment Tax Return And The Short Self Employed Tax Return Form Government Spending Us Budget Pie Chart,

- Irs Schedule Se 1040 Form Pdffiller Government Spending Us Budget Pie Chart,

- Benefits Self Employed Government Spending Us Budget Pie Chart,